Oh, the Prices We Pay: Is Cautious Optimism Too Much To Hope For?

April 17, 2023

By Samuel Richter

By Samuel Richter

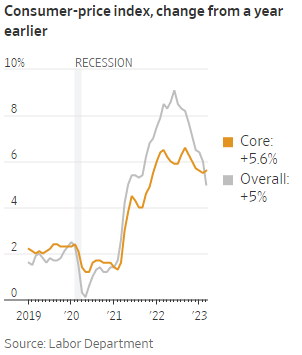

Securities AnalystThe Bureau of Labor Statistics released two different inflation metrics last week. On Wednesday, the consumer-price index (CPI) dropped to its lowest level in nearly two years. CPI measures the change in prices seen by consumers. The inflation gauge rose 5% last month from a year earlier, a solid improvement from February’s 6% increase. Declines in food and energy prices on a year-over-year basis were a big contributor to the decline in headline inflation.

Since core inflation excludes food and energy, it did not ease like the headline number. Core inflation increased 5.6% in March compared to 5.5% in the previous month. This was the first time in more than two years that Core CPI was higher than headline CPI. Why is this important? Because the Federal Reserve will look for both core and headline inflation to decline in the coming months as a result of its restrictive policy.

Two Out Of Three Ain't Bad

On Thursday, the producer-price index (PPI) eased more than anticipated. PPI measures the change in prices paid to producers for good and services. Many economists consider it a predictor of future consumer inflation. PPI rose 2.7% in March from a year earlier, down from 4.9% in February. It fell 0.5% on a month-to-month basis, which is the largest decline since 2020. Inflation showed signs of moderating in March, but still remains well above the 2% target.

More Data To Come Before Next Fed Meeting

These are the final CPI and PPI inflation readings before the next Federal Open Market Committee (FOMC) meeting in early May. The Personal Consumption Expenditures (PCE) index, which is the Fed’s preferred inflation metric, will be released later this month. In addition, we will see the initial reading of the first quarter’s gross domestic product (GDP). The Federal Reserve will consider all recent and upcoming data when deciding whether to raise the federal funds rate in May or pause rate hikes. The markets are currently predicting a 25 basis point rate hike, but a lot can change between now and then.

As the Federal Reserve continues its inflation battle and recession risks persist, our philosophy remains the same. Accounts under our management will remain fully invested and broadly diversified. Portfolios continue to be conservatively structured with your long-term goals in mind.

If you would like to discuss your portfolio, please reach out to us today. Your success matters to us!