Inflation: One Promising Report Does Not Equal a Trend

November 14, 2022

By Ted Hanson

By Ted Hanson

Portfolio ManagerRecently I turned to the local news and came across a commercial for a company’s upcoming Christmas sale. I made a comment to my wife how I can’t believe it is already that time of year, to which she replied how “one commercial doesn’t make it Christmas season.” She reminded me there are many other pieces needed to truly make it the holiday season.

I was reminded of that conversation last week when I saw the results of October’s inflation.

October was a good start ...

The Consumer Price Index (CPI) is used to measure the prices paid by consumers for a broad base of goods and services, effectively measuring inflation. CPI for October rose 7.7% from a year prior, down from 8.2% in September. Even after stripping out the volatile food and energy prices, the core annualized number fell more than expectations.

A large reason for the decline was due to a decrease in used car prices, down 2.4% during the month. In addition, apparel fell 0.7%, airline fares declined 1.1%, and health insurance was down 4.0% — welcome news for the financial markets, as the bond market rallied and stocks surged.

Source: Wall Street Journal

... but there’s a long way to go.

However, as my wife reminded me about the holidays, one positive CPI reading does not create a trend. While last week’s report was a breath of fresh air, there is a long way to go before reaching the Federal Reserve’s goal of 2% inflation.

While at a slower pace, food prices continue to rise, up 0.4% from the prior month. Energy prices increased in October and will be closely monitored as we enter the winter months. Also, housing costs continue to rise and are expected to put upward pressure on inflation for some time. More work is needed to bring these components down.

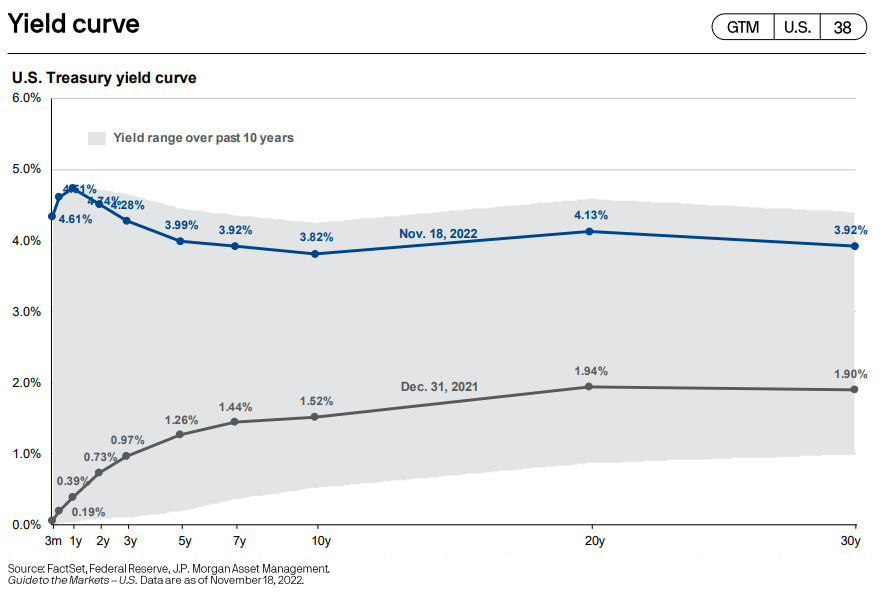

CPI is one of many indicators used to gauge the health of the economy. Going forward, we expect the Fed will continue to raise its short term interest rates into next year, albeit at a slower pace. As a result, volatility and uncertainty in the financial markets will continue.

Portfolios under our management will continue to remain invested throughout an economic cycle. As we enter the final stages of 2022, we begin to look at opportunities for the New Year. If you would like to review your future goals and how we can help achieve them, reach out to an advisor today. Your success matters to us!