Value Investing as a Hedge Against Inflation

May 16, 2022

By Michael List, CFP®

By Michael List, CFP®

Investment Management Officer

“Inflation is always and everywhere a monetary phenomenon in the sense that it is and can be produced only by a more rapid increase in the quantity of money than in output,” Milton Friedman once said.

Most people have a tolerate/hate relationship with inflation. We tolerate inflation when it’s low, but hate inflation when it is high or changes rapidly.

High or rapidly changing inflation make the already difficult task of forecasting even more daunting — whether you're a couple planning for retirement or a business owner considering expansion. How people, businesses and financial assets respond to inflation depends on a variety of factors: the rate and speed of change, how long is it expected to persist, and the underlying causes, just to name a few.

One of the phrases I learned studying as an amateur economist was “all else equal.” It is a way to look at a given situation, change one factor but leave everything else the same, to evaluate the potential impact. In today's article, we will look at the impact inflation has on two different types of stocks: growth and value.

Inflation’s Impact on Growth vs. Value Stocks

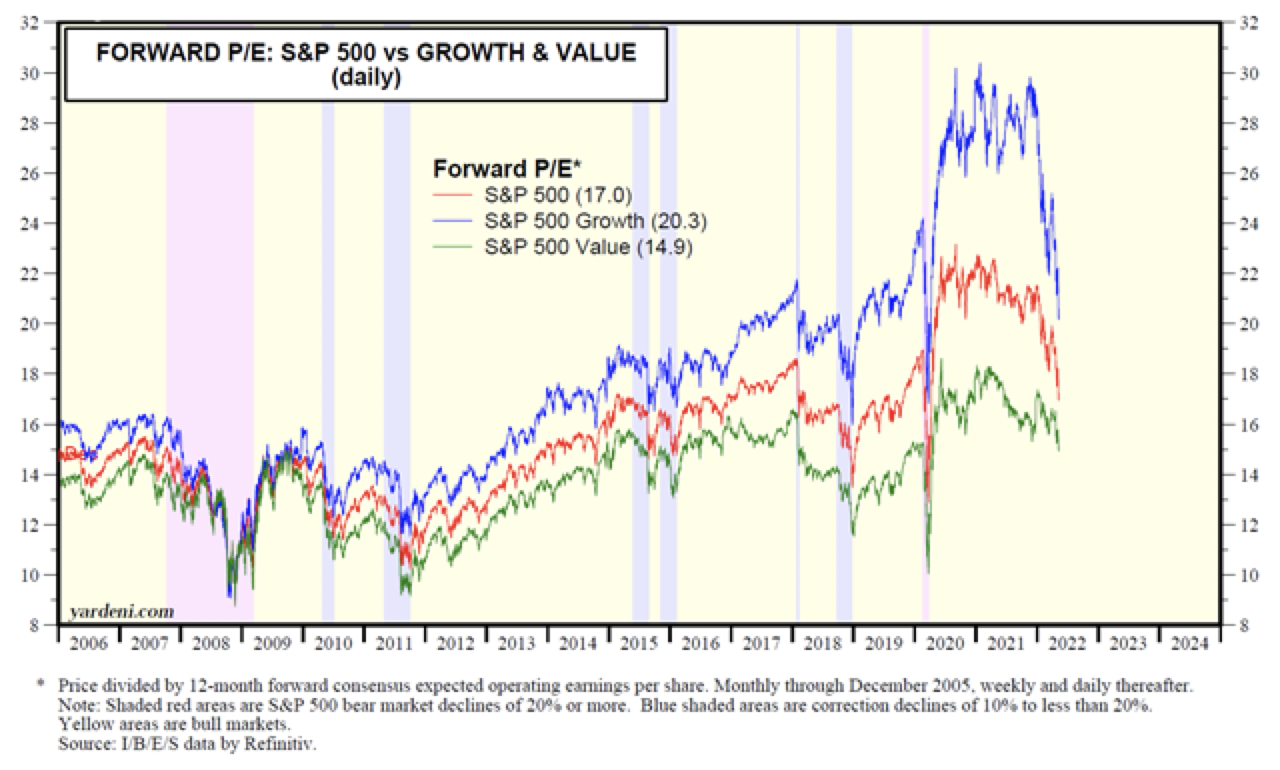

The chart below from Yardeni Research, Inc. shows the breakdown between growth and value over time, in terms of Price-to-Earnings (P/E) ratio.

Through 2021, when inflation was ‘transitory’ and expected to moderate, growth stocks were trading around a P/E of 30 and value stocks were trading at around 17. Based on those ratios, investors were paying $30 for every $1 of growth a company earns. Said another way, 1/30 of a growth stock’s price is today’s earnings and 29/30 are future earnings. In contrast, 1/17 of a value stock’s price is today’s earnings and 16/17 are future earnings. At these price levels, much more of the growth company’s price is based in the future, compared to value stocks.

Here is a hypothetical example to help illustrate how inflation can affect different types of companies. Let’s say we have two companies Growth, Inc. and Value, Inc. Based on our research, we expect Growth, Inc. to grow earnings at 11% and Value, Inc. will grow earnings at only 3%. Now, it is reasonable to pay more for Growth, Inc. stock, because future earnings will be much higher. The question is how much more?

If both companies earn $1 per share today, assuming the above growth rates, in 15 years earnings per share would rise to $4.30 for Growth, Inc. and $1.50 for Value, Inc. Those earnings will be in the future, therefore, we need to adjust for inflation to see what those earnings are worth today. With a 1% discount rate, the stream of earnings in current dollars is $31.20 for Growth, Inc. and $17.10 for Value, Inc. But, what if inflation is higher? What if the discount rate changes to 3%? Now the stream of earnings in current dollars is $25.90 for Growth, Inc. and $14.60 for Value, Inc.

All else equal, higher inflation has a more significant impact on Growth, Inc. This is why in an inflationary environment, value stocks can offer some refuge to better protect your portfolio from that impact.

Of course, we live in a complex world. A change in one factor will have ripple effects throughout the system. We have seen a compression of valuations in 2022, and some of this can be explained by persistent inflation (along with other contributing factors).

What does this mean for you?

Inflation has been one of our concerns since the extraordinary stimulus response in early 2020. During inflationary periods, investors favor cash flow today rather than promises far in the future, all else equal. Portfolios in our care have been structured with this in mind. For equities, we have a tilt toward value stocks that typically have a lower price and higher dividend. For fixed income, we’ve shortened up duration and maturities so we receive cash sooner to reinvest at higher rates. If you would like to discuss how your portfolio is structured reach out to your Advisor.