Market Downturn: Have We Reached The Bottom Yet?

May 31, 2022

By Krista Eberly, CFP®

By Krista Eberly, CFP®

Investment Management Officer

It has been a challenging year for investors across the board as both fixed income and equities are negative on a total return basis. However, we have seen some recent relief. Stocks are on an upward trajectory since the S&P 500 briefly touched bear market territory intraday on May 20. This leads to an important question: Has this market downturn already reached its trough?

What is a bear market?

A bear market is a decline of 20% or more from a peak to a market close. There have been 12 bear markets since World War II with a median drawdown of 31% according to Goldman Sachs. Not all bear markets precede a recession; two-thirds of them took place concurrent with a drop in economic activity.

The last bear market investors experienced was the downturn in March 2020 when stocks fell over 30% in a matter of days. This year's bear market status is dependent on what area of the economy you are looking at. For example, growth themes reached bear market status earlier this year, whereas value themes fared better.

Stock returns following a bear market

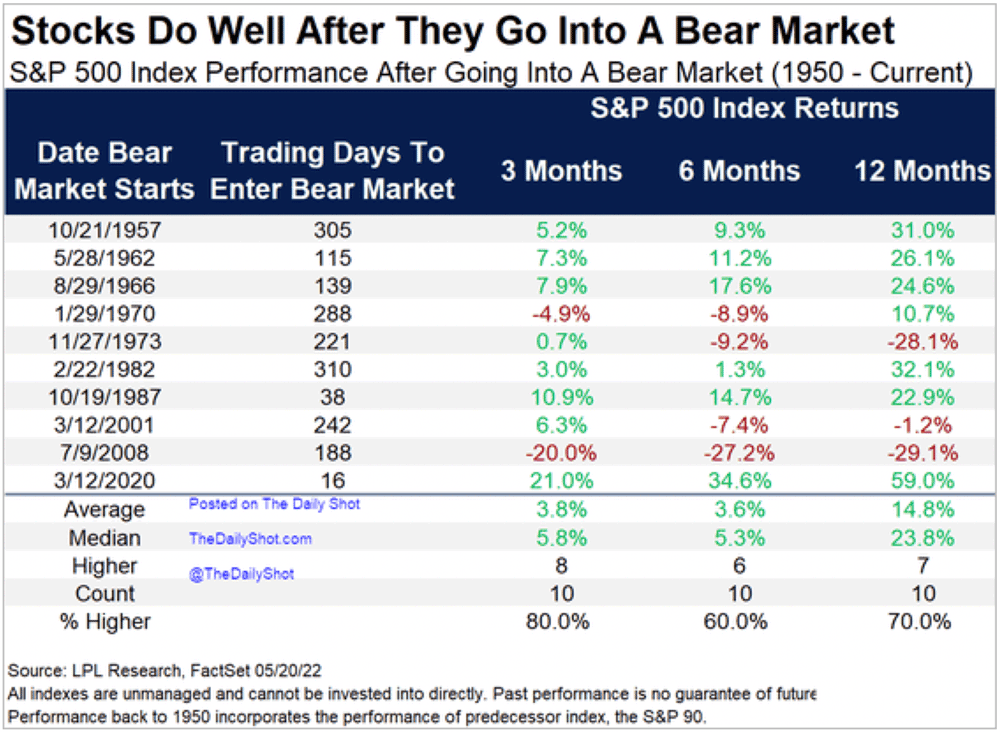

When in a bear market, how do stocks perform? The below chart from the Daily Shot® shows returns on the S&P 500 after entering into a bear market. Surprisingly, the returns are favorable.

On average, the S&P 500 is positive 80% of the time three months after reaching bear market territory, 60% of the time in the following six months, and 70% odds for the subsequent twelve-month period. The median return 12 months after a bear market is 23.8% with an average of 14.8%.

Why is this? The worst and the best days of the market tend to be clustered together. Around the trough of any downturn usually lie some of the best days of that market cycle. In addition, gains are usually the strongest in the early stages of a market recovery. This is why trying to time the market bottom usually doesn’t work out well for investors.

Have we reached the trough?

Since reaching bear market territory for the S&P 500 on May 20, we have witnessed a relief rally. Last week, the major stock indices recorded strong weekly gains of 6-7% on average. This snaps eight consecutive weeks of losses for the Dow Jones Industrial Average and seven straight weeks of losses for both the S&P 500 and NASDAQ. While a sigh of relief for investors, it is too early to tell if we have already reached the trough of this downturn as uncertainties remain.

How do we position during periods of uncertainty?

As my colleague Jonathan Smith pointed out last week, even though recession risks have risen since the beginning of the year, the base case is for no recession in 2022. However, where the Federal Reserve goes with its tightening cycle over the next couple of months will determine if this still holds true. Higher volatility will continue with near term risks tilted to the downside.

During periods of uncertainty, it is important to remain fully invested, disciplined, and conservatively structured. We made changes to our portfolios going into this year to help protect value in challenging times. We carry a value tilt to our equities and a lower duration high credit quality structure for fixed income. If these uncertain and challenging times are uncomfortable for you, please contact us today. Your success and financial safety matters to us.