Inflation Starting 2022 on a Hot Note

February 14, 2022

By Krista Eberly, CFP®

By Krista Eberly, CFP®

Portfolio Manager

What a week for the bond market! The focal point for the market last week was January’s Consumer Price Index (CPI) report and it once again surprised to the upside. Let’s digest the most recent inflation numbers and the bond market’s reaction to it.

January’s Inflation

The January CPI Report showed prices rose 0.6% last month for both the headline and core number. The difference between the two is core excludes the volatile energy and food sectors. On a year-over-year basis, headline inflation rose 7.5% and core 6.0%. Both the monthly and yearly figures came in above expectations. The 7.5% increase from a year ago is a new 40 year high for inflation, beating the 7.0% figure in December. When we look at the components of CPI, used cars and trucks, gasoline, and energy prices continue to dominate the twelve month change. However, inflation is becoming more broad-based, affecting both goods and service sectors.

The Bond Market’s Reaction

After the release of inflation numbers on Thursday, the bond market reacted accordingly. However, it wasn’t the only thing moving rates that day. The Federal Reserve Bank of St. Louis President, James Bullard, delivered very hawkish comments in an interview to Bloomberg. He noted “I’d like to see 100 basis points in the bag by July 1.” This contributed to the unprecedented moves in interest rates. On Thursday alone, the yield on the 2 year Treasury note rose 26 basis points, or 0.26%, in one day! Over the past week, the 2 year yield is up 40 basis points. Since the beginning of the year, the 2 year rate has more than doubled. Crazy times for the bond market!

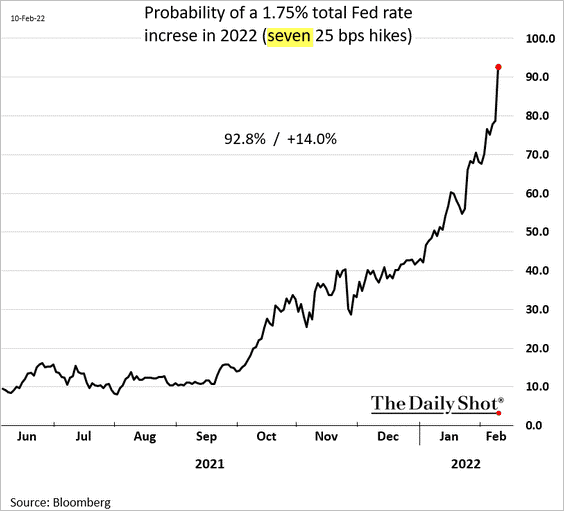

Since the beginning of the year, we have seen large moves in not only short term bonds but longer term ones as well as the market adjusted to a more aggressive tightening cycle from the Federal Reserve. See the chart below from the Daily Shot®. The probability of seven 0.25% rate increases in 2022 is now over 90%. In addition, the probability of a 0.50% rate increase to start the tightening cycle in March is closing in on 90% as well. In short, the Federal Reserve is behind the curve and has to act faster than anticipated to tame the higher inflationary environment.

Our Position

As I noted in our year-end video, we are making changes to our bond portfolios this year as part of our annual rebalancing. The key change is we lowered our duration, which is a measure of price risk. This will help to protect our clients in what is likely to be another challenging year for fixed income investors. If you have any questions about inflation, the Federal Reserve or how these impact the decisions we make for you, please reach out. Your success – and safety – matter to us.