Is AI The New Bubble? What Investors Need To Know

December 22, 2025

By David Newton

By David Newton

Wealth Management Intern

Artificial intelligence (AI) is one of the main topics in the stock market. From headlines about powerful new software to soaring stock prices for tech companies, it can feel like AI is everywhere. This has leads investors to an important question: Is AI becoming a market bubble, or is it truly the future of growth?

The short answer is: AI is real, and it is important—but some of the excitement surrounding it may be getting ahead of itself.

AI has the potential to improve how businesses operate across almost every industry. Companies are using it to automate tasks, analyze data faster, cut costs, and improve decision-making. This leads to higher productivity and, over time, higher profits. Because of this, companies that build AI tools—or the hardware and cloud systems that support them—have attracted massive investor interest. Many of these firms are well-established, profitable, and financially strong, making the AI story feel more believable than past tech trends.

Why Do Bubbles Form?

A market bubble forms when something valuable or exciting attracts attention, causing an increasing number of people to buy it and push its price higher. As prices rise, excitement turns into hype. People begin buying not because the asset is truly worth that much, rather they’re afraid of missing out (i.e. fear of missing out or “FOMO”) and believe they can sell it for more later. Eventually, prices drift far from reality and no longer reflect the actual value or usefulness of what’s being bought. When growth or demand fails to live up to the hype, confidence breaks, people rush to sell, and prices are in freefall—this sudden drop in value is what we call the bubble popping.

Bubbly Characteristics

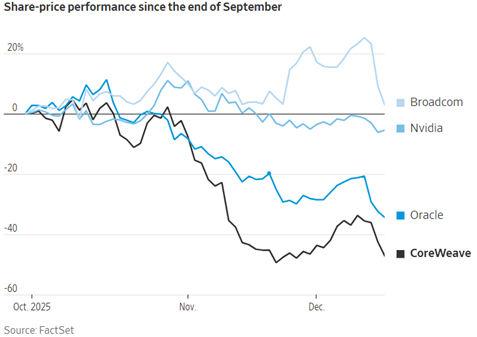

While AI’s long-term impact is real, market behavior matters just as much as technological promise. Several classic bubble characteristics are beginning to appear. First, expectations are running far ahead of current earnings. Many companies associated with AI trade at prices that assume years of rapid, uninterrupted growth. In some cases, firms with limited AI-related revenue have seen their stock prices surge simply by mentioning AI in earnings calls or marketing materials. This type of speculative behavior often signals excessive optimism. Second, capital concentration is increasing. This means a relatively small group of mega-cap technology companies accounts for a disproportionate share of recent market gains. When performance becomes narrowly driven by a single theme, the market grows more vulnerable to sudden corrections if sentiment shifts. Third, competition is intensifying. As more firms enter the AI space, profit margins can compress. History shows even revolutionary technologies do not guarantee outsized returns for all participants. Many early internet companies failed, despite the internet’s eventual success. The chart below highlights the volatility in prices for some of the largest tech/AI companies in recent months.

|

|

There are similarities, but also very important differences. Unlike the dot-com era, many AI leaders today are profitable and already generating real revenue. AI is also being actively used by businesses right now, not just promised for the future. This suggests that while some AI stocks may be overpriced, the technology itself is unlikely to disappear. In addition, there will be winners and losers as it continues to evolve and grow.

What This Means for Investors

AI is not “just hype,” but it is also not a guaranteed win. Parts of the market may cool off as expectations become more realistic. For investors, the key is to stay balanced, avoid chasing headlines, and focus on companies with solid fundamentals. AI will likely play a major role in the economy for years to come. The challenge is investing wisely without getting caught up in short-term excitement.

Bottom line: AI is a powerful long-term trend, but not every AI-related investment will succeed. Staying informed, diversified, and disciplined is the best way to navigate this ever-evolving space. We can help. Please reach out to an advisor today. Your success matters to us.