Correlation is not causation, unless it is ...

November 18, 2019

By Mike Moreland

By Mike Moreland

Vice President - InvestmentsHave you heard of the Super Bowl Indicator? Those of a certain age (ahem) remember when there were two established professional football leagues, the legacy National Football League and the upstart American Football League. The two joined forces in the late 1960s. A few years later, sportswriter Leonard Koppett noticed a pattern emerging: stocks did well in the year following a Super Bowl win by an ‘old’ NFL team (Green Bay, Chicago, etc.), and not so well if a former AFL team won the championship (New York Jets, Kansas City, and the like).

Investors rooted for the NFL alum in the championship game, since that was a good sign for the financial markets in the year ahead.

Is the “Super Bowl Indicator” in the Stock Market a Real Thing?

Was there a correlation between the Bowl outcome and stock market behavior? Absolutely — the indicator had a 90%+ success rate for a stretch of a decade or so. Was there a causal relationship? Not a chance.

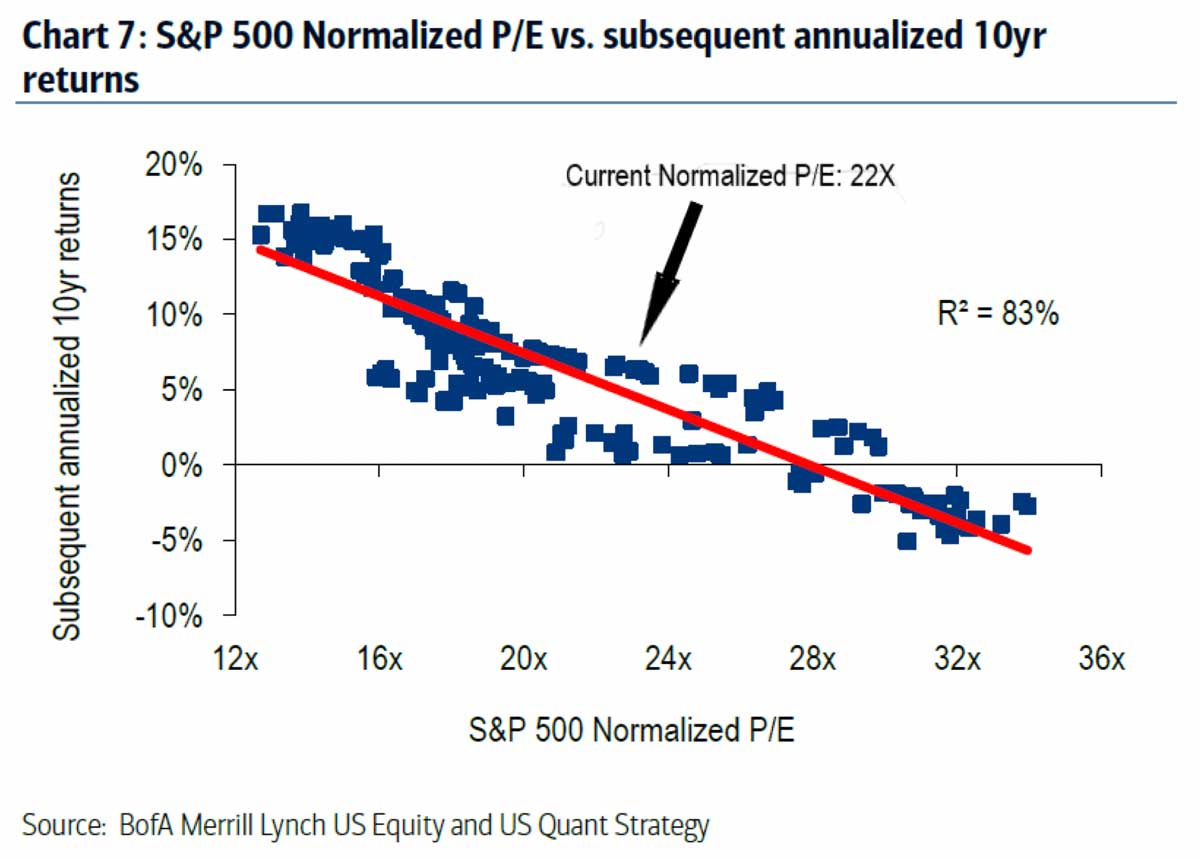

What about other relationships? Are they more meaningful? Let’s consider valuations. Past blogs have pointed out that one of the best predictors of longer term market returns is the valuation level at the beginning of the measurement period. When stocks are statistically cheap at the starting point, future returns (over a five to 10-year period) tend to run high. The opposite is also true. High valuations at the beginning tend to presage more moderate returns over time. In fact, as shown in the following chart, courtesy of BofA Merrill Lynch, the starting valuation of the stock market “explains” about 83 percent of the market price performance over the next 10 years.

This is a pretty powerful observation, to be ignored at the risk of one’s financial well-being. Where are we now? By most measures, stocks carry above-average valuations by historic standards. This doesn’t mean poor results are ahead, but it strongly suggests that a repeat of the mid-teens annualized returns of the last decade is unlikely. Plan accordingly.

For us, that means to stay broadly diversified with an attention to valuation and high quality. Portfolios under our management are structured to participate in rising markets and help protect value in less favorable times. Talk to your advisor about how we balance risk and reward with the wealth you entrust to us.

And just to make sure, root for an ‘old’ NFL team in the 2020 Super Bowl. Plus, if my Green Bay Packers win, we will guarantee a great market year to follow.

Leave a comment