Like College Basketball and the Weather, Inflation is Heating Up

March 18, 2024

By Samuel Richter

By Samuel Richter

Senior Securities AnalystWe are entering one of my favorite times of the year. College basketball is about to heat up with the start of March Madness. The weather is also warming up as we leave winter behind and move into spring.

However, the one thing no one wants to heat up is inflation -- and the release of the consumer price index (CPI) last week showed U.S. inflation was slightly hotter than expected in February.

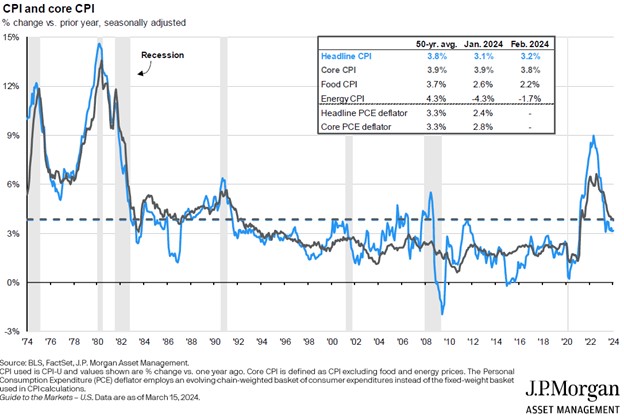

Headline CPI inflation rose 3.2% last month from a year ago, slightly above economists’ expectations of 3.1%. This reading was up from the January release of 3.1%. Core prices, which exclude volatile food and energy, also came in above expectations. Core inflation rose 3.8% year-over-year, down from January, but hotter than the surveyed estimate of 3.7%.

To put it in perspective, CPI headline inflation has declined drastically from its peak in mid-2022 at 9.1% as seen in the chart above. However, it remains sticky and above the Federal Reserve’s target of 2%. The latest inflation report will not impact the Federal Open Market Committee’s (FOMC) rate decision at its meeting this week. The markets already expect the Fed to leave rates unchanged.

Where Are Rate Cut Hopes Amid Sticky Inflation?

Throughout the first couple months of the year, the markets drifted more in line with the Fed’s expectations of “higher for longer.” The markets went from anticipating six rate cuts this year to now expecting three. The Fed anticipated three rate cuts when it released projections at the December meeting. It will release updated projections at the meeting later this week.

The major items to watch for are the tone of Fed Chairman Jerome Powell’s press conference following the meeting and the FOMC projections. Powell has stated the central bank wants more evidence that inflation is slowing sustainably before cutting rates this year. This meeting should give us a view into what the Fed thinks of the recent data. If you have any questions, please contact your financial advisor today. Your financial success matters to us.