.jpg)

Nvidia: Maintaining Growth in the Midst of Competition

September 3, 2024

By Dustin Saia

By Dustin Saia

Securities Analyst

NVIDIA Corporation (NVDA), a semiconductor company and de facto leader of the Artificial Intelligence (AI) revolution, occupies the hearts and minds of many investors across the world. In many ways, Nvidia’s swift rise to prominence and stunning success draws few comparisons in the business world. With sustained success, and continued market euphoria surrounding the potentials of AI, Nvidia’s earnings announcements are evolving into a spectacle with the ability to immediately impact markets. Expectations for the stock are only growing from here. Can Nvidia keep up with the expectations? And what happens if these lofty expectations can no longer be achieved?

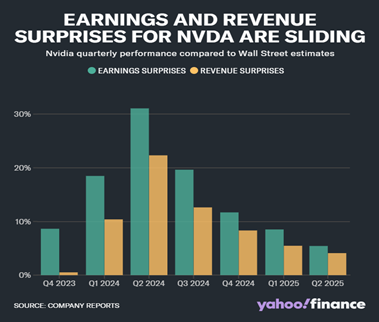

Nvidia’s Growth is No Longer Surprising

Nvidia’s most recent quarterly earnings report gives us a hint of what we can come expect from the company going forward. The chart below highlights Nvidia’s quarterly earnings and revenue surprises going back through Q4 of 2023. These surprises represent the percentage that Nvidia overperforms the expectations set by analysts of the company. The biggest surprise came in Q2 of 2024, when Nvidia outperformed earnings expectations by over 30%. Since that great feat, the ability for Nvidia to surprise analysts has been dwindling with the most recent earnings surprise slightly exceeding 5%. Despite outperforming analyst expectations, Nvidia’s stock traded down following the news. Not only is Nvidia now expected to beat earnings, but investors expect large outperformances to justify the premium placed on the stock price. While Nvidia’s AI prospects are still strong, investors should be aware of lofty expectations and how that can impact the stock going forward.

Broadening Market Leadership

Over the past several quarters, growth sectors of the S&P 500 including technology, communication services, and consumer discretionary are the largest contributors to quarterly earnings growth. Nvidia plays a major role in this, but other growth and technology names are also benefitting from AI related sentiment. These companies remain committed to spending to stay competitive in the race to capitalize on AI related products and services. In the short to intermediate term, spending is predicted to reduce the earnings growth of said companies as we await which companies can convert this spending into profits. Going forward, it is expected that earnings growth will broaden as growth sectors come back into line with the rest of the market.

During times of market exuberance, it remains critical to maintain a long-term approach to investing. Stocks like Nvidia can capture the attention of the market, but we shouldn’t let it capture the attention of your portfolio. As always, remain diversified and reach out to your Advisor today for further guidance. Your success matters to us!