Markets Are a Worrying Thing...

July 29, 2024

By Michael Moreland

By Michael Moreland

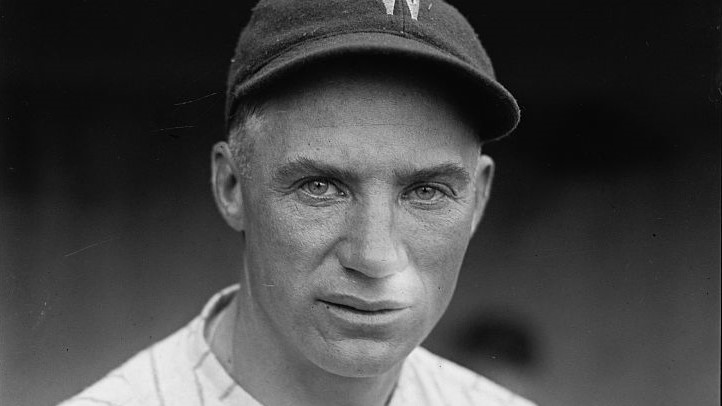

Retired VP - Investments Stan Coveleski was a major league pitcher (and Hall of Fame member) a century ago. While most of us think of baseball as a relaxing, pastoral game, participants see it differently. Coveleski’s memorable quote says it all:

…‘The pressure never lets up. Don’t matter what you did yesterday. That’s history. It’s tomorrow that counts. So you worry all the time. It never ends. Lord, baseball is a worrying thing.’

Many people look at the financial markets through the same lens. There are micro concerns (Will Tesla meet its earnings target?), macro considerations (When will the Fed lower rates?) and everything in between. There’s always something to worry about.

A quadrennial concern is always the presidential election. Do markets behave better during Democrat or Republican administrations? How will the markets respond to a change in Washington’s power structure? Let’s look at history.

source: Bloomberg, SNB Wealth Management

On the surface, the numbers suggest that a Democrat administration (blue bars) is better for stocks than that of Republican leadership (red bars) – an average 12% annual return for the former versus 6% for the latter. Like most things, however, the devil is in the details.

How Elections Can Impact the Markets

The Reagan (1981-1988), G.H.W. Bush (1989-1992), and Clinton (1993-2000) years were generally favorable times to own stocks. Was it due to their leadership – or were there other compelling factors?

Certainly in the Reagan years stock prices were driven by his selection of Paul Volcker as chair of the Federal Reserve. The Fed’s actions to raise interest rates to stratospheric levels crushed the Carter era inflation surge. All financial assets benefited for the next couple of decades – ending in a speculative internet stock mania in the late 1990s.

The G. W. Bush years started with the aftermath of the market bubble bursting and September 11. They ended with a credit crisis following the collapse of overextended housing markets.

The Obama and Biden years also witnessed generally low inflation and Federal Reserve polices friendly to stock and bond markets – until inflation reared its head again and the Fed embarked on the fastest and sharpest rounds of rate hikes in memory.

So it seems one common denominator between market behavior and the political cycle is not only who is President but who he (or she) appoints to run the Federal Reserve. In that sense, elections matter.

Will it be the same going forward? Yes, but given the absence of fiscal discipline by Congress, the latitude of any future Administration or Fed to act is limited. The next President will be faced with difficult economic, fiscal, and monetary environments lacking a clear path to resolution.

Managing Financial Worry

So, circling back to Stan, there’s always something to worry about regardless of which party occupies the White House – the present is no exception. How do we best mitigate the risks we face? Our solution is threefold: diversify, emphasize reasonable valuations, and concentrate on high quality. This strategy ensures participation in favorable times and helps protect value in more challenging periods.

Reach out and let the staff at Security National Bank Wealth Management show you how we do this. Your success matters to us.