Index Concentrations - Are all your eggs in one basket?

July 20, 2020

By Tom Limoges

AVP - Investments

I began my career at Security National Bank around the time of the technology bubble in the early 2000s. As a point of reference, this was around the time Apple introduced the first generation iPod, and Amazon was known mostly as an online bookseller. Yes, I am that old… Prior to the tech bubble popping, stocks (especially ones with .com in their name) experienced a historic run-up in price and then saw a massive sell-off, which completed the boom and bust cycle of the market. Another phenomenon occurred during this period as well. Stock market index representation became more concentrated in just a handful of companies and one particular sector of the market. Over the last five years, we have again witnessed a similar behavior in terms of market concentration. This data raises several questions. Does that indicate that what happened during the technology bubble will happened again now? How do we protect against future volatility given the current circumstances?

A Top Heavy Index

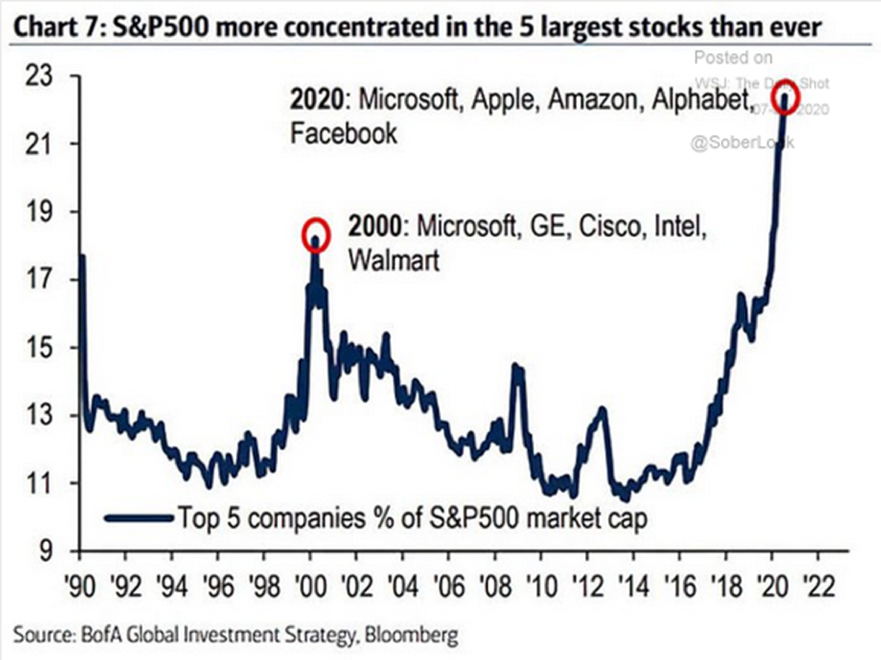

The S&P 500 Index is often used as a measure for the health of the U.S. stock market. This index is capitalization or cap weighted, meaning the companies that comprise the index are weighted by market capitalization. What is market capitalization? In simple terms, the market cap is the number of shares of the company multiplied by their current price. The larger the company, the larger the index representation it receives. The chart below shows the index concentration over the last three decades. Over that period, the market has never been as concentrated in the top five largest stocks as it is now. What is also interesting is that only one of the top five companies from 2000 is in the top five today.

Concentrated Returns

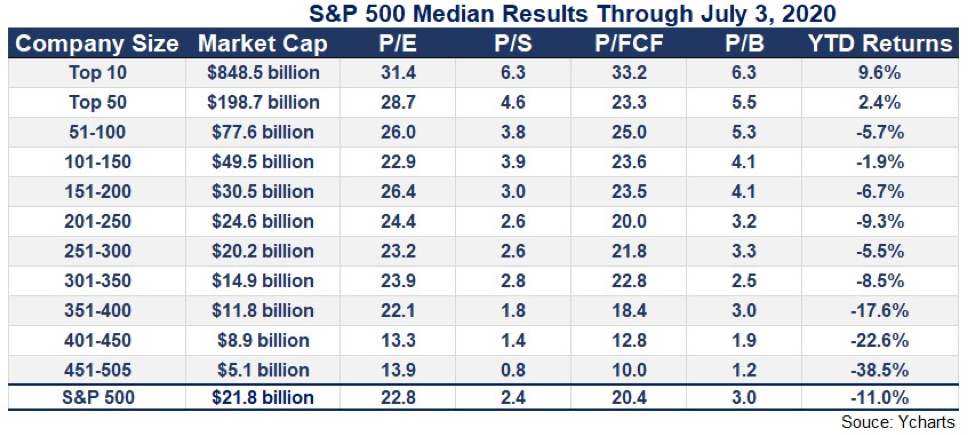

One of the challenges of the S&P 500’s growing concentration in a handful of companies is that the index looks less like a gauge of the entire market. The chart below shows average year-to-date returns based of the size of the companies in the index. The returns for the largest companies are positive while the average returns for the smaller companies are negative. In addition, the valuations of the highest market cap companies are much higher than others in the index. In other words, the largest companies have become more expensive compared to the rest of the market.

Going Forward

One saying that has stuck with me over the last 20 years is that market valuations are never to be considered a timing device. That means that the markets can remain at expensive levels for longer times than investors believe are possible. It is not recommended to sell completely out of one sector (large companies) based on valuations With that being said, a reasonable solution to avoid the pitfalls of a top heavy market environment is keeping your portfolio diversified with smaller companies and international options. Using the technology bubble as a guide, investors who rode out that downturn in the market with a diversified portfolio saw much better returns in the years shortly following the collapse of the tech bubble.

Trends and patterns re-emerge throughout different cycles and times of life. While the early 2000s saw the rise of several corporate powerhouses like Apple and Amazon, there were many other interesting and valuable opportunities in the market. The same holds true in today’s market. These smaller companies might not get all the attention the top-heavy index options attract, but are invaluable in helping balance out a solid portfolio. The old adage says, “don’t put all your eggs in one basket,” and that rings true for more than just eggs.

If you would like to learn more about where to place your eggs so they aren't all in one basket, please come in and talk to an advisor today.