New Labor Data Signal Economic Balance May Be Strengthening

May 6, 2024

By Dustin Saia

By Dustin Saia

Securities AnalystLike most things in life, the economy is all about balance. When the Federal Reserve is examining economic conditions and conducting monetary policy, they are guided by their “dual mandate” or goals of balancing maximum employment and stable prices in the United States.

The Federal Reserve's Balancing Act

The recent focus for the Federal Reserve is on stable prices and taming elevated inflation seen since the economy began recovering from the COVID pandemic. To fight inflation, the Federal Reserve raised the upper limit on the federal funds rate from 0.25% to 5.50% to restrict economic activity and put downward pressure on prices. While inflation declined from its peak in 2022, it remains above the Fed’s target of 2%. In addition to high inflation, by most measures the labor market remains historically strong. Given these circumstances, many are beginning to question if the Federal Reserve is being restrictive enough?

This is where the economy becomes a true balancing act for Jerome Powell and the Federal Reserve. Hold rates too high for too long and risk pushing the economy to the edge with stagnating growth and a possible rapid weakening of the labor market. Cut rates too soon and risk a re-acceleration of inflation and growth in the economy, forcing them to start the process of rate increases over again.

What Recent Jobs Data is Telling Us

During the Federal Open Market Committee (FOMC) press conference on May 1st, Jerome Powell shared his thoughts: “I do think that the evidence shows pretty clearly that policy is restrictive and is weighing on demand.” Powell’s main argument is that we are now seeing progress on the labor side of the equation, with the demand for workers continuing to fall from all-time highs. The most recent Job Openings and Labor Turnover Survey (JOLTS) data was used as support for these claims. In March of 2024, JOLTS data revealed that job openings had fallen to 8.5 million, down from a peak of over 12.2 million job openings in March of 2022. Additionally, the quits level, or voluntary separations from employment, are trending down to near pre-pandemic levels at 3.3 million for March of 2024. A declining quits rate will usually place downward pressure on wage growth with workers having less bargaining power in the labor market. As wage growth declines, this filters through to consumer and business spending, which represents a large share of the performance of the U.S. economy.

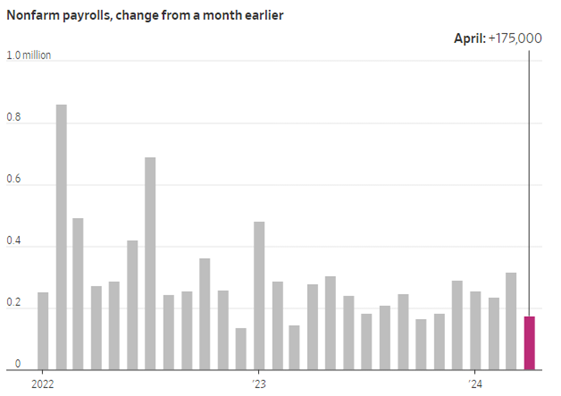

Finally, jobs data released after the Fed’s meeting seemed to solidify this idea. In the chart above, we see that the change in total nonfarm payrolls, measuring the number of workers added in the U.S., increased by 175,000 in April. This increase came in below expectations and is well below levels seen in 2022. Additionally, the data released showed that the unemployment rate ticked up slightly to 3.9% in April from 3.8% in March.

Are We Seeing Signs for Lasting Stability?

Given the current landscape, a softening in the labor market is currently a good thing for Jerome Powell and the Federal Reserve. Restrictive monetary policy seems to be doing its job and bringing the economy back into a better balance. While we might see a slight softening in the labor market in the short term, the long-term hope is for stable inflation and sustainable economic growth. Will the labor market be the key to balancing out the economy going forward? Only time will tell.

While the balance of the economy is important, so is balance within your financial plan. As we wait and see how the Fed’s actions will play out in the economy, we are here to prepare you for whatever situation does unfold. If you would like to discuss your portfolio or review your financial plan, please contact your wealth management advisor today. Your success matters to us!