Inflation Transitions and How They Are Influenced

April 19, 2021

By Michael List,

By Michael List,

CFP® Portfolio Manager

“Inflation is always and everywhere a monetary phenomenon in the sense that it is and can be produced only by a more rapid increase in the quantity of money than in output,” Milton Friedman. The consumer price index (CPI* ~ Inflation) jumped last month and is likely moving much higher in the coming months. Yet, despite their mandate of price stability, the Federal Reserve (Fed) will not be adjusting monetary policy anytime soon, but should we?

Understanding Inflation

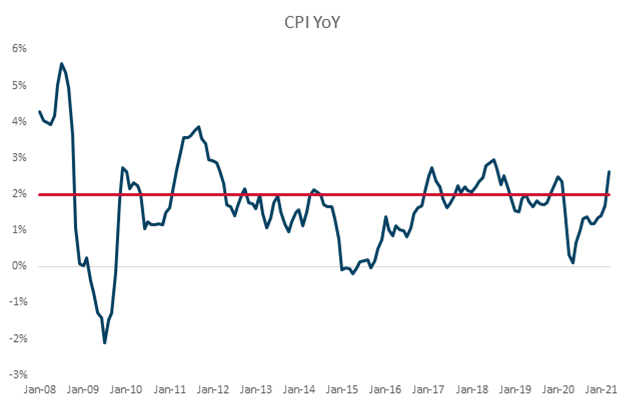

The Fed has been reiterating their patient stance. They believe the recent trend in higher inflation is transitory and that true inflation is a process not just a couple data points. The Fed often uses 2% as a benchmark for stable prices. There have been several periods over the past decade (2010, 2011, 2017, and 2018) when inflation rose above 2%, but it has constantly retreated below 2%. One reason for this is the base effect. When inflation rose above 2%, it was often preceded by lower than average inflation in the previous 12 months. In March, CPI increased 0.6% and 2.6%, from the previous month and year respectively. However, in 2020, inflation fell in March and bottomed out during April and May, as a result the base (denominator) will cause larger than average year over year change. CPI rebounded quickly last summer, so the jump from base effect will be transitory.

Another reason inflation may be transitory is shifting consumer spending. During 2020, US consumers buying habits changed. Personal consumption, which is 2/3rd of GDP, is divided between goods and services. Personal spending on services has been twice as large as spending on goods. However, during 2020, goods spending rose 3.9% while services declined 7.3%. One of the effects of returning to normal will be an increase in service spending (vacation, restaurants, concerts, etc.) leaving less cash to be spent on goods, in theory. This could relieve some of stress on certain areas of the supply chain resulting in downward price pressure.

The Outlook of Recent Inflation

The market’s concerns about inflation have eased recently. Since the beginning of the year, the 10 Year U.S. Treasury rate had risen from 0.9% to a high of 1.75%. Rates have now settled in a trading range between 1.6% and 1.7%, as traders await more data. Inflation will run higher than average for the next several months. Though, while we do not know where rates or inflation will be at the end of the year, rising inflation is a risk for markets and investor portfolios. To help manage this risk we had allocated some of the fixed income exposure into several areas including short term, inflation protected, and high yield. To learn more about how we are investing for this and other risks, contact your Advisor today.

*[There are different measures of inflation; data above is the consumer price index (CPI). The Fed regularly looks at the personal consumption expenditure price index (PCE); however, it lags the release of CPI and data won’t be available until April 30].