Inflation Cools, Raising Hopes for a Fed Rate Cut

July 15, 2024

By Krista Biernbaum, CFP®, CIMA®

By Krista Biernbaum, CFP®, CIMA®

Investment Management OfficerInflation is the topic on everyone’s mind, particularly so for members of the Federal Reserve’s Open Market Committee. Why? Price stability is one of the Fed’s dual mandates (promoting full employment is the other).

Inflation data was the reason the Fed did not cut interest rates in the first half of the year. Progress on the inflation front stalled in the first few months of 2024. Recent statistics are more promising. Does this open the door for a rate cut?

CPI Negative for First Time Since Pandemic

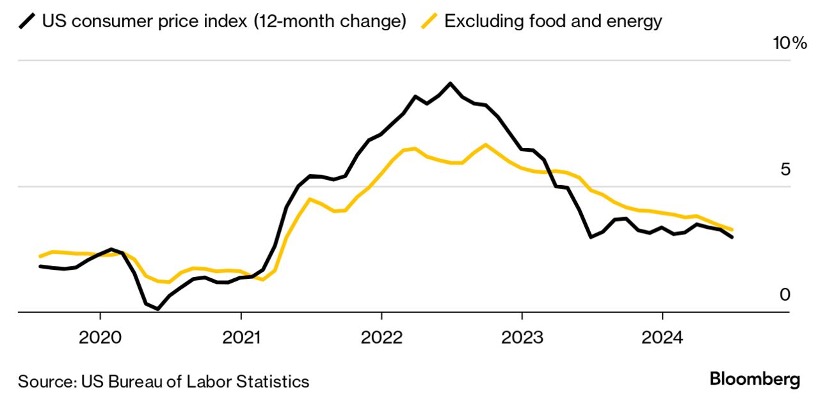

The May Consumer Price Index (CPI) was the first inflation reading of 2024 to show broad cooling in the various underlying components. Last week, the June CPI showed a similar trend. For the first time since the pandemic, CPI was negative for the month, down 0.1%. The Core, which excludes the volatile food and energy components, rose 0.1%. This led the year-over-year drops to 3% for headline and 3.3% for Core CPI. As you can see from the below Bloomberg chart, inflation is at its lowest level since 2021.

With two consecutive months of favorable inflation, does that translate into the greater confidence the Fed needs to start its rate cutting cycle? The markets seem to think so. Following the June CPI release, the bond market now prices in over a 90% probability of a 0.25% cut at its September policy meeting.

At the same time, remember that the market tends to get ahead of itself. At the beginning of the year, the markets priced in over an 80% probability the Fed would cut in March. Reality did not follow expectations.

What This Means for Your Portfolio:

While the most recent inflation is “Fed friendly,” it is too early to tell when the Federal Reserve will both start to cut interest rates and how many cuts will follow. What is certain is the Fed remains data dependent and will assess monetary policy changes on a meeting-by-meeting basis.

In the meantime, as discussed in our quarterly video, it is time to start positioning for the next stage of this rate cycle. You can take advantage by locking in these still-attractive rates across the maturity spectrum. If you would like to discuss the next phase of the rate cycle and what it means for your portfolio, please contact us today. Your financial success matters to us.