How to take the fright out of investing

November 1, 2021

By Michael List, CFP®

By Michael List, CFP®

Portfolio Manager

Investing can be scary. Whether you are investing in your first house, new equipment for your business, or stocks and bonds; you are investing in the future. In the future there are many unknowns, and that which is unknown can be very scary. My children vividly illustrate this point.

What’s hiding in the dark?

Try explaining to a three-year-old that there is nothing to be afraid of in the dark, or that noise they heard was just the heater. As best we try, when the lights go out, it's nearly impossible to keep children from seeing every scary image in the meta-verse (or whatever they're calling it these days). Even with a night light, darkness lingers — in the closet, under the bed. In the darkness are the unknowns. Adults are not immune either.

Recall the scariest movies you’ve ever seen, the best directors let our imaginations amplify the horror. You don’t get to see the monster until well into the movie, so your imagination has time to build up horrifying images. Have you ever been disappointed when you actually see the villain? Unknowns are always more frightening than knowns. However, it is fascinating; there are many times when the benefits of reality exceed anything we imagined. This asymmetry is applicable to the investment world, as well.

Your investment should compensate you for the risk you take for future unknowns relative to the alternatives that are available. Although imperfect, there are methods to help shine light on the future — a candle in a dark room, so to speak. One of most consistent predictors of future returns is the current valuation, commonly referred to as the P/E ratio. Another predictor is past performance. While past performance does not guarantee future results, it’s a pretty reliable indicator. For example, I can predict — with a high degree of confidence and based on past performance — that if someone brings chocolate chip cookies into the office, I am going to eat several.

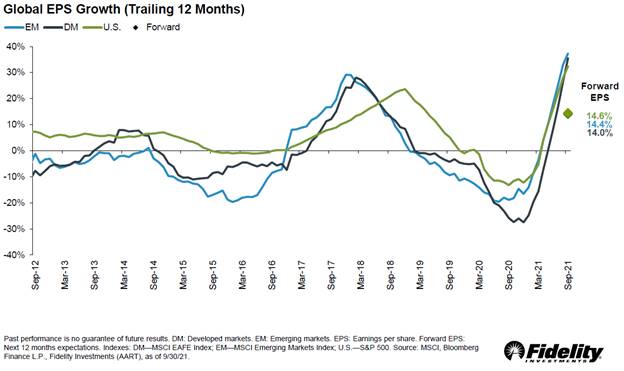

When we look at the markets, there are knowns and unknowns. As of the end of October, U.S. stocks were trading near all-time highs. We also know that earnings are at all-time highs too, not just in the U.S. but also all over the world (as shown in the chart below from Fidelity). Earnings growth everywhere is running at the fastest pace in the past decade, everywhere. However, that won’t last forever. Earnings growth could decelerate, perhaps as it did after 2017. Still, current estimates for future earnings growth are coming in around 15%, which is above the long-term average.

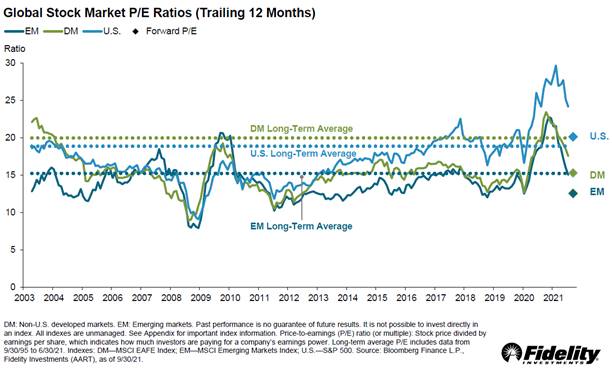

One benefit from faster earnings growth has been a decline in valuations. Growth of earnings has exceeded share price gains in 2021; which has brought down valuations globally. That said, as we noted in the quarterly commentary, valuations are still elevated by most measures relative to history. We also know that valuations are cheaper for international stocks compared to those in the U.S. Valuations have improved since the beginning of the year, but they remain high. In isolation, it indicates future returns will be lower than past returns and international stocks have a good chance to outperform U.S. stocks. That disconnect offers an opportunity for investors in a well diversified portfolio.

Casting a light

These pieces of information help to shed light into the future. That said, there are ways, returns could continue to surprise to the upside. Earnings and revenue growth in 2021 has been faster than many anticipated a year ago. In addition, current earnings estimates for 2022 are still above the historical growth rate. There are still many unknowns in the years ahead. If we focus only on the negative unknowns, it can still look pretty scary. But if we consider the positives, it helps balance the outlook and may be better than we could even imagine.

As mentioned earlier, fear of the unknown can be dissipated with knowledge. At Security National Bank Wealth Management we work to bring you the best information and to help you apply it to decisions on achieving your goals and objectives. If there is something you would like to understand more fully, please do not hesitate to contact us for a time to meet and discuss what is on your mind.