Markets Calm and Confident Despite Downgrade in U.S. Debt Rating

August 7, 2023

By Samuel Richter

By Samuel Richter

Securities AnalystThe United States government’s credit rating received a downgrade last week. Fitch Ratings downgraded the U.S. debt from AAA to AA+. The goal of the ratings agencies is to give reliable data on risks associated with certain kinds of debt. Fitch is the second rating agency to knock the country’s debt rating off the top tier. Standard & Poor’s (S&P) moved the U.S. debt from AAA to AA+ in 2011. The markets are less concerned this time around.

What Happened Last Time?

Over a decade ago, S&P downgraded the U.S. debt for the first time in history. The downgrade came shortly after a heated debt ceiling debate, which eventually ended with an agreement. The day after the downgrade in 2011, the S&P 500 dropped almost 7%. The markets experienced heightened volatility for the following months. Moody’s and Fitch, the two other high profile credit rating companies, kept U.S. debt at the highest rating.

Why Fitch Chose to Downgrade

Fitch downgraded U.S. debt weeks after Congress pushed up against the debt ceiling deadline before coming to an agreement. Fitch pointed out multiple reasons for the downgrade. They noted projections for continued rising deficits, as the government starts paying more on debt due to elevated interest rates. Fitch also noted the repeated debt limit standoffs and last minute resolutions as a contributing factor to the downgrade.

The Impacts of the Downgrade

The markets did not react as drastically this time. The S&P 500 dropped less than 1.5% in the day following the announcement. The 10-year Treasury note rose about five basis points to 4.09%. A strong Automatic Data Processing (ADP) employment report also contributed to the day’s performance.

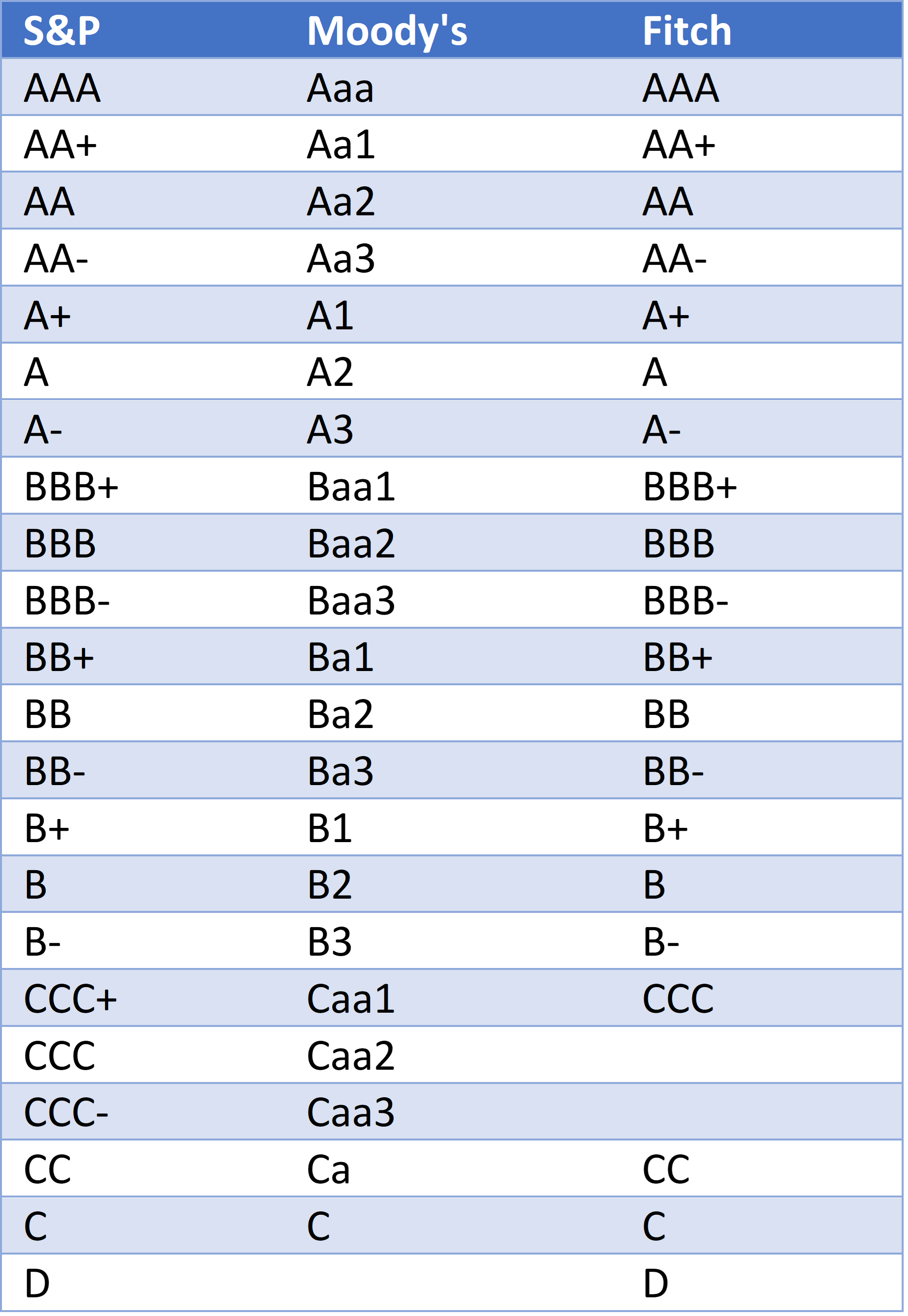

U.S. debt remains one of the safest investments despite the Fitch downgrade. It still has the highest possible rating from Moody’s and the second highest from both S&P and Fitch. Below is a list of ratings from the three companies. U.S. Treasury bills, notes, and bonds remain safe and attractive investments following the Fitch downgrade.

Ratings agency scores (in order of quality):

Reach out to your SNB Wealth Advisor today with any questions or concerns about the U.S. debt rating downgrade or the current market environment. Your financial success matters to us!