Investment Basics: High-Yield Bonds: Weight the Risks

February 6, 2018

By Colin OShea

Securities Analyst

High-Yield Bonds: Weighing the Risks

They carry higher risks, but high-yield bonds can also offer higher returns than other fixed-income investments.

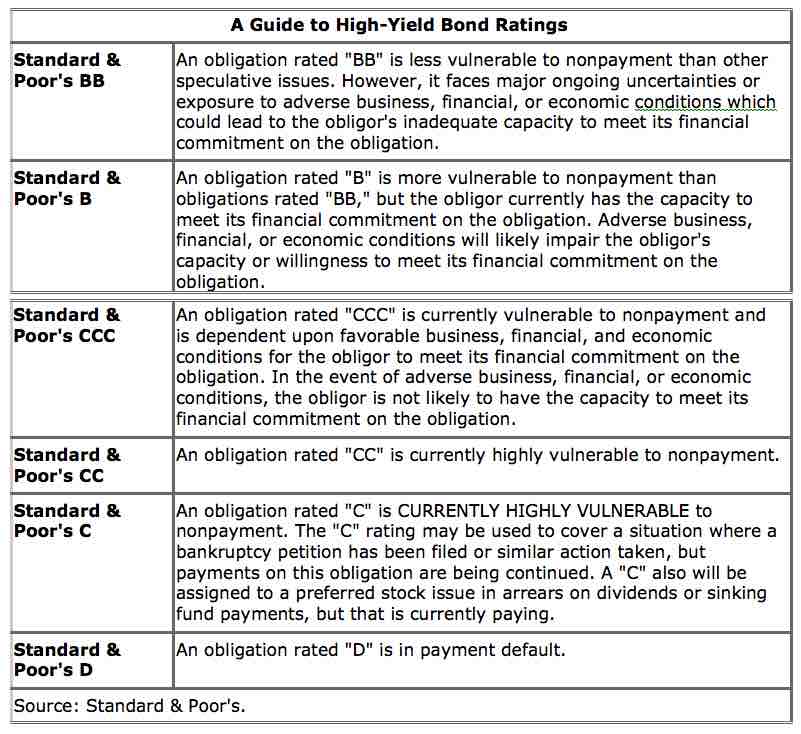

High-yield bonds have grown in popularity due to their relatively high yields, rising credit quality, and diversification potential against high stock market valuations. These bonds earn their junk labels from below-investment-grade credit ratings (BB or lower) from major ratings services. This means issuers are considered more likely to default on their financial obligations to investors.

In exchange for higher risks compared with other types of bonds, high-yield issues have historically provided competitive returns averaging about 4% to 5% above those of U.S. Treasury securities, although past performance can’t guarantee future results. High- yield bonds may provide diversification for long-term investors seeking to maximize yield and/or total return potential without investing more money in stocks; high-yield issues often move independently from more conservative U.S. government bonds as well as the stock market.

In exchange for their performance potential, high-yield bonds are very sensitive to all the risk factors affecting the general bond market -- credit, interest rates, and liquidity. The risk factors associated with high-yield investing make it imperative to carefully research potential purchases. Factors to consider when purchasing high-yield bonds include the underlying financial situation of the issuer, price, and whether you are willing to invest long-term.

Although there are solid reasons for investing in high-yield bonds, especially in the long term, always keep in mind how and why these bonds earned their nickname.

Higher-yield corporate bond prices may fluctuate more broadly than prices of higher-quality bonds. Risk of principal and income also is greater with higher-quality securities.

Although some call them "junk" bonds, high-yield bonds have been popular on Wall Street, and billions of dollars' worth are traded annually.

As the label "high-yield" suggests, the competitive yields of these issues have helped attract assets. With yields significantly higher than elsewhere in the bond market, many investors have turned to high-yield bonds for both performance and diversification against stock market risks.

These are solid reasons for investing in high-yield bonds, especially long term. But as you read about what these issues could offer your portfolio, it's also wise to consider how these bonds earned their nicknames.

What's the Attraction?

High-yield bonds were coined "junk" bonds because of their BB or lower rating from major rating services such as Moody's and Standard & Poor's. These ratings are considered below investment grade, due to their issuers' questionable financial situations. These situations vary widely -- from financially distressed firms to highly leveraged new companies simply aiming to pay off debts.

All these issuers offer high yields to entice investors to overlook lower credit ratings. But over time, it's these above-average yields -- generally 4% to 5% above Treasuries -- that have historically paid off for those willing to invest in these firms (though past performance can't guarantee future results).

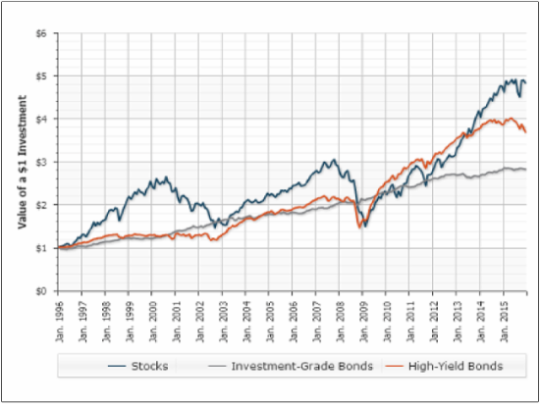

High-yield bonds may provide diversification for long-term investors seeking to maximize yield and/or total return potential without investing more money in stocks. High-yield issues often move independently from more conservative U.S. government bonds as well as the stock market (see chart).

The Risk Trade-Off

In exchange for their performance potential, high-yield bonds are very sensitive to all the risk factors affecting the general bond market -- credit, interest rates, and liquidity.

A high-yield bond's above-average credit risk is reflected in its low credit ratings. This risk -- that the bond's issuer will default on its financial obligations to investors -- means you may lose some or all of the principal amount invested, as well as any outstanding income due.

High-yield bonds often react more dramatically than other types of debt securities to interest rate risk, or the risk that a bond's price will drop when general interest rates rise, and vice versa.

Liquidity risk -- the risk that buyers will be few if and when a bond must be sold -- is exceptionally strong in the high-yield market. There's usually a narrow market for these issues, partly because some institutional investors (such as big pension funds and life insurance companies) normally can't place more than 5% of their assets in bonds that are below investment grade.

In addition, high-yield bonds tend to react strongly to changes in the economy. In a recession, bond defaults often rise and credit quality drops, pushing down total returns on high-yield bonds. This economic sensitivity, combined with other risk factors, can trigger dramatic market upsets, as in 2008, when the well-publicized downfall of Lehman Brothers squeezed the high-yield market's tight liquidity even more, driving prices down and yields up.

The Search for Growth

High-yield bonds have the potential to offer higher returns than investment-grade government bonds. However, on average, high-yield bonds have not consistently outperformed investment-grade government bonds over the long term. This underscores the importance of professional management when making high-yield bonds a part of your portfolio.

Source: ChartSource®, DST Systems, Inc. For the period from January 1, 1996, through December 31, 2015. Stocks are represented by the S&P 500 index. Investment-grade bonds are represented by the Barclays U.S. Aggregate Bond index. High-yield bonds are represented by the Barclays High-Yield Bond index. It is not possible to invest directly in an index. Past performance is not a guarantee of future results. Copyright © 2016, DST Systems, Inc. All rights reserved. Not responsible for any errors or omissions.(CS000152)

Look Before You Leap Into High Yields

The risk factors associated with high-yield investing make it imperative to carefully research potential purchases. Some of the factors to consider when buying high-yield issues include:

True junk vs. hidden value -- The low credit ratings of high-yield bonds can be due to the issuers' distressed financial status, or simply because the issuer is small and/or highly leveraged and needs to finance debt to maintain rapid growth. These hidden-growth companies are more likely to meet their financial obligations to investors.

Look for companies with improving credit characteristics or the ability to emerge strong from a restructuring or bankruptcy.

Investment costs -- Prices of individual bonds can range from $10,000 to $100,000. In some cases, obtaining a break on brokers' commissions in the high-yield market means investing at least $25,000.

Fund expenses -- Research by Standard & Poor's indicates that mutual funds (including high-yield bond funds) with lower expense ratios have performed better over time than more expensive funds. As you review your fund choices, keep in mind that the average expense ratio for all actively managed domestic fixed income funds is 0.97%. Using this average as a benchmark can help you determine if you're purchasing shares of a fund that is too expensive.

A long-term outlook -- High-yield bonds have lost as much as 26.2% and gained as much as 58.2% in a given calendar year. Aiming for the market's average annual return means making a long-term commitment.1

A diversified portfolio -- Because high-yield bonds carry the same long-term risk as some stocks, your portfolio should also include conservative investments such as investment-grade municipal bonds and money market instruments.2

Mutual funds -- A high-yield bond fund can be an easy and affordable way to invest in this market. Combining several bonds in one portfolio, a high-yield bond fund is inherently diversified against the risk of loss from a single issue. A fund's professional management saves you the effort of researching and evaluating individual bonds; and low initial investment requirements can give you the diversification you need in this higher-risk market at an affordable price.

The total return potential of high-yield bonds makes these issues a terrific way to diversify a portfolio. But remember that "junk" always exists in different degrees in this market and can affect returns from time to time. You will want to pair these bonds with more traditional, conservative investments in your portfolio and keep a long-term perspective. You may also want to talk with your financial advisor regarding the appropriateness of these investments to diversify your portfolio and help reach the longer-term goals you've set.

Contact your Security National Bank Wealth Managment advisor for more information.