Investor Optimism's Effect on the Stock Market

January 16, 2018

By Tom Limoges

By Tom Limoges

Trust Investment Officer

The New Year affords an opportune time to look back at the past and adjust for the future. Not only do New Year’s resolutions aim to improve health, fitness, personal and professional goals, but they can also help review your investments.

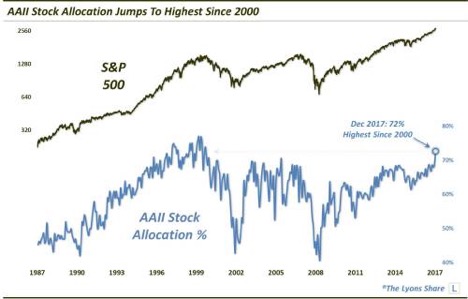

Aided by low unemployment, a new tax bill, and rising stock prices, individual investor confidence has increased over the last year. One popular way to measure investor confidence is to follow the money. There are several surveys published by investment managers that measure customer trading activity and overall account allocation percentages. Recently, these surveys have shown a decrease in average allocation to cash and a higher weighting in stocks. This indicates that investors have more optimism towards the stock market. What’s interesting about these survey results is that the last time readings showed this level of equity allocations was 2000 – near the peak of the Technology Bubble.

Do these recent survey results indicate a bubble or a sign of a correction in the near term? We don’t believe so. In fact, during the late 1990s, these indices remained high for nearly three years while the stock market continued to advance. Despite current elevated readings, improving global market fundamentals and low interest rates could allow stocks to perform well for several more years.

While the returns may be favorable in the near future, the recent spike in optimism toward the stock market does represent a higher level of risk associated with owning stocks. Historically speaking, individual investors tend to move in and out of the markets on a more frequent basis when compared to institutional managers. This additional buying and selling can enhance market gains – and losses. Looking at the graph below helps to visualize this.

One of the best ways to control risk in your portfolio is to identify your target return and select an allocation that represents the appropriate risk. As markets rise and fall, resist the urge to make changes based on emotions and the fear of missing out. The start of a New Year is a great opportunity to review your accounts with your Security National Bank Wealth Management financial advisor and rebalance, if necessary.