Pour a Cup of Coffee, Sit Back, and Put Things in Context

June 13, 2022

By Michael Moreland

By Michael Moreland

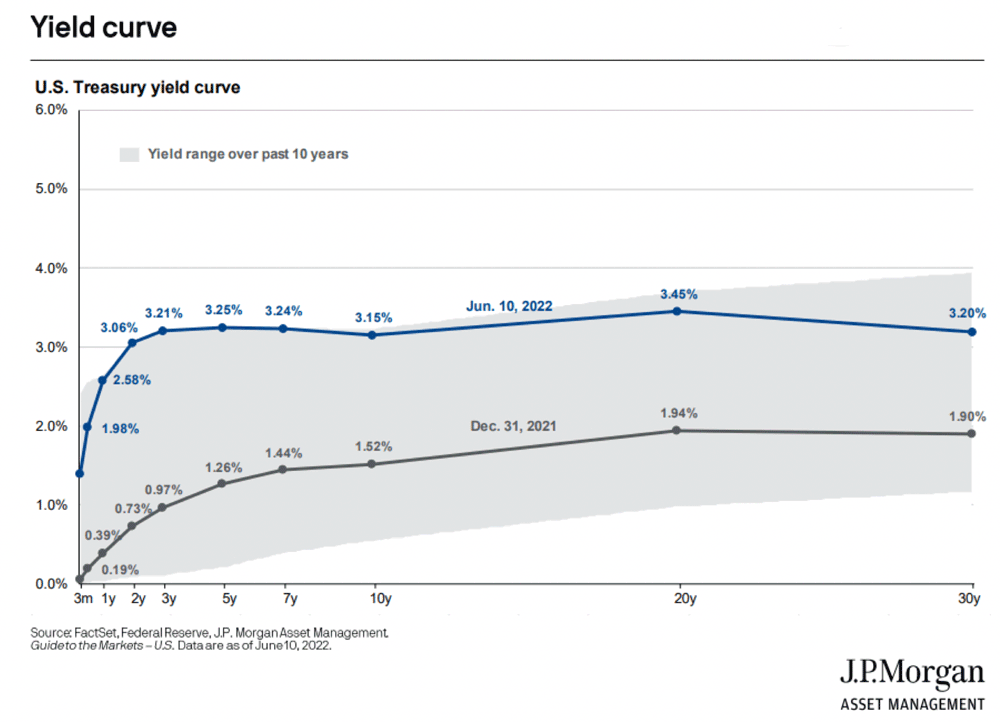

Vice President - InvestmentsThe Federal Reserve’s failure to address rising inflationary pressures in 2021 led to predictable consequences in the first half of 2022. As ‘transitory’ price hikes became embedded and pervasive, the Fed was forced to act – much more aggressively than previously forecast. Bond prices tumbled as the Fed belatedly signaled multiple half-percent rate hikes through the end of the year. Fixed income markets, normally a safe haven during challenging times, suffered their worst losses in over forty years in the first months of 2022. Not-so-coincidentally, that last episode also featured runaway inflation and a Federal Reserve scrambling to catch up.

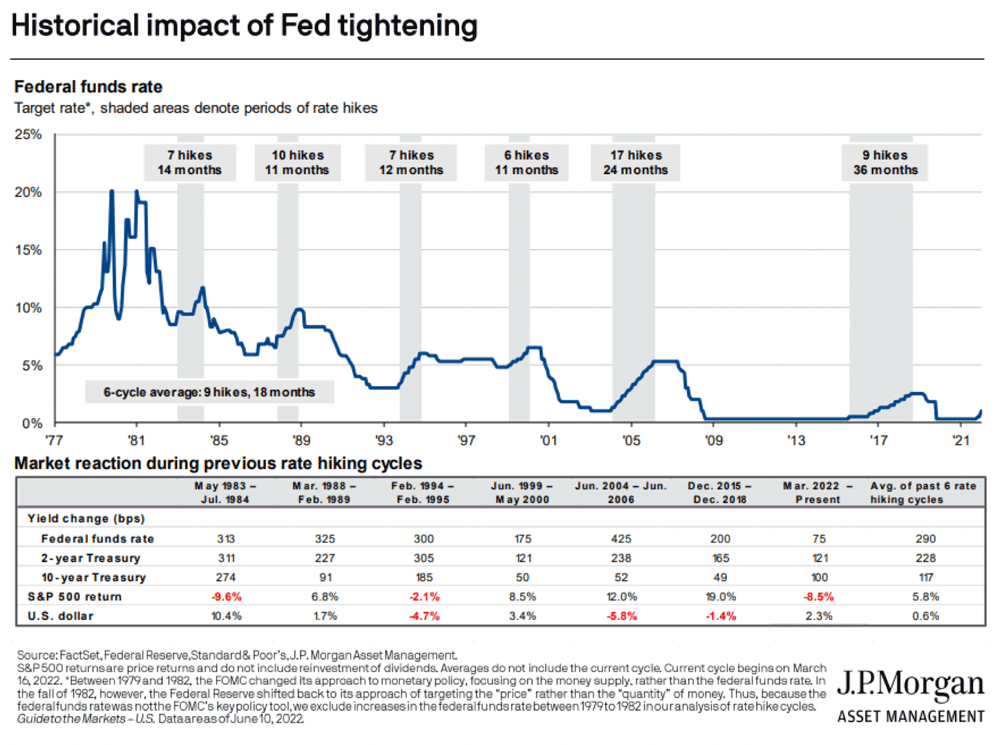

What happens next? There have been six cycles of increasingly restrictive monetary policy in the last four decades. Most lasted over a year, and all included at least six rate hikes by the Fed. There is no reason to believe this episode will be different – in either the number of increases or the ultimate stopping point. The large gap between current rates and core inflation – even if it is moderating and rate hikes are ‘front-loaded’ – suggests that the Fed will be in tightening mode into 2023.

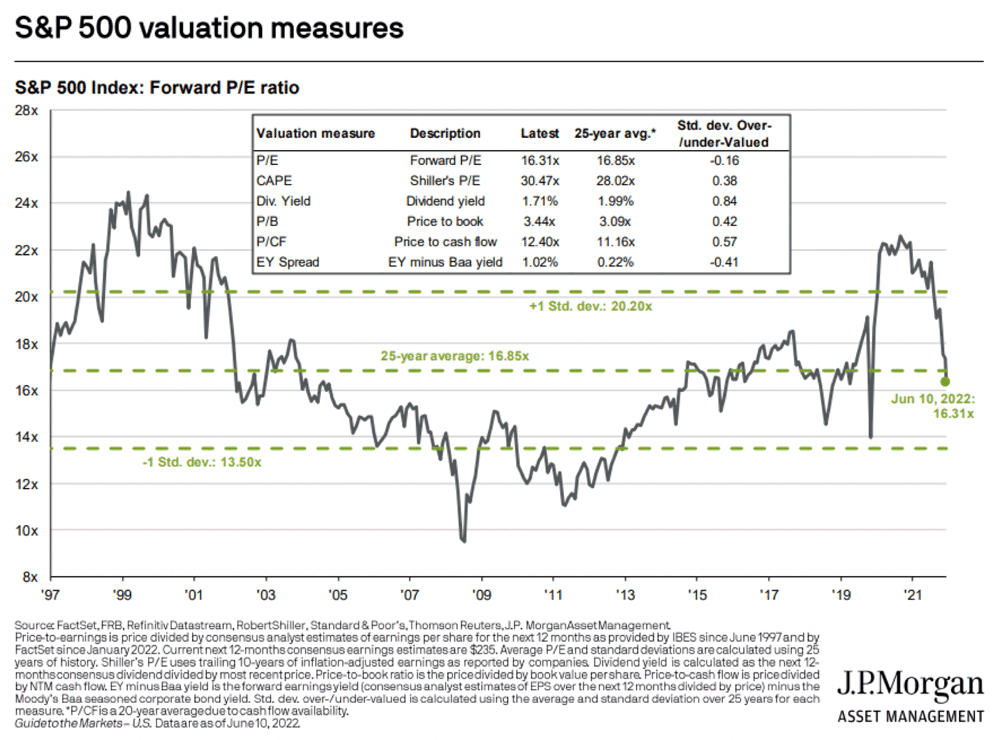

These commentaries have long emphasized the importance of low interest rates as a critical support for high equity valuations – particularly among popular growth themes. That support is gone. The S&P 500 is down over twenty percent (as of this writing) for 2022. The damage is worse among last year’s leaders – the Russell 3000 Growth Index lost nearly one-third of its value through mid-June.

While market declines are unpleasant, they do have a salutary effect. Forward-looking capital market assumptions are built upon a foundation of current valuations. The lower the starting point, the better the opportunities ahead. The primary valuation measure for the S&P 500 – the price/earnings ratio – is now below its midpoint of the last quarter-century. Other measures remain elevated by historic standards, but much less so than in the recent past.

That said, sustained bull markets usually don’t start from average valuations. Deep undervaluation – a ‘washout’ – opens the door to rising markets. With uncertain economic prospects, inflation still out of control, an increasingly hawkish Fed, an absence of leadership in Washington, and global chaos, the risks remain to the downside. ‘Not as expensive’ is not the same as cheap. Markets are not there yet. While the ‘irrational exuberance’ (to borrow a phrase from former Fed Chairman Alan Greenspan) of 2021 is long gone, the capitulation phase may still be ahead.

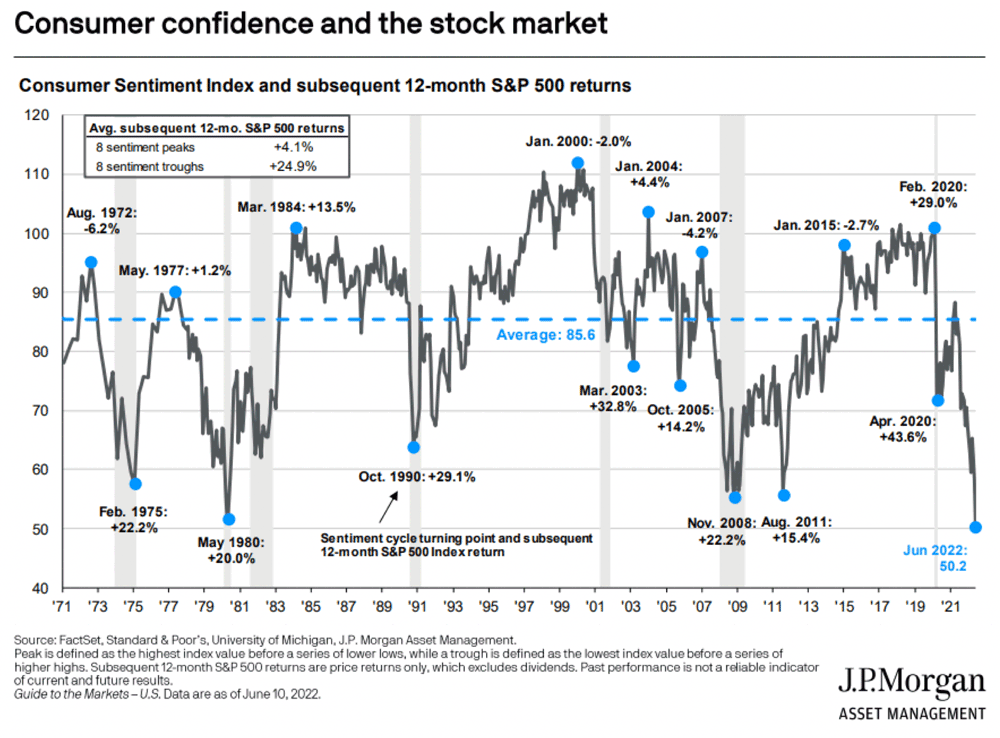

On the other hand, nearly all market forecasts are based on valuations and hard data. Few take into consideration the ‘soft’ information around us. It’s worth keeping in mind – particularly sentiment readings. Consumer sentiment, measured by the respected University of Michigan index, reached a four-decade low point in June.

We do not know when expectations will improve, but look at the market behavior following the trough. In the eight troughs in sentiment since 1975, the subsequent year witnessed an average gain of 24.9% in the S&P 500. We don’t know when the next trough will appear, but we believe we are much closer to the low in consumer sentiment than the peak. History suggests market behavior is a ‘coiled spring’ at the turning point – one needs to be present at the start to fully participate. The lesson is to stay the course – through good times and bad.

Our Positioning

We remain fully invested in our client portfolios. We maintain a value tilt and broad diversification by market capitalization and geographic exposure in equities. Fixed income is high quality, short- to intermediate-term, and yield-conscious. We want to keep pace when the market environment is favorable, and reduce downside risk in poorer times. While sometimes there are ‘few places to hide’, this philosophy has worked well for many years. We are confident it will do so in the future. Our clients – and their success in reaching their goals – matter to us.

Do you have a question about your portfolio, or how our experts can help you reach your financial goals? Contact an advisor today.