The market is on its longest winning streak since November. Will it continue?

August 15, 2022

By Tom Limoges

By Tom Limoges

Vice President - InvestmentsAs summer break comes to an end here in the Midwest, parents, students, teachers, are soaking up the bittersweet last few days of freedom. We mourn the end of lazy summer days, yet look forward to a new school year ahead. Students will have new classes, new names to learn and new memories to make.

Yet there is always a fear of the unknown, anticipating pop quizzes or worrying who to sit with at lunch. Much like the unknown ups and downs of a new school year, the financial forecast continues to be bittersweet with many unknowns.

Over the last week, U.S stocks marked their fourth consecutive week of gains in the longest run since November. Since reaching a low back in June, most broad based markets have recovered half of the losses in this year’s drawdown. Growth stocks have moved even higher. The tech-heavy NASDAQ market index (QQQ) reached levels that were 20%+ higher than their market lows seen back in June.

Many investors are now wondering: have we moved into another bull market? Or is this just a bear market rally? What changed from June? Do the markets have more room to run?

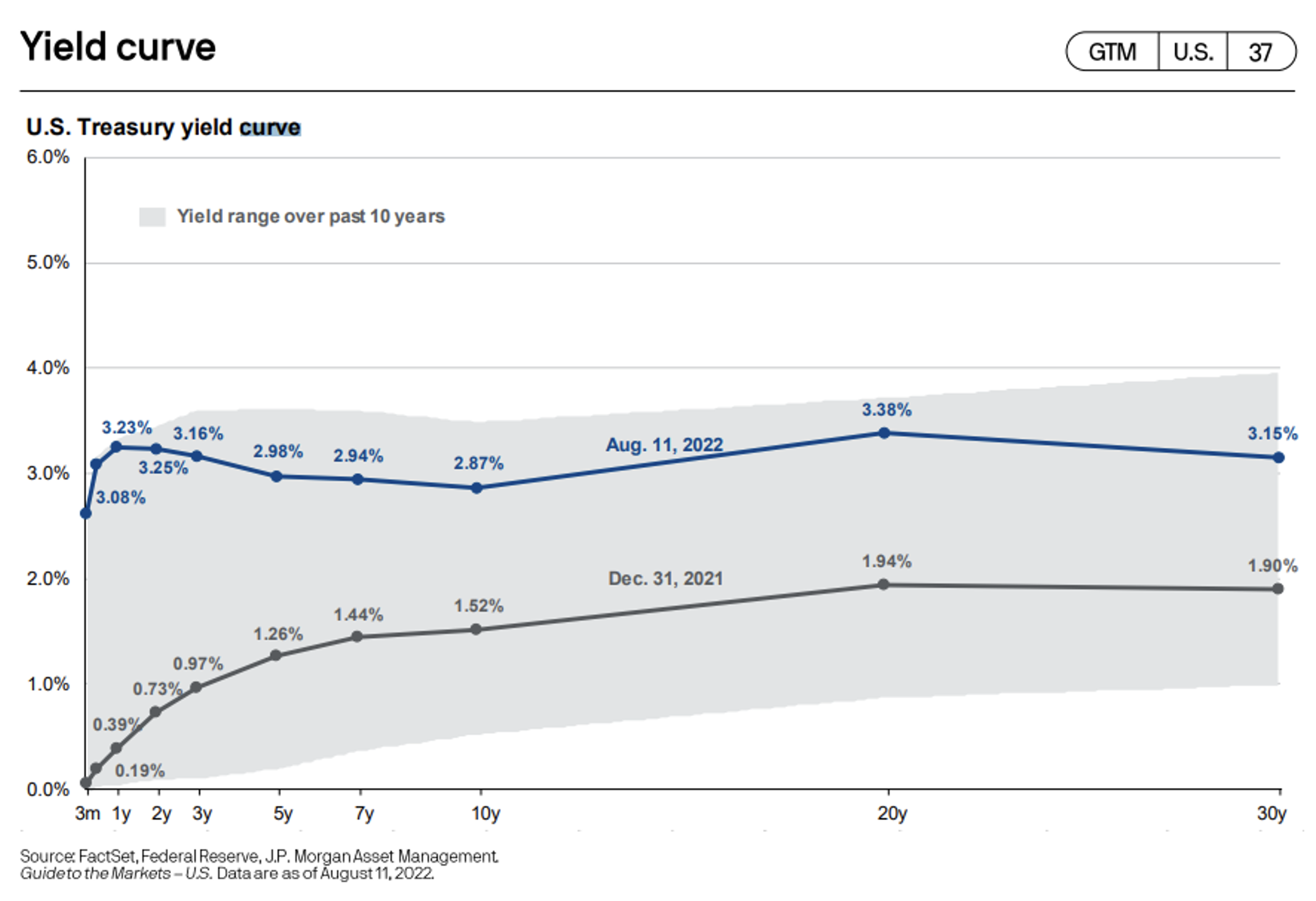

The Fed has remained aggressive with their stance on taming inflation, pushing short term interest rates higher. Longer term interest rates declined over the last few months in anticipation of lower future economic growth. This decline caused the yield curve to invert further over the last month.

The chart above shows the yield curve as of August 11th in blue, the yield curve at the end of 2021 in grey, and the range over the last ten years shaded in the background. The yield on the 10-year treasury moved over 3.5% in June, but has settled down more recently in the 2.7-2.8% range. With so much in our economy tied to interest rates, lower rates are considered a positive. This decline in interest rates sparked activity in risk-oriented assets (stocks) and has moved market indexes higher. Additionally, investors are now more optimistic with the recent CPI data that inflation may have peaked and could moderate further in the future.

Has this type of bear market rally occurred previously? The short answer to this question is yes. During the recession following the Technology Bubble of the late 90s as well as the Great Recession of 2008-2009, we have seen instances where the market advanced more than 20% and then saw a secondary decline. So, it is possible that the market could sell off if economic conditions worsen. We also know that following the recessions of those periods, longer term bull markets developed. While it is too soon to give an opinion on this, the chart below takes a historical approach to the question.

Source: JP Morgan

Over the last 42 years, the average market decline on a yearly basis has been 14% while returns have remained positive over three quarters of the time. In the short term, market volatility will likely continue depending on the economic data and the Fed’s reaction. While no one has a crystal ball to see into the future, we can rely on past trends to make educated assumptions. Patiently riding out the lows of the market sets investors up for success in the long run.

While market returns for both stocks and bonds have improved in recent weeks, downside risk could persist over the short-term. Our strategy of maintaining fully invested and well diversified client portfolios will continue to provide consistent results over the longer-term.

We believe in our motto, “Everything Matters.” Our clients matter, and we remain dedicated to supporting you through any challenges or opportunities that may arise. Let us know how we can help.