Knock on Wood - It Looks Like a Strong Finish for 2023

December 4, 2023

By Tom Limoges

By Tom Limoges

Vice President - InvestmentsHistorically speaking, the fourth quarter tends to be the best quarter in terms of equity market returns and (knock on wood) this year is falling in line with that trend. In the month of November, the S&P 500 (500 largest U.S. companies by market cap) rallied 8.9%. Last week marked the fifth straight week of market gains for most major indexes.

What changed from a couple of months ago — and will this short term market rally continue?

Rate Expectations Look Promising

Most of the enthusiasm around the equity markets is associated with lower interest rates and the growing confidence the Fed will navigate the economy toward a soft landing vs. a recession. Additionally, the market expects the Fed to conclude raising interest rates and to start reducing them in 2024.

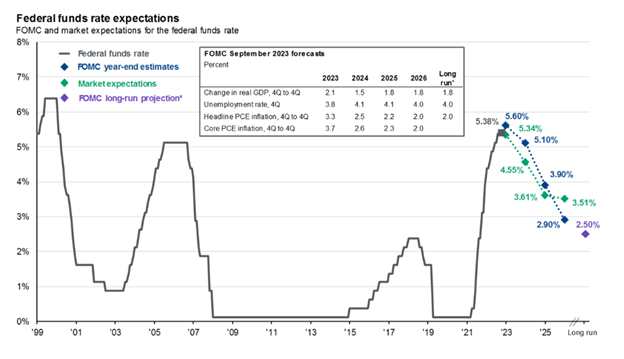

The chart below highlights the Federal Funds rate path and expectations of the market and Federal Open Market Committee (FOMC).

Fed Warns Against Premature Confidence

As you can see from the chart above, there is a slight disconnect between the market and Fed. Just this past week, Fed Chair Powell pushed back against the market’s belief that rate cuts are on the horizon, saying it’s “premature to conclude with confidence” that monetary policy is “sufficiently restrictive”.

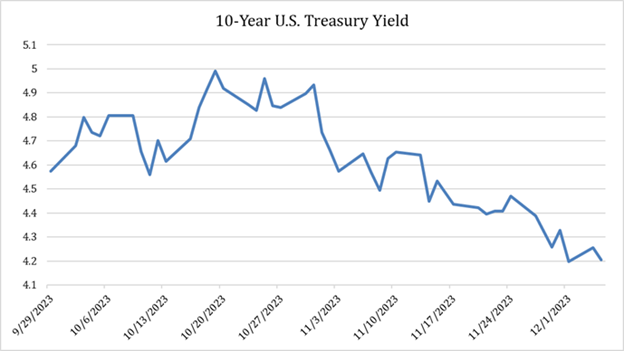

Our view is that the Fed will be data dependent and not reduce rates until inflation gets to a comfortable level. This change in interest rate assumptions affected rates across the yield curve. The chart below shows rates on the 10-year Treasury:

Since touching five percent around mid-October, the yield on the 10-year U.S Treasury bond declined to around 4.2%. In terms of interest rates, this is a big movement in a very short amount of time.

Earnings For Many Companies Outpacing Estimates

In addition to lower interest rates, corporate earnings and outlooks are in line to ahead of most analysts’ expectations. As of recent (according to Zacks Investment Research), about 80% of the companies in the S&P 500 reported both Q3 earnings and earnings for the current quarter are on track to increase by 1.5% with similar growth in revenues. So far, over 80% of the companies that reported outpaced estimates on revenues. The main takeaway from these reports is that earnings, while slowing, remained positive, and overall, the markets reacted favorably to that news.

While the market traditionally finishes the year strong in the final month, lots of economic releases and events can affect the market. The Fed will meet next week to discuss monetary policy one last time in 2023. While the market expects the Fed to remain on hold, any change in verbiage could alter the market’s path. Our client portfolios will remain fully invested and in line with their long-term investment policies. We understand that short-term movements can affect allocations and will look to rebalance portfolios after the new year with careful attention placed on high quality and value.

If you have any questions, please reach out today Your success matters to us.