Nvidia's Boom: Have You Missed Out?

June 24, 2024

By Joseph Adams

Intern

Nvidia's stock (NVDA) surged over the past few months. It briefly became the most valuable company by market cap, surpassing Apple and Microsoft. The stock rose over 43% in June alone and more than 200% year-over-year, demonstrating strong performance. However, it's important to remember that past performance doesn't guarantee future results, and some analysts set cautious price targets for the stock.

You Could Own More Than You Think

The S&P 500, or Standard & Poor's 500 Index, measures the performance of 500 of the largest publicly traded companies in the United States, representing a broad cross-section of the U.S. economy. When a company in the S&P 500 grows and increases its market share, its weight in the index also increases. This means that companies with larger market values exert a greater influence on the index's overall performance. The following top 10 holdings below account for 36% of the entire index’s weight. If you own an index that tracks the broad based market, you likely have plenty of exposure in these top holdings.

Source: Morningstar, SPY fund, first bought, and market value are SPY fund-specific.

Top Companies Hold Disproportionate Share of Market

Recently, the top companies in the index grew more rapidly than others. This growth led to a higher concentration in the market. With these top companies holding a disproportionately large share of the index's total market capitalization. This concentration can impact the index's performance, making it more sensitive to the fluctuations of these few dominant companies.

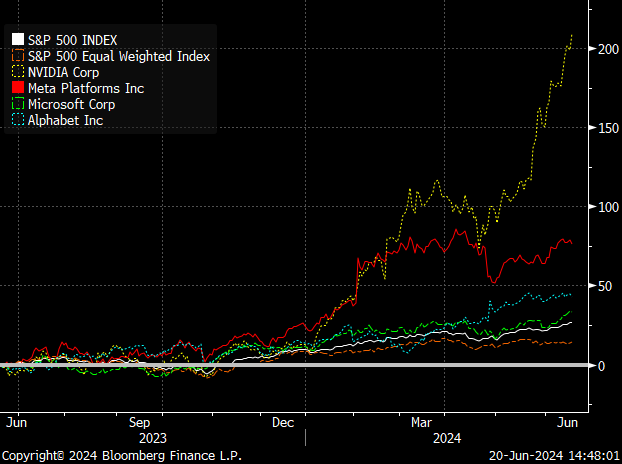

To help visualize how these companies are lifting the markets, the graph below shows the 12-month performance of the S&P 500 and a version of the S&P 500 where all the holdings are the same weight. The gap between the two versions begins to widen around the turn of the year and again in recent months.

To break it down further, here are the individual returns of some of the largest holdings.

Nvidia's Big Jump

Nvidia jumped from the middle of the pack to the front runner of the market. People and investors alike are trying to predict what will happen next with the AI craze. To put Nvidia’s growth into perspective, we need to do some math. Nvidia’s price one year ago was $40.63/share (accounting for the recent stock split). On June 20, 2024, the price closed at $130.78. If we expect the same growth over the next year, the stock price for Nvidia on June 20, 2025, would be almost $420 dollars per share, which means the market cap will grow from $3.2 trillion to over $10 trillion!

This growth isn’t impossible, but it is highly unlikely. We expect this AI boom to slow, leading to a rebalance in the market giving other sectors of the market the opportunity to catch up and contribute. This shift will result in a better-diversified market. Please reach out to your financial advisor to learn about the role diversification play in your investment portfolio. Your financial success matters to us.