Market Volatility - A Balanced Approach

February 21, 2018

By Tom Limoges

By Tom Limoges

Trust Investment Officer

Last week’s market gains highlighted the importance of Keeping your nerve in a jumpy market. Friday’s advance capped off the best weekly gain in the S&P 500 since 2013 – pushing returns back into the black for the year. What changed from the previous week? The short answer is “not much”, but inflation fears that spurred the recent round of volatility appear to have calmed.

This recent stock market drawdown and ensuing recovery highlight the fact that financial markets can (and often do) act irrationally and erratically over short-term time periods. Most would consider the recent market selloff irrational, but the fact that the markets advanced in every month over the last year could be considered equally illogical. Historically, one of the best defenses to reduce volatility in an irrational market is a well-diversified portfolio of both stocks and bonds.

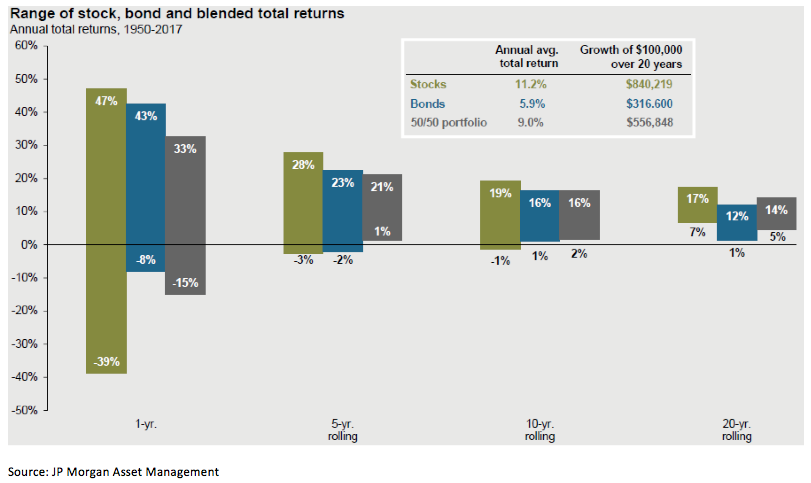

The chart above shows the distributions of annual stock and bond returns over the last 57 years. The shorter term (1-year) time period has a wide range of outcomes for either asset class. Over the longer term, the range of possible returns is much narrower and mostly positive. A balanced mix (grey bar) of both stocks and bonds is also used to show that having a diversified mix can dampen portfolio volatility.

The chart above shows the distributions of annual stock and bond returns over the last 57 years. The shorter term (1-year) time period has a wide range of outcomes for either asset class. Over the longer term, the range of possible returns is much narrower and mostly positive. A balanced mix (grey bar) of both stocks and bonds is also used to show that having a diversified mix can dampen portfolio volatility.

One of the fundamentals of Security National Bank’s investment management process is to balance the risks of both stocks and bonds to lower overall volatility. It is our goal to have conversations with clients about financial objectives and risk tolerance to develop a plan to address both. Tax season provides an excellent opportunity to gather your investment statements and review your allocation with your Security National Bank Wealth Management Advisor.