Good Investment Principles Are More Important Than Predictions

February 10, 2020

By Michael List, CFP®

By Michael List, CFP®

Portfolio ManagerJanuary was a vivid reminder how uncertain the future is. We listened to dozens of market outlooks for the full year 2020 and not one predicted the major headline (Coronavirus) only weeks into the future. Predictions are a necessary part of our profession, but they take a secondary role to the principles we use to construct portfolios.

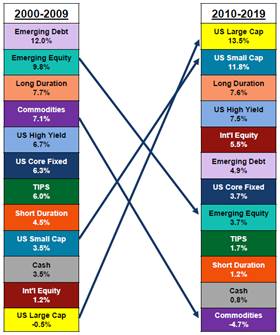

We have seen time and again, success in the investment world is driven by being consistent over a long period and equally importantly, avoiding the major pitfalls. The chart below from SEI is an illustration of the dangers of performance chasing:

Asset Class 10-Year Annualized Returns

If you started investing in 2010, you might have been inclined to invest heavily in emerging markets and commodities. Not only had emerging markets produced the best return but they were also the countries expected to drive population and economic growth into the future. That growth prediction came true, emerging market economic growth exceeded developed market growth rates, but at a slower pace than expected. In China, GDP growth has been around 7%, which is two to three times faster than the U.S., but was slower than the 9-10% experienced the previous decade. Even though the prediction was correct, emerging markets fell to one of the bottom performing asset classes the following decade. Being diversified and regularly rebalancing portfolios helps to avoid chasing performance.

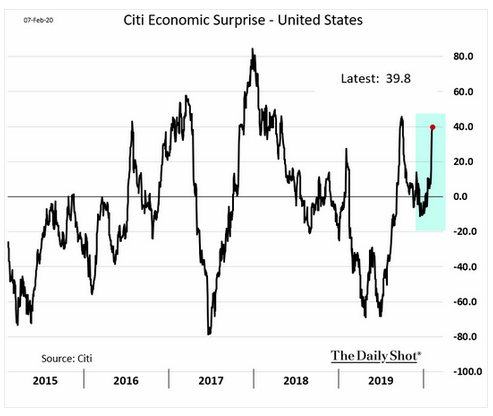

As we look back at our Winter 2020 Economic & Market Commentary in light of recent developments, our thesis remains intact. Economic data is trending better (seen below in the chart titled Citi Economic Surprise), markets are making modest gains, and our focus on risk control is warranted as markets have already experienced bouts of volatility.

Citi Economic Surprise Index

Portfolios will remain fully invested, but we are rebalancing. During the rebalance, we are taking some gains of 2019 off the table and shifting them to areas with better valuation measures. If you have questions about our outlook or rebalance and how they affect your accounts schedule a meeting with your account Advisor.

Leave a comment: