Possible Fed Pivot: Has the Rate Forecast Shifted?

December 18, 2023

By Jonathan Smith

By Jonathan Smith

Securities Analyst

Last week’s FOMC meeting brought no surprises as Fed officials unanimously voted to keep short-term interest rates unchanged at the range of 5.25% to 5.50% for the third consecutive meeting. In their post-meeting statement, there was a noticeable shift in their tone for the first time in over a year.

Officials noted that they will monitor a range of data to see if “any” additional policy firming is appropriate. The market reacted positively to the dovish tone, as all major asset classes in both stocks and bonds moved higher by at least 1% on Wednesday.

The FOMC statement indicates it is likely done raising interest rates during this cycle. With that said, the financial market started to price in expectations for a rate cut in the first quarter of next year prompting the 2-year Treasury bond yield to fall under 4.4% on Wednesday. The Fed can control short-term interest rates, but the market influences long-term interest rates based on its expectations of economic health.

Economic Projections

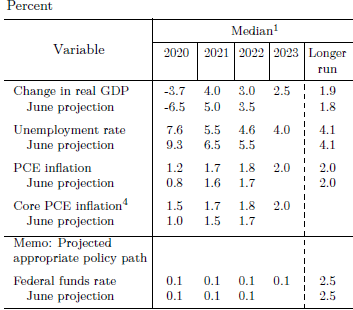

The Fed’s updated quarterly economic projections showed that they lowered their inflation forecasts for this year and next. Their preferred metric of inflation is the personal consumption expenditures (PCE) index, which measures the prices that Americans pay for goods and services. Policymakers now see that number increasing by 2.4% per annum in 2024. They also lowered their forecast for economic growth slightly for next year, while keeping projections for unemployment unchanged. Finally, Fed members now anticipate reducing the federal funds rate to 4.6% in 2024 and 3.6% by the end of 2025. These projections indicate that the Fed believes the economy will avoid the anticipated recession in the upcoming year while keeping inflation and unemployment at manageable levels.

Source: The Federal Reserve

Source: The Federal Reserve

The financial markets will continue closely watching remarks from any media appearances from Fed officials to get some degree of clarity that Powell did not offer during the FOMC press conferences. In past meetings, Jerome Powell continued to push against the market’s view of monetary policy. It makes his job a lot tougher to slow economic growth to contain inflation if the market rallies.

The market may be getting ahead of itself by anticipating rate cuts earlier than what the Fed projects. Longer-term bond yields fell from those expectations, but still provide great opportunities. Now is the time to put any cash on the sidelines to work and lock in bond yields in longer maturities.

Contact your Advisor today if you have any questions regarding next year’s interest rate pivot. Your financial success matters to us!