Objective Data and Sentiment Diverge - What Happens Now?

March 31, 2025

By Eric Johnson

By Eric Johnson

Securities AnalystActions speak louder than words. An age-old adage that applies to our personal lives, but also to financial markets. Ways to measure the economy are countless, but they can, generally, be separated into two categories: soft and hard data. Soft data includes consumer and business sentiment, opinions, and expectations for the current and future environment. Conversely, hard data is objective and concrete, such as retail sales, the unemployment rate, and industrial production. While these two data types tend to move together, we’ve recently seen a dramatic divergence between them, leaving many unsure of the state of the U.S. economy.

Soft Data

The latest Conference Board Expectations Index - a gauge of consumers’ short-term outlook on income, business conditions, and the labor market - dropped 9.6 points in March to 65.2. This marks its lowest level in 12 years. The Present Situation Index – a barometer of consumers’ judgement of current business and labor market circumstances – fell only 3.6 points to 134.5. While the Present Situation Index experienced a decline, it is at a historically healthy reading, suggesting individuals feel things are worse off than they really are.

Hard Data

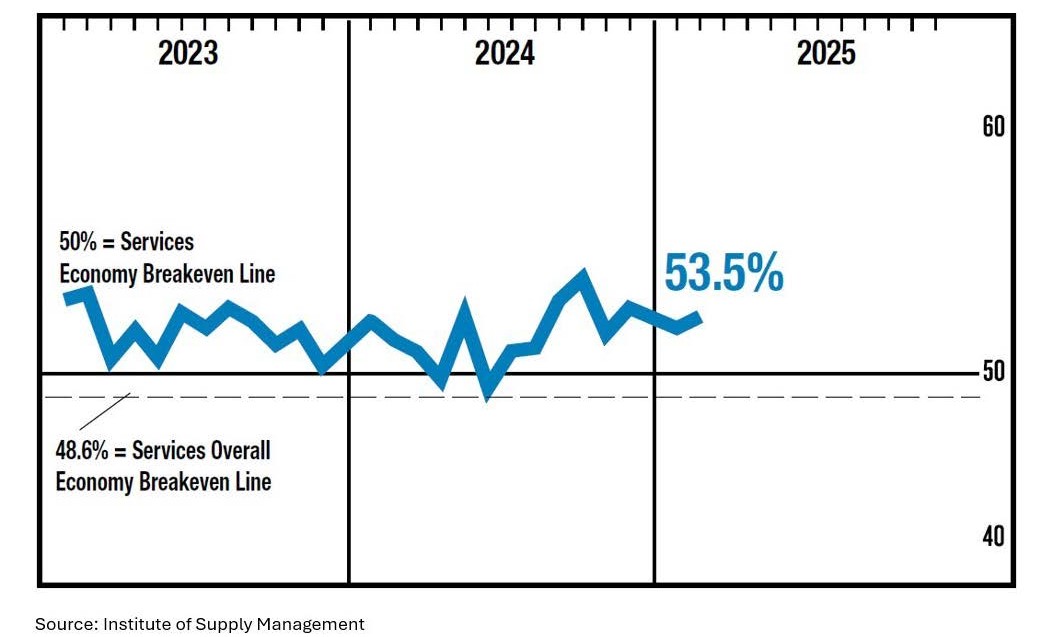

The Institute for Supply Management (ISM) Services Purchasing Manager’s Index (PMI) – a performance measure of the United States services sector – increased 0.7% month-over-month in February to 53.5, above economists’ estimates of 52.5. Most subcomponents of the index, including new orders, employment, and backlog of orders, saw notable improvements. Why does this matter? Nearly 70% of U.S. Gross Domestic Product (GDP) comes from consumer spending. Approximately two-thirds of this consumer spending occurs in the services sector, making it an integral contributor to domestic growth. While recent soft data has undoubtedly swung the sentiment pendulum to a glass half empty attitude, people’s opinions aren’t being reflected in the hard data (as of now).

During a conversation at the Detroit Lakes Chamber Economic Summit last week, Neel Kashkari, President of the Federal Reserve Bank of Minneapolis, acknowledged during his 10 years at the Federal Reserve “this is the most dramatic shift in confidence I can recall except for when COVID hit.” Uncertainty surrounding trade policy, inflation, government spending, and economic growth has led to extreme emotions of fear and apprehension but has created pockets of opportunity. Here at Security National Bank, we offer a tailored experience to help you ride the ups and downs of the market by focusing on well-diversified portfolios. If you have any questions about current market conditions or our outlook going forward, please reach out to your Wealth Manager Advisor. Your success matters to us.