Is A Soft Landing For the U.S. Economy Probable?

May 22, 2023

By Jonathan Smith

By Jonathan Smith

Securities AnalystA soft landing refers to the Federal Reserve’s (or Fed) actions to cool down the U.S. economy in an effort to reduce inflation while avoiding a recession. The Fed achieved a soft landing only one time in the past 60 years. This occurred under former Fed Chairman Alan Greenspan in 1994-95. At that time, the central bank doubled interest rates to 6% over a 13-month period.

Due to recent record high inflation in the aftermath of COVID, the Federal Reserve aggressively raised short term interest rates for 10 consecutive meetings to a range of 5% to 5.25%. These rate hikes began March 2022. Mixed signals in recent reports indicate strength and weakness in different sectors of the economy.

Is there a pathway for The Fed to avoid a recession?

The Federal Reserve's rate hike over the past 14 months which has caused a slowdown in the U.S. economy. The Fed’s efforts initiated stress in the banking industry as credit tightened. In addition, the robust labor market shows signs of softening as businesses adjust to higher borrowing costs. Finally, household savings has eroded from higher costs on consumer goods and services. With that being said, recent economic data released this month indicate there may be room for the U.S. economy to avoid a recession.

Unemployment Reports

The latest unemployment rate reading in the U.S. edged down to 3.4%. The report was viewed favorably as it displayed the strength of the labor market. Weekly U.S. unemployment claims reported 216,000 new jobless claims, down slightly from the 4-week average. Labor reports signal resilience in the labor market despite the toll from higher interest rates on businesses.

Retail Sales

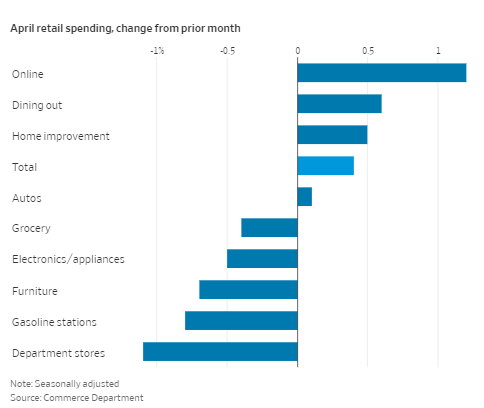

Source: WSJ

U.S. retail sales rose 0.4% in April following two consecutive months of declines. Last month’s retail sales sector increase was driven by auto dealers, general merchandise stores, online retailers, restaurants, and bars. Despite higher costs for goods and services, there is evidence that consumers are willing to spend. However, the slight increase also suggest that consumers are becoming more concerned with spending as the economy slows.

Stronger-than-expected labor numbers and consumer demand for goods and services are trending near normal levels, which may indicate that the Federal Reserve is having success in engineering a soft landing. Only time will tell.

What does this mean for your portfolio?

In the first quarter, we recently rebalanced our portfolios to adjust to volatility and economic risks in the coming months. In equities, we positioned our portfolios to defensive, high-quality companies. In fixed income, we focused on high credit quality bonds that provide great diversification of income. If you have any questions on your portfolio, please contact your Wealth Management Advisor. Your financial success matters to us!