Investment Volatility - Stick to the Travel Plan and Stay the Course

April 3, 2018

By Tom Limoges • Trust Investment Officer

Traveling cross country always has the risk of unexpected delays and frustrations. Road construction, cancelled flights, and mechanical breakdowns are all a part of journeys by plane, train, and automobile. There are certain things we can control to avoid these headaches, like routine vehicle maintenance or flight insurance. Yet sometimes, we are in the middle of our trip and the unavoidable occurs. At that time, you (or your pilot) react and make changes to the course, speed, or simply pull over and ask Siri. Yet in the end, you reach your destination with some interesting stories to tell.

Investments are much the same way. There is always risk involved; some of it is avoidable, while some requires some adjustments on our part. Your investment services at SNB take both types into consideration as we build and maintain your investment portfolio.

While global stock market returns were mostly flat during first quarter, there was plenty of excitement as the recent instability in the stock market created some wild trading days and the first market correction (10% decline from high) in nearly two years. Does this recent selloff in stocks change Security National Bank’s outlook for the markets going forward? What changes are being made to my investments to position for higher volatility?

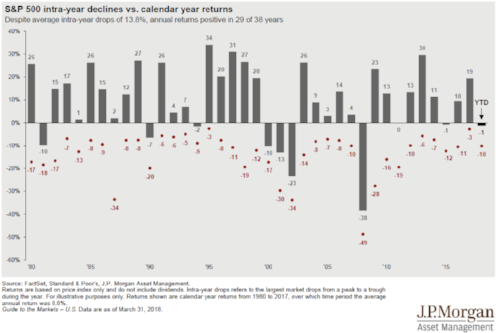

This turbulent change is fairly common. Annual corrections of greater than 10% are normal for the stock market. In fact, there is greater than 60% chance that in a given year, the market will experience one. The chart below illustrates that the average correction in a given year over the last 38 years has been 13.8%; however the market has been positive over 75% of the time. The months leading up to the most recent correction were more of the exception than the rule. We are still en route for the right destination, we just needed to tighten our grip on the steering wheel a bit.

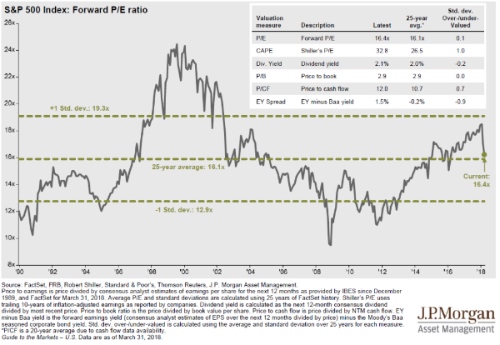

As we move forward in our journey this year, our outlook for the upcoming quarters is fundamentally unchanged by this recent correction in the stock market. Market valuations, which are good predictor of future returns, have come down (below chart) and global economic growth is improving. Inflation remains under control and fiscal policy remains accommodative. Longer term, we remain positive on the outlook for stocks. That bump in the road was simply a pothole, not a detour or road closed sign.

Security National Bank reviews and rebalances client portfolios on a regular basis. The process of rebalancing helps to reduce risk by bringing an account back in-lie with the client’s target allocation. For instance, over the last year, stocks have produced higher returns than other investments, and have become overweight. The process of reducing those overweight sectors can lower the risk level of the account over time. Tactically, we reduced exposure in sectors of the market that we felt were overvalued (growth stocks) and added proceeds to sectors we felt was more reasonably priced (international).

With SNB steering your investment portfolio, you can rest assured that no storm, flat tire, or I-29 construction will derail your long-term plans. We reduce risk whenever possible, and deal with the inevitable challenges as they occur while sticking to the travel plans. Please contact Security National Bank Wealth Management to talk with an Advisor today.