Learning From The Past

October 23, 2017

By Michael Moreland

By Michael Moreland

Vice President Investments

Each Friday our internal Investment Committee meets with our personal trust and employee benefit Advisors to review performance, discuss possible changes to your portfolios, and provide market information. This keeps everyone up-to-date and able to build our broad themes into individual investment relationships.

Each week begins with education – fifteen minutes or so of whatever strikes us as interesting and pertinent to the work we do for clients. Last week’s topic was a look back at the Crash of 1987, when the broad market averages lost about one-quarter of their value in one day. The “more experienced” team members who lived through this had a number of stories to tell.

It’s a different picture thirty years later. Global economic growth is accelerating and stock markets are setting records almost daily. Fear is disappearing, and that’s perhaps the most notable aspect of this phase of the post-election bull market. One way to monitor fear is to look at market volatility. By that measure we are in the midst of calm seas and participants are confident they will continue so.

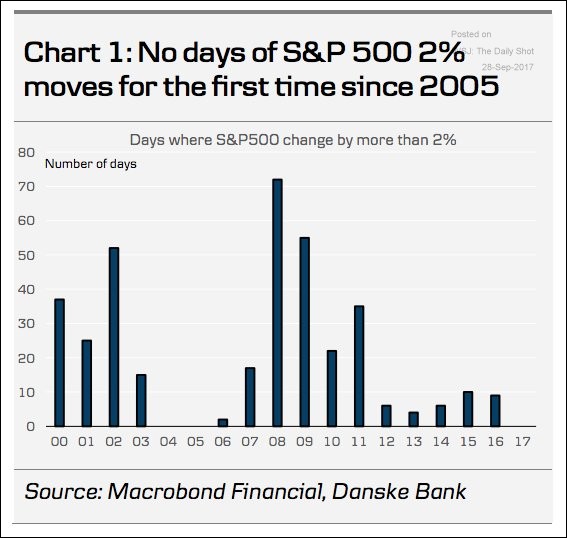

The chart below (from the Wall Street Journal’s Daily Shot) shows that there have been no days of 2% moves in the S&P 500 thus far this year. It’s the first time we’ve seen this since 2005.

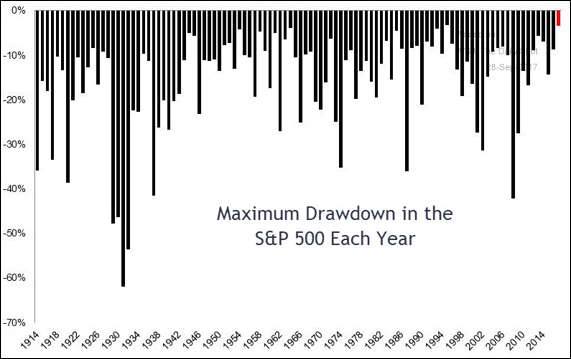

More interesting to me is the next chart, also from the Daily Shot. The biggest top-to-bottom drawdown this year is the smallest in the last century. (What’s a drawdown, you might ask? It’s a Wall Street euphemism for a market decline. As former President George H. W. Bush might have said, it’s a “kinder, gentler” term for a bad market.)

How could life be better? A growing economy, rising stock prices, a near-absence of fear, and no visible risk. This market has it all. But, as noted economist Herbert Stein once said, “If something cannot go on forever, it will stop.”

Perhaps this will be the perpetual bull market. Reason suggests otherwise, and that there will be a reversion to the mean – in valuations, volatility, and downside risk. When – not if – this occurs, we want it to take place gradually, not all at once. One market crash in a career is enough for me.

So what do we tell our Advisors and clients? First, you cannot expect to eliminate market risk and still benefit from market gains. You can position yourself to participate in the good times and protect most value in less favorable periods. Diversification is the key.

And, even if the worst occurs, stay with a well-designed plan. A chaotic event thirty years ago is barely visible on today’s charts. Time is on your side. Talk to your Security National Bank

Wealth Management Advisor about how to position your portfolio for today – and tomorrow.