Investment Basics: Incentive Trusts -- Keeping a Steady Hand on the Tiller

March 27, 2018

Incentive Trusts -- Keeping a Steady Hand on the Tiller

An incentive trust is an estate planning tool that allows the trust grantor to reward heirs for desired behavior. It also allows the grantor to impose appropriate penalties for undesirable activities. An incentive trust should set concrete goals and offer objective criteria for assessing whether the goals have been met. It should treat all heirs equitably, giving each substantially equal opportunity to perform and be rewarded as such. By the same token, an incentive trust can also be used as a mechanism to encourage heirs to pursue careers that are rewarding yet less lucrative. An incentive trust cannot be used to encourage illegal or inappropriate behavior, and its design must conform to the laws of the state in which the trust will be set up. In addition, trust design must also comply with IRS generation-skipping transfer rules.

A good legacy may work wonders for those left behind, but you may also believe that your heirs need more than mere financial benefit from your estate. To provide direction and help ensure that important life goals remain foremost in their heirs' lives, many people are including incentive trusts in their estate plans.

Common Themes

- Education: To provide support to those heirs who pursue advanced degrees, focus on designated fields of study or attend specified institutions; or to reward instances of outstanding academic achievement.

- Moral and family values: To provide income support to heirs who choose to stay at home with children. Some trusts offer beneficiaries bonuses for childbearing, foster care, or adoption. Some withhold benefits from those heirs who might be convicted of a crime or fail a prescribed drug or alcohol screening test.

- Business and vocational choices: To provide incentives to those heirs who commit to helping carry on a family business. Trusts can be designed to encourage or discourage career choices specified by the trust creator.

- Charitable and religious opportunities: To encourage religious behavior by requiring specific observances. Some subsidize those heirs who choose missionary work or other religious vocations. Some provide matching funds for heirs' contributions to favored organizations.

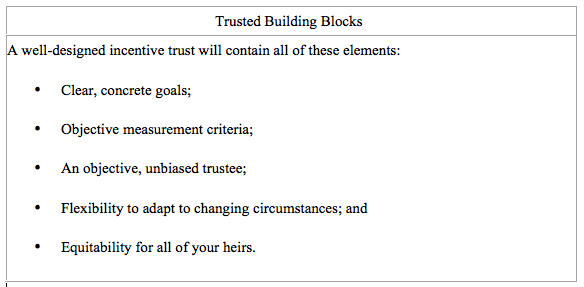

Elements of a Solid Incentive Structure

In a typical incentive trust scenario, assets are placed in a trust and then distributed to heirs over time as they meet specific incentives or have specific needs as spelled out in the trust. There are a number of considerations for trust design that may be especially significant for incentive trusts.

- Setting goals and criteria: The most effective incentive trusts spell out concrete goals and offer objective, readily verifiable criteria for assessing achievement of the goals. You'll also want to spell out the precise reward for achieving each indicated goal.

- Selection of the trustee: Well-designed trusts not only name a trustee, but also list alternates to serve if the primary trustee becomes unavailable or incapacitated. Since a trustee's decisions should be completely dispassionate, you'll want to be certain that the person you designate has no stake in the outcome of any trust provision. Also, you'll want to be sure that the trustee is not a potential beneficiary of the trust.

- Treatment of beneficiaries: Many trust creators try to be sure that all potential beneficiaries have substantially equal opportunities to earn rewards from the trust. It is also common that incentive trusts also have special provisions to provide assistance for beneficiaries with special needs.

- Flexibility: Unforeseen events such as illness or catastrophe may interfere with carrying out the intentions of the trust in the future. You may want to lay out conditions under which your trustee can deviate from your blueprint in order to adapt when necessary.

Key Limitations

Just as you have broad discretion as a parent or guardian, you have great latitude when you create an incentive trust. But there are limits.

- The trust cannot require blatantly illegal activity, neither can it provide incentives for actions that might be deemed contrary to public policy. For example, a trust generally cannot provide incentives for a beneficiary to divorce an unpopular mate, nor can it be used to undercut existing voluntary separation, child support, or other domestic arrangements generally permitted by law in your state.

- Incentive trusts may be subject to the rule of perpetuities. This is a legal concept that says trusts must be liquidated at some definite interval after their creation. This rule is enforced in many, but not all, states. As a consequence, you'll want to be sure that any trust you do create can last for as long as needed to achieve your goals.

- Certain trusts may be subject to the generation-skipping transfer (GST) tax. Where an incentive trust fits the complex definition of a GST, the rules limit the aggregate amounts that can be placed in the trust without incurring a tax of about half of the value in the trust.

Creating an effective incentive trust involves complex legal, tax, and investment management choices. So be sure to seek advice from knowledgeable legal and financial professionals.