One Word Describes the 2023 U.S. Economy: Resilient

December 26, 2023

By Krista Biernbaum, CFP®, CIMA®

By Krista Biernbaum, CFP®, CIMA®

Investment Management OfficerAs we approach the end of a year, it is natural to look back and reflect. Coming into 2023, the base case forecast was the U.S. would enter a recession due to the Federal Reserve’s monetary tightening cycle. While the timing of it was uncertain, both economists and investors viewed it as an easy projection to get right. However, it ended up being wrong. The U.S. economy proved resilient this year.

Why Was the U.S. Economy Resilient?

Both consumers and businesses took advantage of the record low interest rate environment during COVID to shore up their balance sheets. Most consumers who had a mortgage refinanced, student loan payments were deferred until recently, and businesses refinanced debt and pushed out maturities on bonds coming due. In addition, consumers had a built-up savings from the government stimulus. Lastly, municipalities received aid and used it to pay down debt and improve their financials. When the Federal Reserve started its rate hiking cycle in March 2022, consumers, municipalities, and businesses went into it in good financial health.

Third Quarter Growth

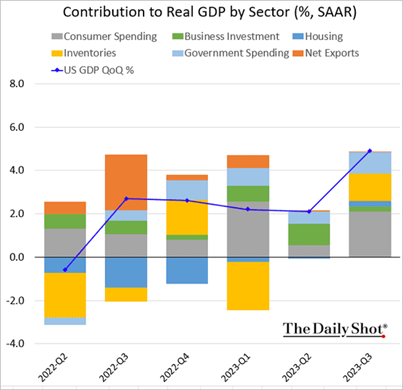

Gross Domestic Product (GDP) is the primary measure of economic growth in the U.S. In the release last week, the Commerce Department reported the U.S. economy grew 4.9% on an annualized basis in the third quarter. While lower than previous estimates, it still is the highest quarter of growth since 2021. The below chart from the Daily Shot® shows the components of GDP and what contributed to the strong quarter. Consumer spending was the largest contributor, as personal consumption rose 3.1%. Since over two-thirds of our growth is consumer driven, this bodes well for growth in the fourth quarter and heading into the first part of 2024.

Source: The Daily Shot®

Economic Growth Will Slow from Here

While the U.S. economy remained resilient in the first three quarters of 2023, growth is expected to slow going forward. An almost 5% annualized growth rate is not sustainable, especially if the Fed wants to win its inflation battle. While both economists and investors agree the U.S. economy will slow going forward, the consensus is mixed if we see a soft landing or a recession in 2024. We are solidly in the soft landing camp. We believe growth can slow enough to get inflation back to the Fed’s 2% objective without entering a recession. Time will tell.

As we end this year, we want to thank you for your continued business and confidence in us in helping to achieve your long-term goals. We hope you have a Happy New Year and look forward to working for you in 2024. Please reach out to your Wealth Management Advisor if you have any questions or would like to schedule your year-end review. Your success matters to us.