Improved Outlooks Boost the Appeal For Bonds

March 6, 2023

By Ted Hanson

By Ted Hanson

Portfolio Manager

February has come to a close and it was an active month for the bond market. As the prominent American author Nora Roberts once said, “Even though February was the shortest month of the year, sometimes it seems like the longest.” That certainly applied to bond investors this past month. However, there are some lessons to take away.

What Happened?

This year started with a bang in the financial markets. The prospect of declining inflation and the Federal Reserve’s end to its tightening cycle provided a boost for the bond market. All bond indices rose at least two percent or more in the month of January, on a total return basis, as the ten year Treasury yield declined to 3.50% after starting the year at 3.87%.

However just like its weather, February placed a damper on this optimism. The month started with a 0.25% rate hike from the Federal Reserve and was quickly supported by strong labor data. What really caught investors’ attention was inflation data released mid-month. The variety of data pointed to a scenario where inflation continues to be sticky and the Federal Reserve will need to keep restrictive monetary policy in place for longer. Bond investors began to reassess their year-end inflation expectations, which was reflected in the February increase in bond yields. Bond indices lost January gains as the ten year Treasury yield rose to end the month at 3.92%.

Now What?

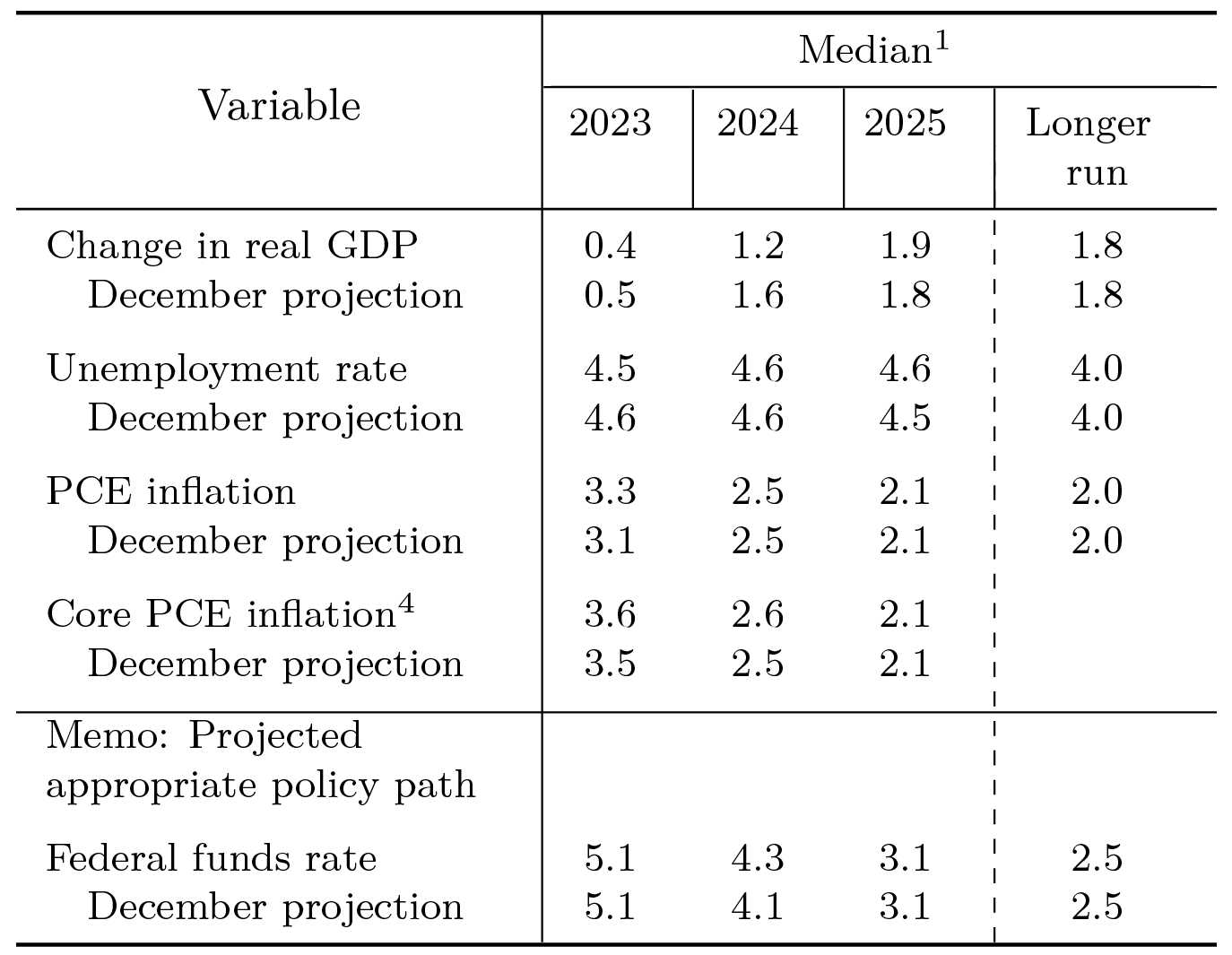

Inflation continues to be the primary concern for many. Federal Reserve members spoke out in support of remaining committed to reaching their long term goal of two percent inflation. After a brief divergence, market participants believe the Fed’s narrative of keeping rates higher for longer (meaning no rate cuts this year).

How does that effect bond investors? As you can see in the chart above, bond yields continue to be at some of the best levels in years. Starting yields are important as the higher the rate, the larger the income stream and future returns. This is welcome after an environment where investors needed to sacrifice liquidity or credit quality to gain reasonable income streams. In the current rate environment, there continues to be opportunities for conservative investors or those looking to de-risk their portfolios.

Last year’s volatility in the bond market has continued into 2023. It will likely continue in the short term as the Federal Reserve and investors’ assess incoming economic data. However, long term outlooks have improved and shouldn’t be ignored. If you’d like to review your portfolio and future goals reach out to your Advisor today!