Not About DOGE or Tariffs or Ukraine or the Economy...

March 17, 2025

By Michael Moreland

By Michael Moreland

Retired VP - Investments

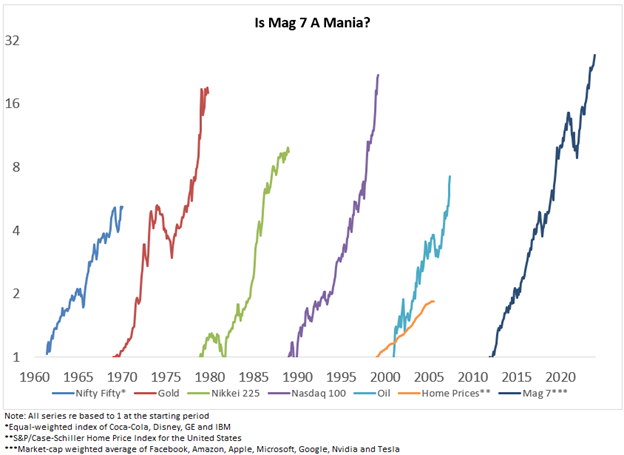

Our first quarter 2025 quarterly Economic & Market Commentary revolved around history repeating itself – that this time was not different, and that trees don’t grow to the sky. In the Old Testament book of Ecclesiastes, we learned ‘there is nothing new under the sun’. Markets –and manias – move in cycles, and recognizing when the tide turns is a key to avoiding major losses by ignoring fundamentals.

Manias come in many forms, but are often connected by too much money chasing too few opportunities. Advances become self-fulfilling prophesies and end when fundamentals cannot support price levels. The aftermath can affect all asset classes.

A few of the prominent manias of the last half-century are shown below, prepared by Alpine Macro and taken from an article in The Burning Platform, an iconoclastic political website:

As an older (seasoned?) investment manager, most are fresh in mind. Not fun to live through, particularly if your valuation disciplines steered you away from participation during the good times.

A few memories stand out. During the boom years for Japan’s economy and markets, there was legitimate concern about the purchasing power of Japanese investors in American companies and properties. One story (perhaps apocryphal) was that a few square miles of downtown Tokyo had a higher valuation than the entire state of California. No wonder the Pebble Beach golf course looked attractive to Japanese investors.

In the 1990s, the internet was the next big mania. New dot-com companies appeared overnight with no revenues, let alone profits. Valuations exploded beyond all reason. Market capitalizations of internet-related startups often surpassed those of a basket of long-standing well-financed, dividend-paying industrial and consumer companies. The latter are still standing, most of the former are not.

In hindsight, the peak was approaching when the financial press ran stories about co-workers who met to day-trade tech stocks before starting their regular tasks. And, who remembers The Beardstown Ladies’ Common Sense Investment Guide, written by the members of an investment club that boasted startling market-beating returns? The book sold over one million copies. It turned out that members’ fees were added to its published returns. Due diligence never goes out of style.

Did you know that Union Pacific was considered a quasi-energy stock during the oil boom? It was originally awarded land grants on adjoining track properties across the northern plains in the Dakotas and Montana. As the Williston Basin oil and gas fields were developed, the company’s prospects and valuation were more tied to the energy sector than to its core business.

And that brings us to the Magnificent Seven. While the story is far from over, the one-sided rush into AI- and technology-related themes appears to have topped out in the new year. Time will tell, but history suggests that more challenging economic times tend to wash away unbridled enthusiasm for specific stocks or market sectors. That appears to be happening now. Manias rarely end calmly.

While we can’t avoid volatility, we can take steps to reduce risk. Diversify, pay close attention to valuation, and focus on proven quality. These are the tenets of the Wealth Management Division; always have been and always will be. Talk to your Advisor and Investment Manager to discuss how we work to preserve and grow your wealth. Your success matters to us.