Look What's on the Verge of a Major 40,000 Milestone

April 1, 2024

By Anders Staxen

By Anders Staxen

Wealth Management InternIn early December 2020, my colleague, Michael List, published an article marking the Dow Jones Industrial Average hitting the 30,000 milestone. In that article, Michael describes four different methods that each provide us with an educated guess as to when the Dow would cross the 40,000 milestone, with guesses ranging from two to six years.

Michael said that the 40,000 milestone probably would be here faster than we expect but that it ultimately would leave us with more questions, e.g., when would the Dow reach 50,000? And now, about 40 months later, or 3.33 years, the Dow is approaching 40,000, causing us to guess when it ‘turns’ 50,000.

To continue our analysis, let’s use the same methods utilized by Michael to predict the arrival of the Dow at 50,000.

Trend Analysis

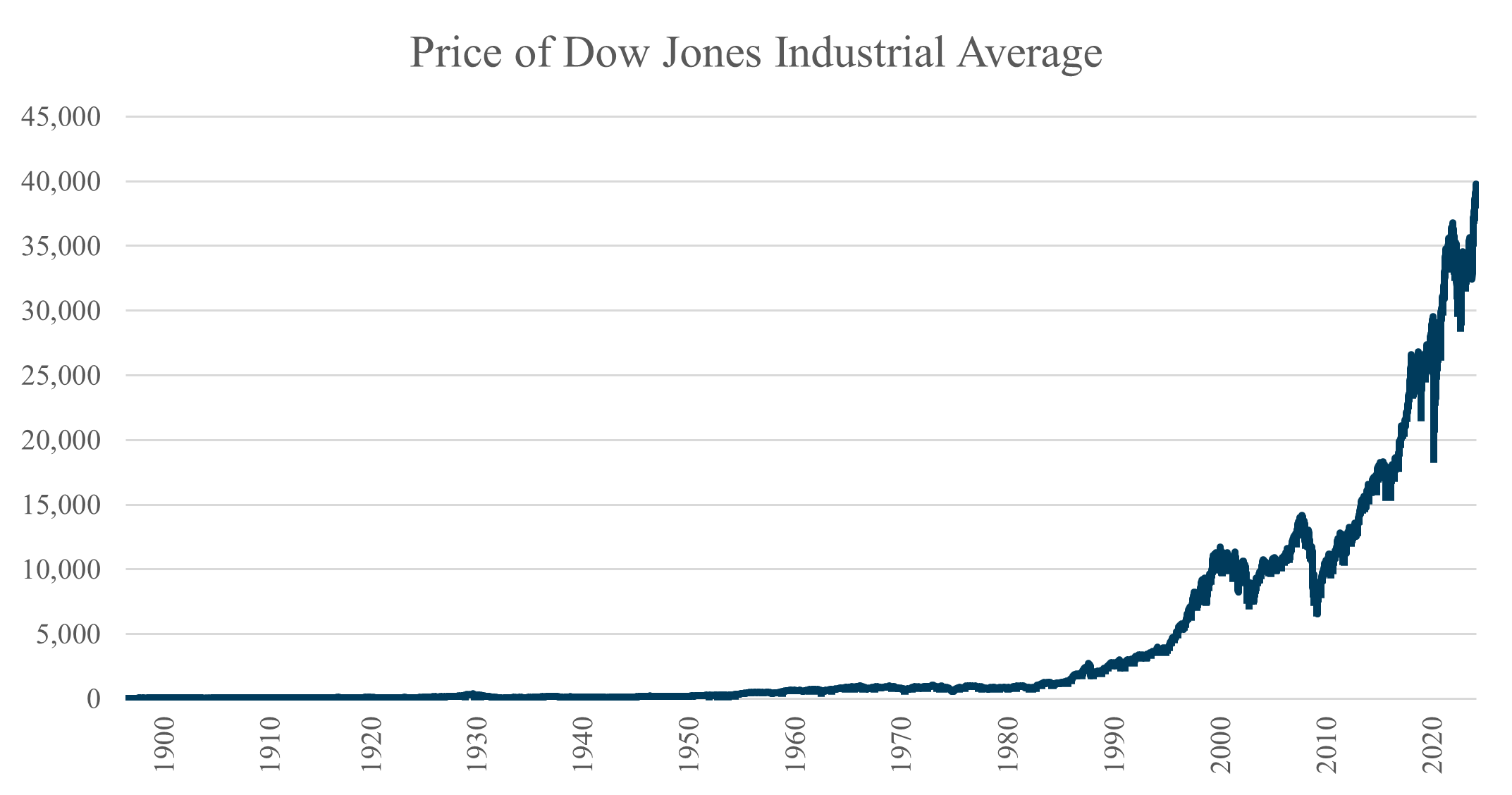

The chart below illustrates the daily closing price of the Dow since its inception in 1896 (data from Bloomberg).

After taking more than a century to reach 10,000, it took the Dow less than 18 years to reach 20,000, less than 4 years to reach 30,000, and less than 3.5 years to reach 40,000, provided it hits the milestone in the coming months. If this trend continues, the Dow could pass 50,000 in less than 3.5 years.

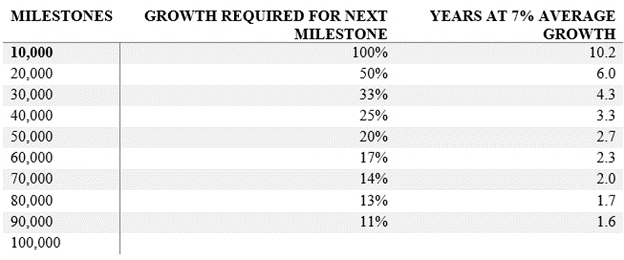

The apparent faster pace at which new milestones are reached, Michael says, is easily explained by the table below.

The table shows how the required growth rate to the next milestone declines as the starting point increases. For example, going from 10,000 to 20,000 requires a 100% growth rate while going from 40,000 to 50,000 ‘only’ requires a 25% growth rate. With an estimated 7% average annual growth rate, the Dow would reach 50,000 in 3.3 years.

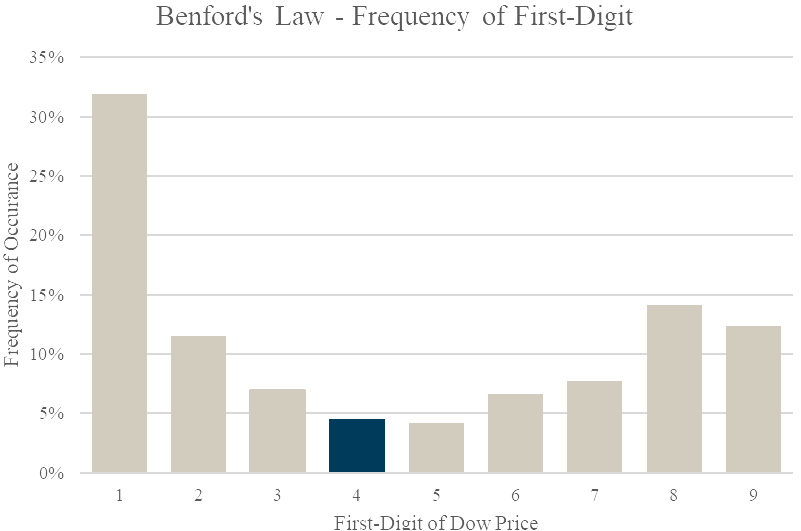

Benford's Law of First Digits

The change in required growth rates also helps explain the phenomenon of Benford’s Law, which states that in any given collection of data, such as the daily prices of the Dow, the leading digit is likely to be small. When applying this law to the Dow, it can be seen how the daily price of the Dow has spent 32% of the time with a lead digit of 1 (100s, 1,000s, 10,000s). In comparison, it has only spent 9% of the time with a lead digit of either 4 or 5 (400s, 500s, 4,000s, etc.). According to Benford’s Law, the Dow would reach 50,000 in approximately 2-2.5 years.

Historical Rate of Return

Another method is to examine past market results and use them for future projections. Since its inception in 1896, the Dow has averaged around 5.3% annual return over 128 years. If the Dow earns that 5.3% return going forward, it will take a little more than four years to reach 50,000. However, there are drawbacks related to this strategy, as the market rarely realizes the average return in any given year but instead is mixed with good and bad years.

Capital Markets Assumption1

An alternative approach to estimating potential market performance involves analyzing projections formulated by established investment firms. These firms construct complex models, incorporating historical return data, current asset valuations, and anticipated economic growth to forecast future returns. In that regard, several prominent investment firms have recently issued their outlooks on the direction of the markets. As of Fall 2023, BlackRock anticipates a 5.2% nominal return for large-cap equities in the United States over a 10- to 15-year timeframe, while J.P. Morgan projects a 7.0% nominal return. Research Affiliates and Charles Schwab have also offered their projections, estimating 4.0% and 6.2% nominal returns, respectively. Taking the average of these projections (5.6%), the Dow would reach 50,000 in slightly more than four years.

With the Dow on the cusp of a new milestone and the S&P 500 surpassing 5,000 for the first time in February, market observers are now turning their attention to new potential milestones: When will the S&P 500 reach 10,000, Nasdaq climb to 20,000, and Dow hit 50,000?

Should you have any questions concerning these indices or your financial success, please contact your Financial Advisor. Your success MATTERS.

_________________________________

[1] Morningstar; https://www.morningstar.com/portfolios/experts-forecast-stock-bond-returns-2024-edition