Is the Cold Snap Freezing Out Retail Sales?

February 24, 2025

By Dustin Saia

By Dustin Saia

Securities Analyst

Like most of the U.S. last week, Sioux City, Iowa experienced some extremely frigid temperatures due to what meteorologists call a polar vortex. During this polar vortex, parts of the upper Midwest experienced wind chills as low as -60 degrees and impacts of the cold weather were felt as far south as Texas. Cold weather was a constant for much of the country to start the year and we may now be seeing it impact the economy through retail sales data.

The Importance of Retail Sales

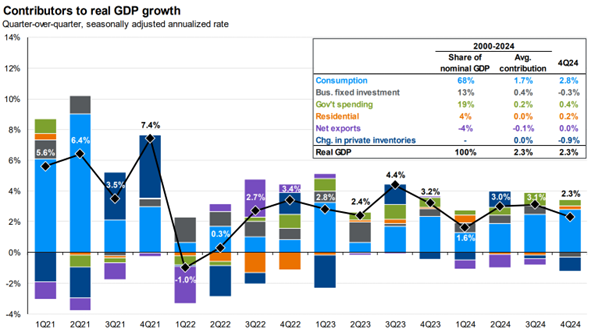

Retail sales is a key piece of economic data for investors as it gauges the level of consumer demand for finished goods. Consumer demand and consumption is vital to the health of the economy as it makes up about two-thirds of U.S. economic output as measured by Gross Domestic Product (GDP). Therefore, when retail sales figures are high or increasing, it is a good indicator the economy may be expanding. When those figures are low or decreasing, it can be an indicator that the economy may be contracting. The chart below shows the contributors to U.S. real GDP growth in each quarter starting in Quarter 1 (Q1) of 2021. From the chart, we see that consumer consumption (light blue bar) is a major driver of GDP growth and the U.S. consumer remained resilient over this period maintaining growth through spending. This resilience continues to drive strong U.S. growth that is outpacing other developed country peers.

Data as of February 21, 2025. Source: JP Morgan Guide to the Markets

Retail Sales in January

First estimates for retail sales in the month of January showed that sales fell by 0.9% compared to the previous month. The reading was below economists’ expectations for a 0.2% decline and dropped by the most in nearly two years. Categories of spending that contributed most to this decline included sporting goods and other hobbies. Additionally, motor vehicle sales were down sharply with the auto industry being hampered by price increases and lower inventories. Generally, the decrease is being attributed to major weather events like the extreme cold keeping consumers indoors and the toll of natural disasters like the California wildfires. While retail sales are adjusted for seasonal variation and holiday differences, it can still be difficult to account for the large seasonal swings in January following the end of holiday spending in the previous fourth quarter.

Although retail sales declined more than expected in the month of January, it may not reflect a broader shift in the trajectory for consumer spending going forward. January’s report comes on the heels of several months with large increases seen in overall sales. Retail sales data and the impact of more cold weather could contribute to a lower reading of GDP to start the 2025 year. Despite this, the U.S. consumer and economy have shown to be resilient, and we expect that to continue into 2025. While economic data releases may cause volatility in the short term, our broadly diversified investment portfolios can help to dampen those effects and contribute to your success in the long term.

Please reach out to your Wealth Management Advisor if you have any questions or would like more information. Your success matters to us. Stay warm!