Positioning Your Investments in the Hopeful World of Rate Cuts

September 16, 2024

By Samuel Richter, CFP®

By Samuel Richter, CFP®

Senior Securities Analyst

After the labor data Krista discussed in last week's commentary, we received new data on the other side of the Fed’s dual mandate. Last Wednesday, the Bureau of Labor Statistics released the Consumer Price Index (CPI) inflation report. This was the last major data release before this week’s Federal Open Market Committee (FOMC) meeting. Let’s look at CPI and what to expect from the Fed meeting this week.

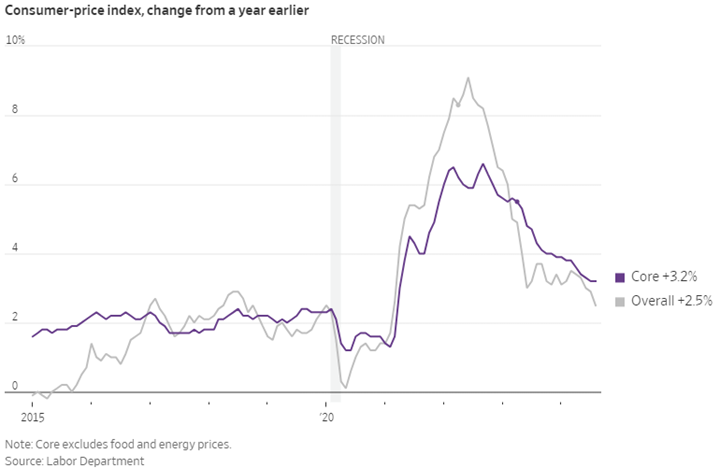

Inflation eased to a three-year low in August. As you can see in the chart below, headline (overall) CPI rose 2.5% from a year earlier. The reading was in-line with economists’ expectations and down from 2.9% in July. Inflation has declined for five straight months, a great sign for the Federal Reserve.

Source: The Wall Street Journal

Core CPI Remains Sticky

Core CPI, which excludes the often-volatile food and energy prices, did not experience the same decline. Core inflation held steady at 3.2% year-over-year. An acceleration of Owners Equivalent Rent (OER) was the main driver of this. CPI uses OER as a housing/shelter component. It is the amount of rent that would have to be paid to substitute a currently owned house as a rental property.

Overall, the slowdown in inflation likely cements a rate cut at the FOMC meeting this week. Inflation easing in recent months allows the Fed to focus more on the cooling labor market. The magnitude of the Fed’s first rate cut is still up in the air as the markets are pricing in close to a 50/50 shot of 0.25% or 0.50%. Another focus of this meeting is the Fed’s dot plot of the federal funds rate, revealing an updated look at committee members’ projections for the pace of rate cuts moving forward. As we discussed in the past, interest rates have historically taken the steps up and elevator down.

Time to Review Cash and Short-Term Fixed Investments

Now remains an attractive time to lock in intermediate-term rates. It is important to review and monitor your cash and short-term fixed income positions in this declining rate environment. Security National Bank is offering some attractive Certificate of Deposit (CD) options. Reach out today to discuss how you are positioned for the Fed’s rate cuts ahead. Your financial success matters to us.