Mind The Gap

November 27, 2017

By Mike Moreland

Vice President of Investment Services

Years ago we worked with a Boston-based firm named Standish, Ayer, & Wood. One of its managing partner’s tenets was that a bear market transferred wealth from weak hands to the strong. What are the signs of weakness to which this refers? Among the most prominent is letting emotion – fear and greed – overrule fundamental analysis and careful planning. The outcomes are generally not good.

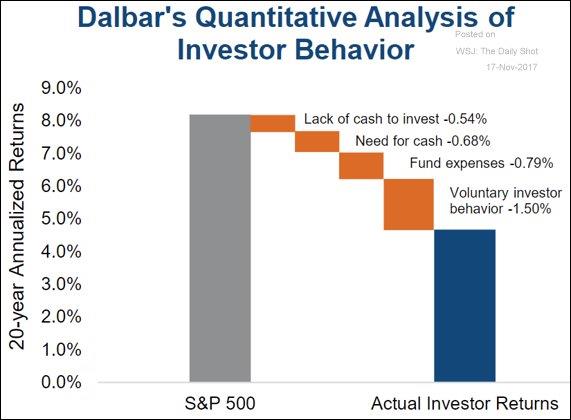

The consulting firm Dalbar, Inc. analyzes investor performance as part of its evaluation of financial firm business practices, product quality, and service. Its findings are disheartening, but not surprising. As shown below, in rolling twenty-year periods the average individual investor captures barely half the market return. The largest component of this shortfall is the category Voluntary Investor Behavior. This is also known as ‘Buy High, Sell Low’.

Source: The WSJ Daily Shot

Many investors view themselves as contrarians, willing to go against the crowd in the expectation of superior results. Sometimes this happens, most of the time it does not. First, few people are willing to commit funds when the outlook is bleak – they wait until the ‘trend is their friend’. Then, most do not sell until well after the outlook fades. When the financial pain becomes too great, they exit and, far too often, sit on the sidelines until the next upturn is under way.

This last point – being late to invest – is important. Studies show that an outsized percentage of price gains occur early in a market cycle. Waiting for confirmation that the worst has passed, and will not return, is expensive insurance.

The lesson from this? Always be the strong hands – remove emotion from the process to the greatest extent you can. That’s much easier said than done. Talk to us. We have a disciplined investment process, developed over decades and applied consistently. We fully recognize the role of emotions in the investment process, and we work hard to minimize their impact.

There are no guarantees, but there are steps that help close that Voluntary Investor Behavior gap. Let the Security National Bank Wealth Management team show how we can help.