How to Bank on the Market's Forward Rally?

December 2, 2024

By Tom Limoges

By Tom Limoges

VP - InvestmentsComing off the Thanksgiving holiday, investors have a lot to be thankful for this year. Strong returns from both equity and fixed income investments through the end of November were as exciting to experience as the Iowa and Iowa State football games from this past weekend – Sorry Nebraska and Kansas State fans. Given the favorable return environment, can the current market rally move forward? There is an old saying in the investment world, “Don’t fight the Fed”, meaning that if the Fed is lowering interest rates, it tends to be positive for asset prices over time. Let’s use the Fed as our guide as we address this question.

The Federal Reserve or “Fed” controls monetary policy in the U.S. most notably through the ability to influence short term interest rates by raising and lowering the Fed Funds Rate. This rate is what banks pay to borrow funds from each other. It impacts everything from deposit rates to short term interest rates charged on loans. The Fed adjusts rates on its path to balance price stability (inflation) and full employment, its dual mandate. This past September, the Fed concurred inflation cooled enough to lower short term rates to combat a slowing economy. As a result, the Fed Funds rate was lowered by 0.5% initially, followed by another 0.25% at the November meeting. Using historical data, lets review how rate cuts impacted various markets performance.

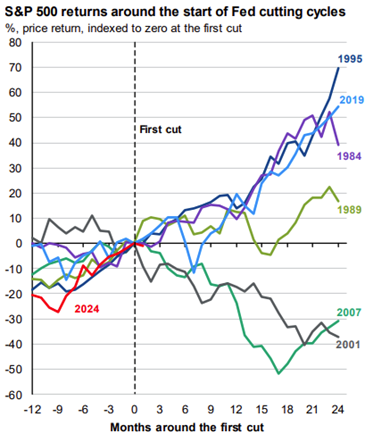

Rate Cuts & Equity Market Returns

Source: JP Morgan Guide to the Markets Data as of October 31, 2024

This chart highlights the performance of the S&P 500 Index (U.S stock market benchmark) following the last six times the Fed started cutting rates. Price return is marked vertically, and time is measured horizontally. In 2/3 the instances, the stock market was higher in the two years following that initial rate cut. The two periods the market was negative (2001 & 2007) were marked by severe recessions. Given the resilient U.S. consumer, slowing (not negative) corporate profit growth, and now easing monetary conditions, the odds of a severe recession in the near term are muted. This will allow equity markets to advance over time.

Rate Cuts & Bond Market Returns

Source: JP Morgan Guide to the Markets Data as of October 31, 2024

The next chart highlights the performance of the bond market using the return of the 10-year Treasury bond around the start of the Fed cutting cycle. In all six instances, the return moved higher for bonds following the first rate cut. This makes sense given that interest rates are closely tied and inversely related to bond prices. High quality intermediate term bonds remain a favorable place to invest.

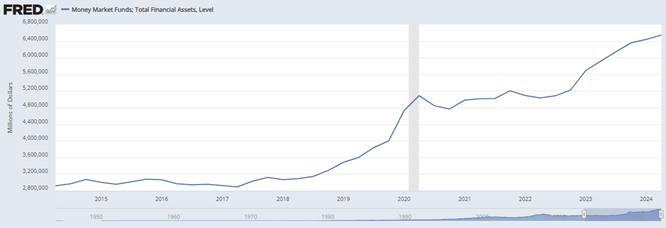

Source: St. Louis Fed

The last chart details the amount of dollars in retail money market funds ($6.5 Trillion). Attractive short-term rates moved a significant amount of dollars to safe and short-term investments, such as Treasury bills (T-bills) and money market funds. As the Fed reduces short term interest rates in the future, additional pressure will be placed on yields for these safe short-term investments. We advise long term investors with excess cash positions to look at adding to intermediate term bonds or CDs. Stocks (equities) carry additional risk but proven to provide favorable risk/return characteristics over the longer-term time period. If there are any additional questions, please reach out to an Advisor today. Your financial success matters.