Market Normandy: Landing on Uncertain Shores

June 9, 2025

By Tom Limoges

By Tom Limoges

Vice President - InvestmentsOn June 6, 1944, more than 150,000 Allied troops stormed the beaches of Normandy in one of the most decisive turning points of World War II. D-Day was not the end of the war but was the beginning of the end—a shift that moved the Allies to the offensive following embarrassing prior results in France. After the landings the path forward was full of uncertainty and victory was far from guaranteed. Eighty-one years later, the markets are waging a different kind of battle—facing volatility, policy headwinds, and shifting sentiment. And much like the Allies navigating tide charts, weather windows, and formidable defenses, investors in 2025 are trying to land on firm ground while facing macroeconomic uncertainty, tariff crossfire, and unpredictable inflation currents.

The Landing: A Volatile Entry

The beach landings on D-day weren’t smooth—especially on Omaha Beach, where early waves met fierce resistance and chaos. From an investment perspective, 2025 has felt rough and chaotic for investors. After a strong 2024 finish, markets stumbled out of the gate this year, rattled by trade tensions, credit rating concerns, and a pullback in consumer confidence.

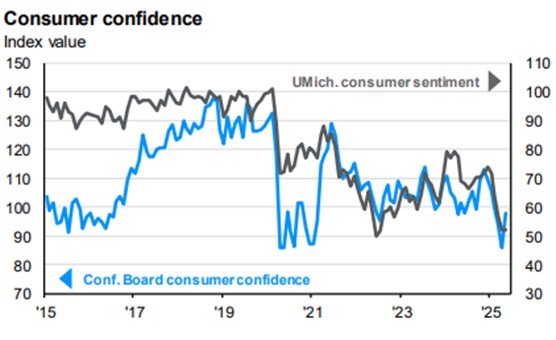

Source: JP Morgan Asset Management Data as of June 5, 2025.

This chart details consumer confidence measured by the University of Michigan (Gray) and the Conference Board (Blue). Overall confidence fell by both measures in early 2025 as consumers digested uncertainty surrounding tariffs and heightened market volatility. It is important to note that confidence surveys can be volatile, however recent data suggests the worst may be behind us. Recent gains in the markets could continue to support improving sentiment.

The Breakout: Market Gains in May

Once the beachhead was established, Allied forces slowly began pushing inland—liberating towns and opening supply lines. Progress was uneven, but it was progress. With the nearly twenty percent decline earlier in the year, the market’s “breakout” began quietly in May. Corporate earnings, most noted in the tech sector, exceeded expectations. Consumer demand, while softening, hasn’t collapsed. And investor sentiment—though still cautious—is beginning to turn.

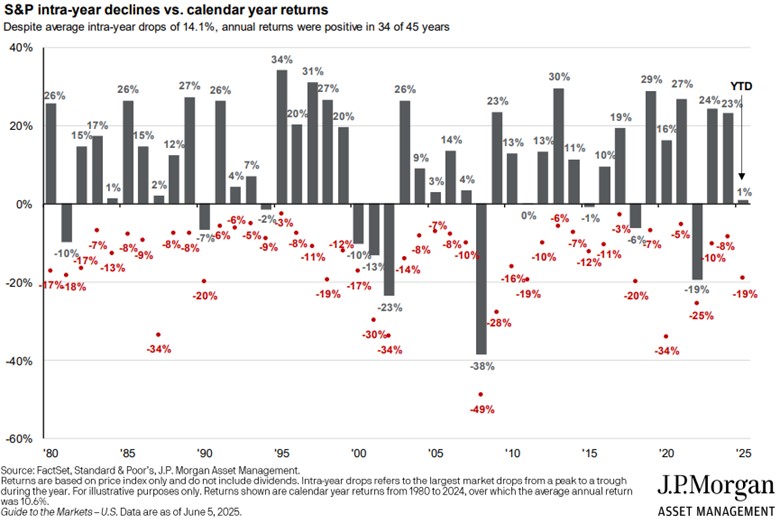

One of my favorite quotes on market volatility is that “Market volatility is the cost investors pay for long-term returns.” In this chart, we see that annual market returns (Gray) are positive 75% of the time going back to the early 1980s. However, the average intra-year decline for the markets is 14%. Early in 2025, the markets experienced a nearly 20% decline but have since rebounded and are now positive year-to-date. We aren’t celebrating victory yet, but like the post-D-Day advance, market growth is improving.

Invasion: A Diversified Approach

The Allies didn’t place all their hopes on a single beach or tactic—they launched a coordinated attack across five separate beaches, using land, air, and sea forces from multiple nations. This diversification of efforts increased the chance of success, even if one front stalled.

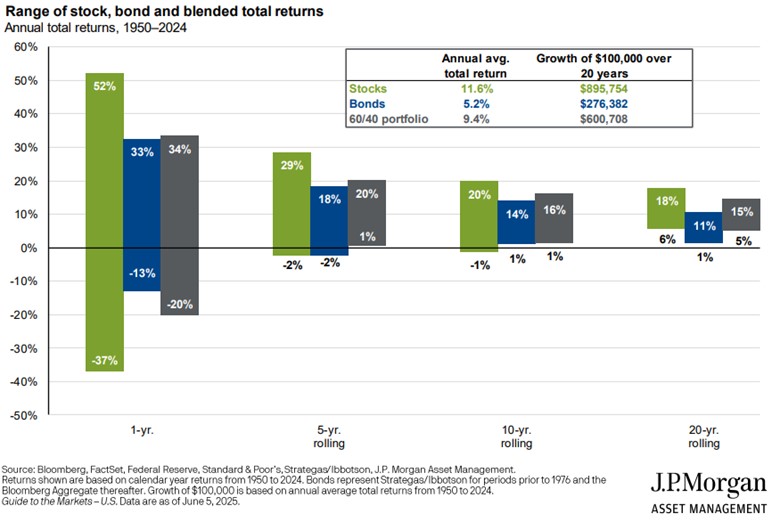

In this chart, we see possibilities of results for stocks (green), bonds (blue) and a diversified portfolio (gray). In the short term, volatility can be high for nearly all investments. However, over long-term time periods, results tend to be positive. Having a well-diversified portfolio of stocks and bonds can help reduce the chances of negative results. In the same way, investors benefit from diversified portfolios. Concentrating all exposure in one sector, geography, or style can leave you vulnerable to setbacks. But by spreading risk across asset classes (stocks and bonds), you improve your odds of long-term success, even if one area underperforms.

Final Thoughts: Staying the Course

D-Day was ultimately successful not because every detail went right, but because the Allies remained committed to the mission—improvising through setbacks, reinforcing weak points, and maintaining momentum even when the path forward was uncertain. In 2025, markets are asking investors to do the same. The early-year decline was unsettling, much like the initial landings at Omaha Beach. But recent progress—strong earnings, recovering sentiment, and a more stable economic backdrop—suggests that the worst may be behind us. Just as the Allies built from the beachhead and advanced inland, investors can build on improving conditions by staying focused on long-term goals, leaning into diversification, and accepting that volatility is part of the journey. Reach out to your Wealth Management Advisor if you have any questions. Your financial success matters.