Lights, Thanks, and Sales: The Economic Significance of the Holiday Spirit

November 27, 2023

By Ted Hanson

By Ted Hanson

Portfolio ManagerThe holiday season is officially upon us. I hope everyone had a Happy Thanksgiving and you were able to celebrate with others and reflect on all that you are grateful for. I know I am grateful I put Christmas lights on the house last weekend before it became so cold! As we enter the last month of the year, this becomes an important time for not only shoppers and businesses, but our economy as well.

The Make or Break of Seasonal Sales

Traditionally, holiday shopping is not only a great time for shoppers to find deals, but also provides a boost to company profits. As you can see in the chart below, 2022 holiday retail sales accounted for over a quarter of many retailers’ annual sales. Will this year be the same? Holiday retail sales in the U.S. are forecasted to reach $957 billion, a modest 2.2% increase from last year. Both Target and Walmart mentioned in their third quarter earnings report they remain cautious going into the holiday season. It is too early to tell whether declining excess savings in households will hinder shoppers’ willingness to spend.

Pocketbook Pressures Plaguing Americans

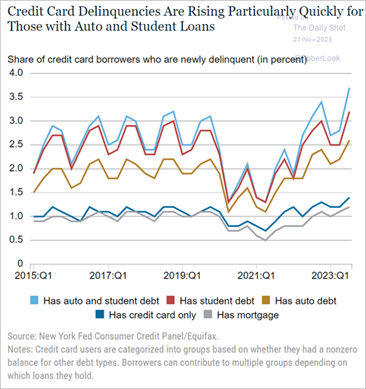

As many Americans look to buy gifts, they will need to be diligent when managing their spending. The past years of increased inflation, rising interest rates, and lagging wage growth, have continued to place pressure on American pocketbooks. The personal savings rate (personal savings as a percentage of disposable personal income) has trended downward for several months. September’s rate of 3.4% is down from 2023’s peak of 5.3% in May. While not uncommon for Americans to utilize credit cards to supplement spending, the chart below highlights many of the challenges a rising interest rate environment can have. Credit card delinquencies continues to grow but even more so for those carrying other debt (student and auto loans in particular).

This continues to be an area we will monitor going forward as consumer spending accounts for over two thirds of our national gross domestic product (GDP). In part, due to the challenges facing the consumer previously described, many economist are forecasting slower economic growth in 2024. The Federal Reserve forecast next year’s GDP to average 1.5%, down from 2.1% projected for 2023. However, as experienced this year, the U.S. economy can prove resilient as inflation has trended downward.

Time will tell how 2024 plays out, but no matter the case we will remain fully committed to helping you achieve your long term goals. Portfolios under our charge will remain fully invested throughout an economic cycle. We continue to be attentive to valuations and credit quality. We are grateful you have entrusted us with helping you reach your retirement goals. Reach out today if you'd like to schedule a meeting with your Advisor! Your success matters to us.