“In Investing, What Is Comfortable Is Rarely Profitable.”

April 24, 2023

By Michael Moreland

By Michael Moreland

Retired Vice President of Investments‘In investing, what is comfortable is rarely profitable.’

The introductory quote, from Robert Arnott, founder and Chair of Research Affiliates, is something to keep in mind for long term success. And it’s not always easy to do so.

With the collapse of Silicon Valley Bank and the forced mergers of other global firms, investors rushed to the exits of value themes – of which financial stocks are a large component. That, combined with recession fears and the expected impact on economically sensitive sectors, created one of the largest market sector performance divergences in recent years.

While headline market returns were all positive in the quarter – a surprise in itself – short term success was governed by ‘the crowd’. The flight from value to the seemingly safe alternative – growth – was a classic reaction to the news of the day. Investors looked for comfort rather than opportunity.

Statistics Tell Where the Comfort Lies

Let’s look at the statistics. The S&P 500 (a little over one-third technology and information services) rose 7.5% in the three months. The DJIA rose only 0.9% in the period, while the smaller company Russell 2000 gained 2.7%.

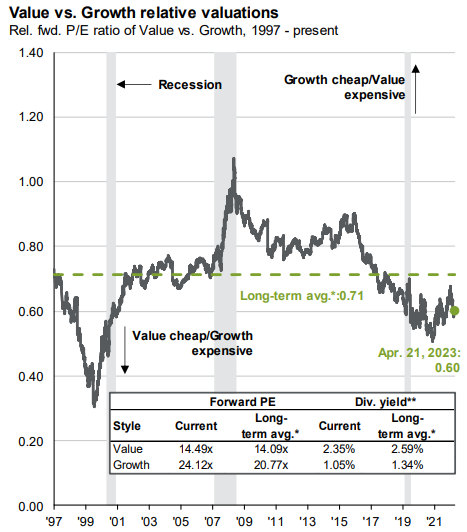

The real dichotomy appeared between growth and value themes. The Russell 3000 Growth index – where technology abides – gained 13.9%, while the companion Value index matched the Dow index, gaining only 0.9%.

The disparity was even more pronounced in NASDAQ indices, the tech-heavy home of OTC stocks. The Composite index gained 17.0% in the quarter, while the top 100 names rose 20.8%.

Value-Vs-Growth

The rush to growth in the first quarter was definitely the ‘comfortable trade’ – and it worked in the short term. Longer term, we remain firm believers in maintaining a tilt toward value. The opportunities present when others are uninterested are compelling; history supports this.

While there remain many challenges as the Federal Reserve attempts to rein in inflationary pressures, a conservative strategy of broad diversification and an orientation toward value will benefit our clients. It has done so for many decades, and we are confident it will do so in the future. Ask your Advisor or Investment Manager how our philosophy can help you achieve your goals. Your success matters to us!