A Shift of Hope: Fed Hints at Rate Cuts, Markets Soar

August 25, 2025

By Michael List, CFA, CFP®

By Michael List, CFA, CFP®

Investment Management OfficerOn Friday, Federal Reserve Chairman Jerome Powell delivered his annual speech at the Jackson Hole Symposium. While no decisions are made at this meeting, Powell signaled a likely shift in the Fed’s monetary policy, with rate cuts expected to resume in the coming months. Let’s review some highlights from the speech and how the market reacted.

Two quotes from Powell seem to capture the change in tone and policy direction:

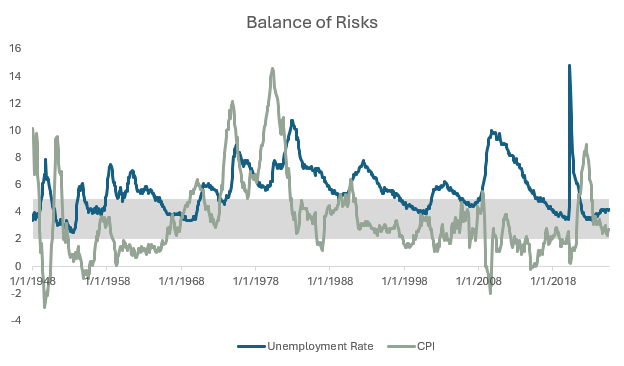

First: “The balance of risks appears to be shifting.”

The chart below illustrates two data points tied to the Fed’s dual mandate: stable prices (CPI) and full employment (unemployment rate). The Fed manages policy to balance these sometimes conflicting objectives. If rates are kept too low, inflation may rise. Conversely, if rates are kept too high, it risks slowing economic growth and increasing job losses. However, as the chart shows, both inflation and unemployment have remained relatively stable for most of the year. So, where’s the shift?

Source: bls.gov

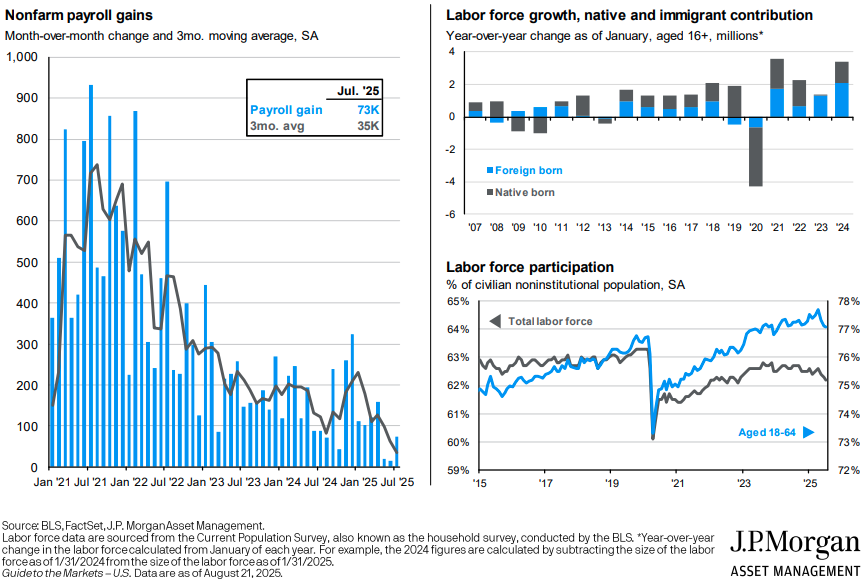

Second: “While labor markets appear to be in balance, it is a curious kind of balance that results from a marked slowing in both the supply of and demand for workers.”

Recent labor data revisions show a decline in jobs added over the past few months. The chart on the left below shows monthly payroll gains over several years. Lately, employers have been adding fewer jobs, reflecting a slowdown in labor demand. At the same time, labor supply has also been decreasing, as seen in the chart on the bottom right (labor force participation). This simultaneous slowdown in both supply and demand suggests a weakening labor market. Yet, because both are slowing at a similar pace, the unemployment rate has remained relatively stable—what Powell refers to as a “curious kind of balance.”

How Did the Market Respond?

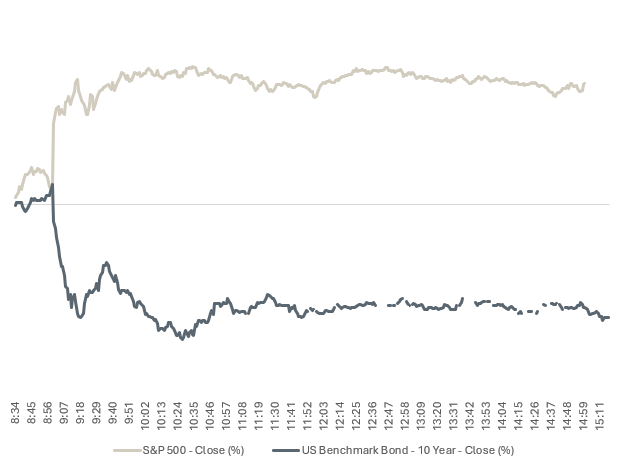

The speech began at 9:00 a.m. Central Time, and investors were closely watching as seen in the following chart. The S&P 500 and other equity indices moved sharply higher, while the 10-year Treasury yield and other bond rates declined. We’ve been anticipating the Fed to resume cutting interest rates in the second half of 2025 and have been adjusting portfolios under our care accordingly.

Source: FactSet

The Federal Reserve has three meetings before the end of the year with lots of data releases they will be considering in their decisions. We will continue to monitor developments regarding monetary policy and its implications on portfolios. As always, if you have any questions, please reach out to your advisor today. Your financial success matters.