Interest Rates Take the Stairs Up and the Elevator Down

September 20, 2024

By Michael Moreland

By Michael Moreland

Retired Vice President - Investments

Wall Street is replete with truisms, which put into simple terms the sometimes convoluted narratives that surround projections for economic and market behaviors. Keep these in mind, and you’re ahead of most people and institutions that adjust outlooks on the news of the moment.

Surprise Move by the Fed

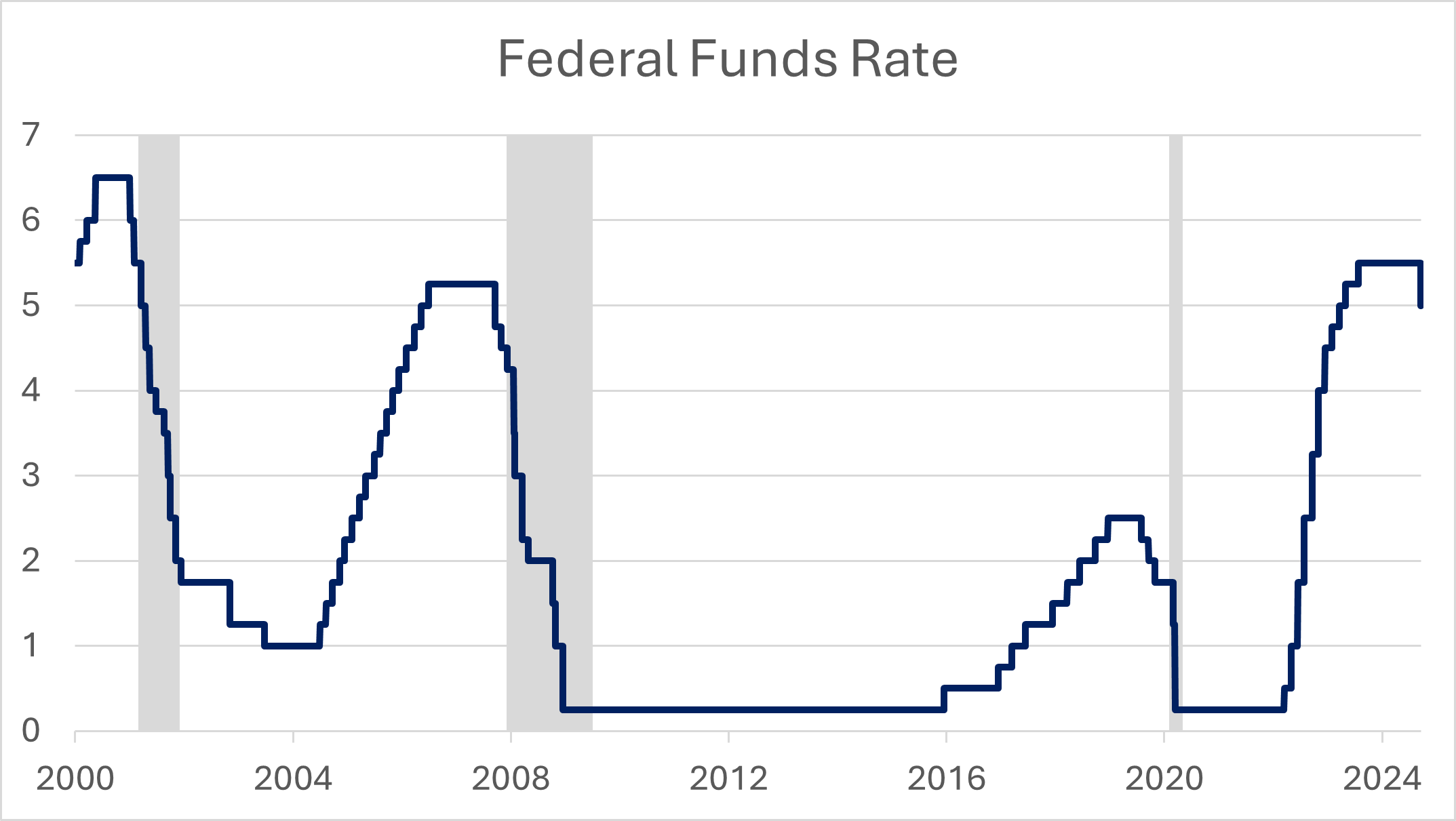

Last week the Federal Reserve’s Open Market Committee (its rate-setting arm) reduced its target rate for overnight borrowing by 50 basis points (one-half of one percent). This was the first decrease in four years and the largest one-time cut in over a decade. While a cut was widely expected, its magnitude was a bit of a surprise. Until late the previous week, most analysts were predicting the standard one-quarter point cut. Only in the few days before the meeting did expectations move toward the more aggressive policy move.

Source: Bloomberg; SNB

The Fed’s statement was clear. Its members are satisfied with progress to date on the inflation front. At the same time, in Chair Powell’s post-announcement press conference, he indicated employment concerns are rising (the Fed’s dual mandates are to promote stable prices and full employment). He noted softness in hiring and ongoing downward revisions in past reports as matters garnering increased attention.

What's Directing the Change in Focus?

A couple of points on this change in focus. First, employment data are generally seen as a lagging economic indicator. The broad economy is already showing softness by the time it is reflected in employment numbers. While economic activity is still moving forward, momentum is slowing. The last few years of restrictive monetary policy ultimately reduced inflation pressures by placing downward pressure on economic activity (particularly housing and other interest-sensitive sectors). The Fed’s shift is logical and appropriate.

A second consideration is the Fed’s recent history. Market consensus is that the Fed was late to the game in addressing inflation pressures building following the end of Covid-induced lockdowns. The outcome was a series of hikes that were much more aggressive and held longer than may have been needed had the Fed acted sooner a few years ago. Even with last week’s cut, real (inflation-adjusted) interest rates remain well above core inflation.

Looking Forward

This suggests monetary policy is still restrictive. Expect additional rate cuts in following Open Market Committees (the next is in November). We will receive two additional employment reports before then, and their tone will determine whether we see another outsized cut. Still, whether its one-quarter or one-half percent, the direction is clear.

Markets reacted positively following the news. But, as always, don’t plan your investments based on what happened yesterday. Build your strategy to meet your long term goals and to provide protection in a variety of scenarios. Talk to your Advisor and Investment Manager about how we work to accomplish this for you. Your financial success matters to us.