Invest Like A Bull, You Could Get the Horns

July 24, 2023

By Morgan Altman

By Morgan Altman

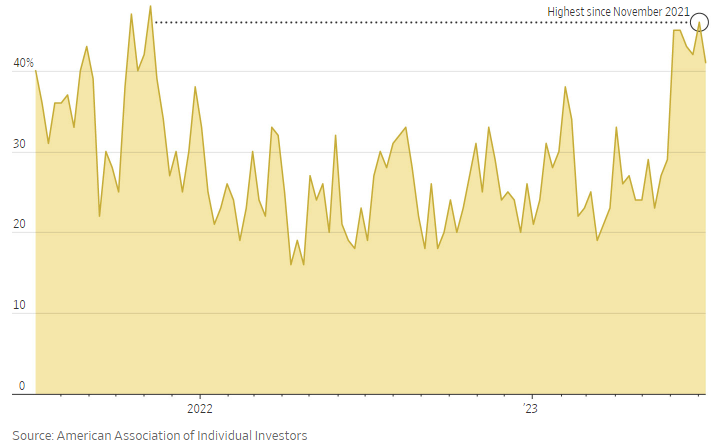

Securities AnalystEarlier this month, the U.S. Investor Sentiment’s percentage of bullish investors hit its highest point since November 2021. This bullishness has surged heavily into the technology sector this year, especially with the release of new AI technology.

Investing Like It's 2021

Technology has seen a significant comeback this year, causing the Nasdaq 100 Index to schedule its second special rebalance in history. Six stocks – Microsoft (MSFT), Apple (AAPL), Nvidia (NVDA), Amazon (AMZN), Alphabet (GOOGL), and Tesla (TSLA)—currently account for over half of the Nasdaq 100’s weight. Rebalancing it decreases the combined weight of these names. This helps resolve the concentration by redistributing the weights of these names compared to the index overall.

These six stocks have seen impressive growth year-to-date. Microsoft gained momentum with its investment in AI in Q1 and its recent approval to acquire Activision Blizzard. Apple hit a milestone market cap of $3 trillion. Nvidia temporarily hit the $1 Trillion market cap, due to the AI boom. Amazon, Google, and Tesla have been swept in with the rest of the growth stocks and the AI wave sweeping the markets this year.

Seeing the growth in the aforementioned stocks, it may be tempting to allocate more money in those names. However, it is important to not let emotion direct investment decisions. Many investors fall prey to “FOMO” – fear of missing out – when an opportunity arises. Understandably, they do not want to miss out on an investment with the potential to be highly profitable.

Unfortunately for most, FOMO does not usually arise until a stock is already overvalued, and the investor puts their money towards it right before it falls back to its true value.

In 2021, we saw a few examples of this when low-valued stocks such as GameStop and AMC went viral on social media platforms. Many invested in those stocks too late, rode out the peak, and ended up with losses, rather than the gains they expected.

Scenarios like these emphasize the importance of investing for the long term, rather than for short term gain.

How Long Can the Euphoric State Last?

Could the perfect storm be brewing? While more investors are bullish about the current market, those who remain bearish say the market could be nearing another crash.

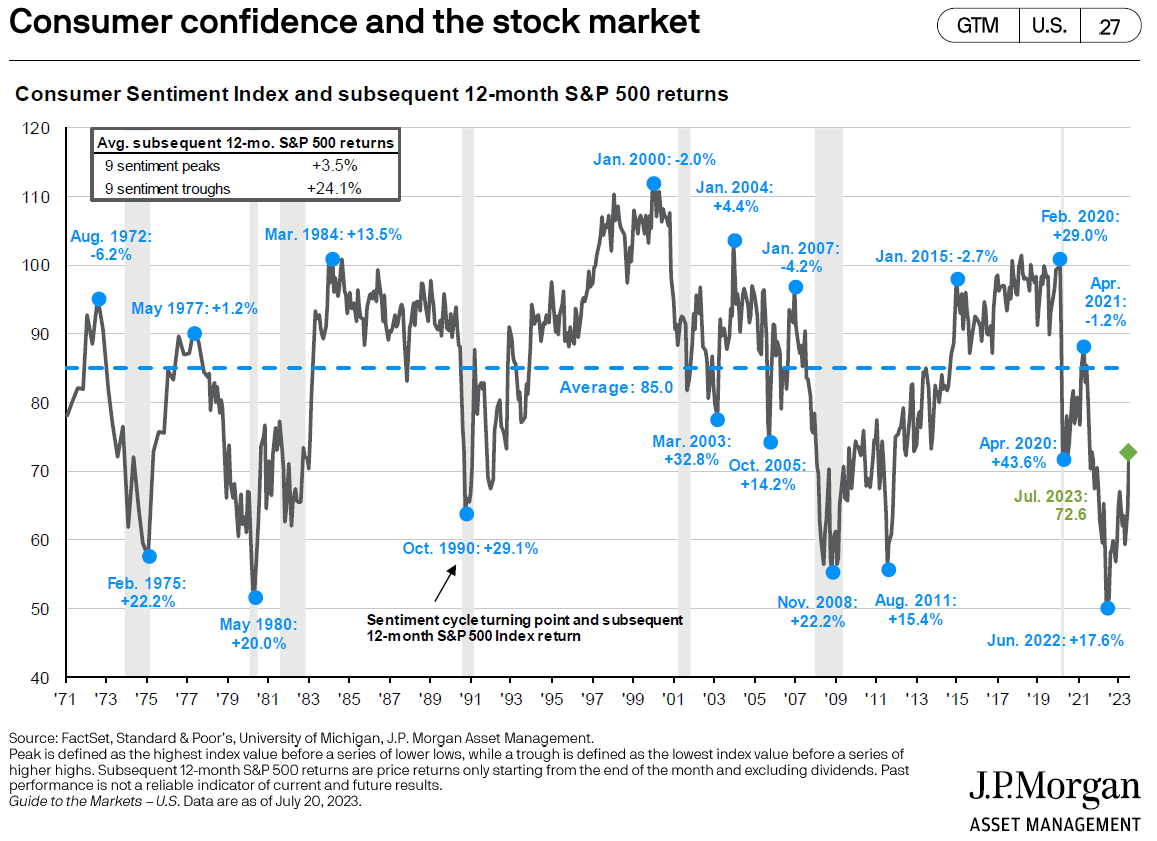

In late 2021, investors were in a similar euphoric state, and a few of the most-watched indices hit all-time highs. By January 2022, most indices peaked, and the S&P 500 went on to lose 19% throughout the course of 2022. The below chart demonstrates this concept.

It may seem counterintuitive, but historically, market returns and consumer confidence hold an inverse relationship. When consumer confidence is high, future market returns are lower. Right now, confidence has increased and returns thus far are better than average, pushing valuations higher.

With the high performance in growth stocks this year, we’ve seen value stocks lag behind. However, in 2022, growth stocks were the bottom performers and value stocks were the top performers. The last three years highlight the importance of diversification. It is important to hold growth stocks to take advantage of periods of rising momentum. However, it is also important to hold value stocks to protect your assets when the markets are down and the growth stock craze fades.

Reach out to your SNB Wealth Advisor today with any questions or concerns about the current market environment. Your financial success matters to us!