Jumping In and Out? You're Likely Missing the Point

May 5, 2025

By Krista Biernbaum, CFP®, CIMA®

By Krista Biernbaum, CFP®, CIMA®

Investment Management OfficerThere are periods in life where time flies by. You blink and the next thing you know the day or month is over. April was not that. The wild day-to-day swings in the markets from the continually evolving tariff landscape left investors feeling fatigued. Would this never end? While the volatility was difficult to stomach, April ended on a much better note than on which it began. Patient and disciplined investors benefited from staying invested throughout the entire month.

Time in the Market-Vs-Timing the Market

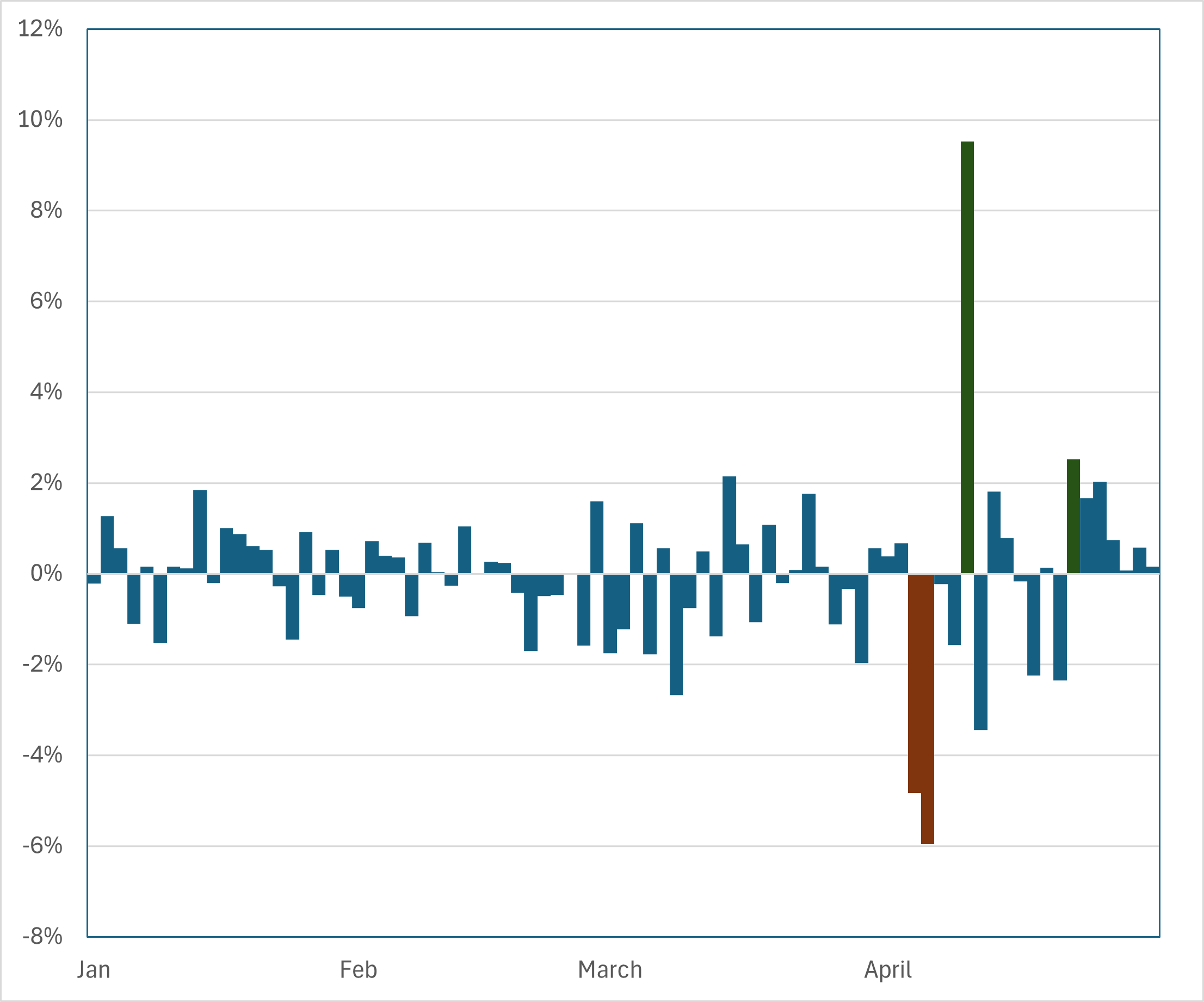

There is an old adage that time in the market is more important than timing the market. This year is no exception. Below is a chart of year-to-date daily returns in the S&P 500 Index through the end of April. Most of the daily price changes were within 2% up or down until last month. Following the announcement of reciprocal tariffs on April 2, the S&P 500 fell over 10.0% the subsequent two trading days. However, it recorded its best day of the year the next week, up 9.5% from the announcement of a 90 day pause on those tariffs (excluding China).

Source: Morningstar™

Through all of volatility, the S&P 500 was down just 0.7% in April. Year-to-date the Index is down 4.9%. If an investor decided to sell out of stocks after those two consecutive down days (the red bars above) for fear of the unknown, the loss falls to 15.0%. Conversely, if you missed the best two days of the year (the green bars above), the loss is 15.3%. This highlights the importance of staying invested during these bouts of volatility.

Markets are Forward-Looking

While uncertain times can make it difficult to stick with your long-term plan, the chart above illustrates the challenges with trying to time the market. And, while not shown above, history supports this view. The best and worst days in any year are often packed closely together. If you want to avoid the worst days, you unfortunately miss out on the best days too. Why? In times of heightened volatility, knee jerk reactions to the headline of the day trigger both strong and dismal days. From a bigger-picture standpoint, keep in mind that markets are forward-looking. What we know today and expect going forward based on that knowledge is already priced into the market.

We do not expect you to navigate these uncertain times alone. We are here to help you through any market environment. If this volatility is affecting you, let's have a conversation. We can review your plan and ensure you are still on track for financial success.