Exactly how grim was last week's GDP report?

May 2, 2022

By Ted Hanson

By Ted Hanson

Portfolio ManagerIt is a challenging start to 2022, with last week’s GDP release shedding light on this. Gross domestic product (GDP) measures the goods and services produced within a country. It is an important indicator used to measure the health of an economy.

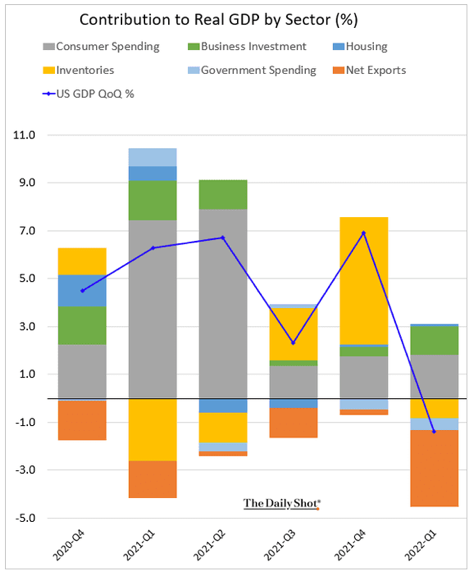

In its most recent GDP report, the commerce department announced the U.S. economy shrank 1.4% at the beginning of 2022, the worst quarter in two years. This was lower than the 1.0% growth economists expected and significantly lower than the 6.9% annualized rate logged in the fourth quarter of 2021.

What caused the U.S. economy to shrink?

In addition to geopolitical events (e.g. the Ukraine war, China COVID lockdown), a primary cause in the decrease in GDP can be traced to an expansion of net imports. The U.S. saw a surge in imports during the first quarter while exports fell, reflecting many of the supply chain issues plaguing countries over the past few years.

Consumer spending, usually the main driver of GDP, actually rose in the first quarter. The 2.7% annualized growth was slightly higher than the previous quarter, an indication of the higher prices consumers are paying. Businesses also spent more this past quarter as business spending rose 9.2%. However, the increase in consumer and business spending wasn't enough to keep the economy from contracting.

What does this mean going forward?

With persistent inflation and slower economic growth, the terms recession and stagflation (defined as slowing growth and raising inflation) are capturing headlines. One quarter of economic contraction does not make either of these terms a reality, but it does heighten the risks.

The Federal Reserve is set to meet this week and is widely expected to continue to raise interest rates. The recent reading of GDP does not change The Fed's expected path forward, as it remains committed to combating inflation. This week will provide a glimpse into what lies ahead.

At Security National Wealth Management, accounts under our charge will remain fully invested, with a focus on quality, diversification, and valuations. Throughout a market cycle this strategy has proven to help investors reach their long-term goals. Talk to us about your goals and what we can do to help achieve them. Your success matters to us.