Payroll vs. Unemployment Numbers: Why Don't They Add Up?

December 6, 2021

Michelle Holmes, CFA

Michelle Holmes, CFA

Assistant Vice President - Investments

Employment numbers were mixed for November. Job growth came in below expectations while the unemployment rate fell more than expected. How can the unemployment rate drop, with more people coming back into the labor market to look for work, all while job growth remained low? Let's take a look:

What's the difference between payroll and unemployment reports?

Payroll and employment numbers are based on two separate employment surveys. The Bureau of Labor Statistics (BLS) conducts these two surveys monthly: the employer survey and the household survey. Not only do the two numbers come from separate surveys, they each have slightly different definitions of employment — which periodically leads to divergences.

Employer Survey (Payroll numbers)

Payroll numbers, wages and industry breakdowns come from the employer survey. It does not have an age limit, and counts each job — not each person.

Household Survey (Unemployment numbers)

The household survey, meanwhile shows us the unemployment rate and labor force participation, or the number of people actively looking for work, and breaks down the information by gender, race and age. The household survey includes a wider group of workers including agricultural, self-employed and unpaid family workers. It counts people on unpaid leave as employed. The household survey only counts those over the age of 16, and only counts each person once — even if the person holds more than one job.

The surveys can also cover different time periods. The household survey is for the calendar week that includes the 12th of the month. The employer survey is for the pay period that includes the 12th of the month, which may not be the same as the calendar week.

What happened in November?

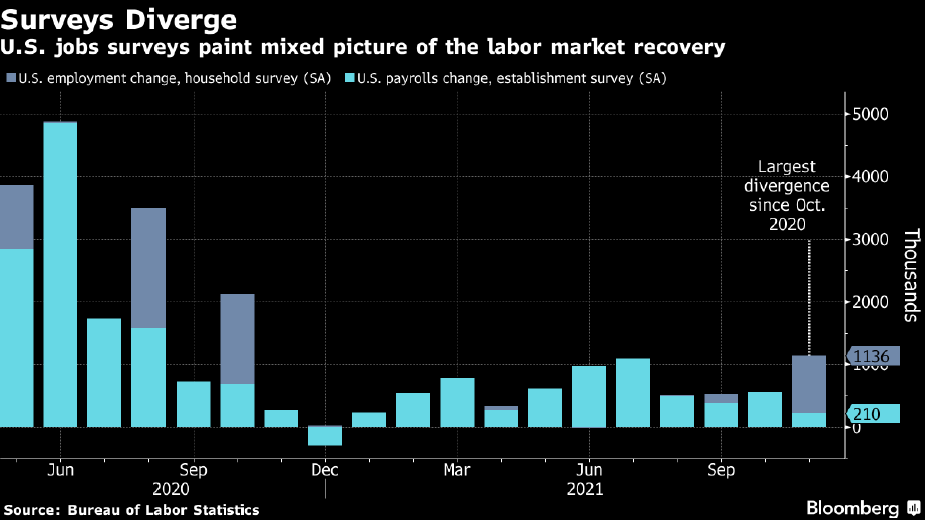

In November, the employer survey showed an increase of 210,000 jobs (far below the 550,000 expected by economists), while the household survey showed 1.14 million. As shown in the chart below, we have not seen this large of a divergence between the two surveys since October of 2020.

This helps explain how the unemployment rate fell to 4.2%, even with a larger labor force and job growth lower than expected.

What does this mean for the Fed?

The Federal Reserve’s (Fed’s) dual mandate is to maximize sustainable employment and price stability. Federal Chairperson Jerome Powell said the Fed was preparing to accelerate the wind-down of its bond buying program. The Fed admitted this week that inflation is likely to remain higher than anticipated because of continued supply chain issues along with the new Omicron variant poising a risk to the global economy. The remarks suggest the Fed is shifting concern from the labor market recovery to rising prices. Therefore, the mixed jobs report will not likely deter the Fed from accelerating the wind-down.

What does this mean for us?

Our investment strategies focus on achieving clients’ long term goals. This focus on the long term means we remain fully invested across market cycles - we do not engage in short term trading or other market timing activities. We balance risk and reward within our portfolios and remain broadly diversified across global markets with an emphasis on valuation.

These principles govern the management of all accounts for which we are responsible, and provide the ability to customize solutions to meet individual client circumstances. Contact us today to find out how we can help you.