Rebalancing Your Portfolio, in Times of Uncertainty

March 23, 2020

By Michael List, CFP®

By Michael List, CFP®

Portfolio ManagerA resolution I had coming into 2020 was to spend more quality time with my children. I just didn’t know it was going to come in the form of having them home from school for four straight weeks. Life has a special way of throwing us curveballs.

I have more respect for our leaders, who have taken dramatic steps to #FlattenTheCurve and slow the spread of coronavirus. These are tough times and tough decisions, and the decisions made will come at an economic cost. But, after listening to the experts from a variety of disciplines, I'm convinced our leaders are attempting to make prudent decisions in challenging times.

There are still many unknowns about the future in almost every area of our daily lives. In the absence of a crystal ball, we use the next best thing: history. Last week, my colleague Tom wrote about the importance of maintaining perspective during times of stress. One of the quotes we often use is “History doesn’t repeat itself, but, it often rhymes.” The challenge in the midst of crisis is identifying what part of history rhymes with today? The rhythms we see today are similar to many different events in our past: The Spanish Flu pandemic (1918), Great Depression (1930's) and Black Monday (1987) to list a few potential parallels.

However, just because there are many unknowns today, doesn’t mean we should do nothing, or overreact and make rash decisions. Once we have proper perspective of history, we can make prudent decisions that can sometimes be at odds with our emotions.

This week, we will rebalance portfolios back to their long-term target asset allocations. This will be our second rebalance in 2020, but it is not about timing the market (there is no guarantee that markets will not decline further from here). Rather, disciplined rebalancing is a way to balance risk over time and distance your emotions from the decision process.

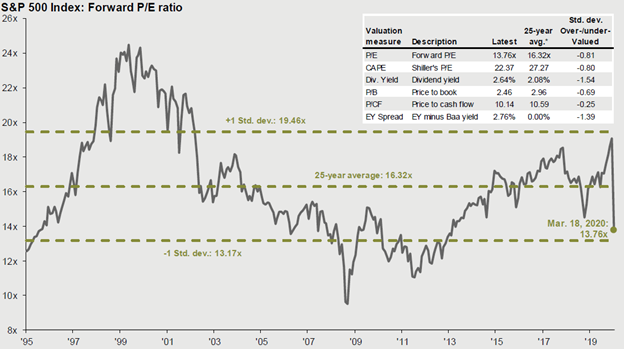

The rebalance earlier in the year helped to reduce overexposure to equities, after a very strong 2019. As we can see from the JPMorgan chart below, at the end of 2019, valuations had risen to a multi-year high. Today is a different picture:

Looking at the various valuation measures today, the stock market is trading meaningfully below its long-term averages. With the significant market declines, the equity portion of portfolios has fallen below the long-term target allocation. The rebalance this week will result in buying equities at a discount to their historical valuations — and that will accelerate the recovery as skies begin to clear.

As always, please contact an advisor if you have any questions or concerns about your portfolio. We are here to help.