Recoveries Do Not Die of Old Age!

July 31, 2018

By Michelle Holmes, CFA

By Michelle Holmes, CFA

Trust Investment Officer

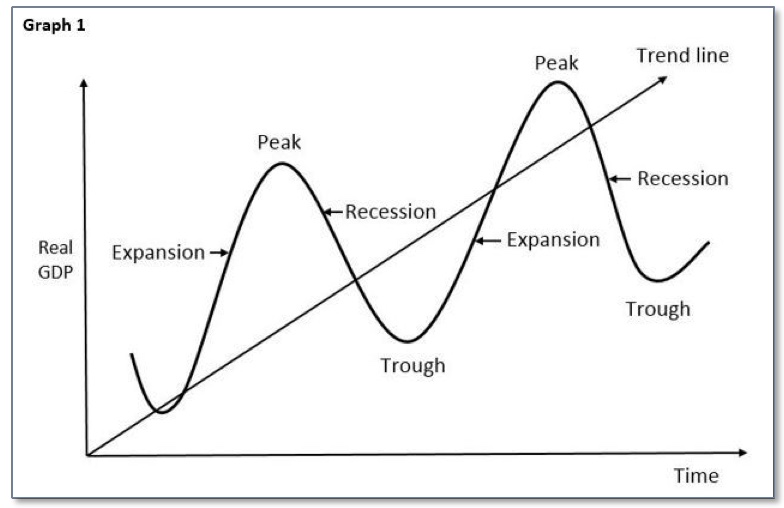

The economy goes through phases called the natural "business cycle," which involves an expansion, peak, recession and trough before beginning the business cycle over again. This we know. What we don't know, however, is exactly how long each business cycle will last.

When will the current economic expansion end?

The good news is, economic expansions do not die of "old age" — they continue until something changes to slow growth. The National Bureau of Economic Research found the average business cycle in the United States lasts about 56 months. However, the current business cycle has lasted twice that length. In fact, it is now the second longest expansion in U.S. history. The chart below shows the current economic expansion is also the slowest recovery in history; this supports a longer-than-average recovery time.

Key Indicators to Watch

There are several factors to watch as indicators of a recession. Most of them point toward a recessionary state prior to the beginning of a recession. Today’s indicators are at least neutral, if not pointing toward expansion, so the current business cycle is not likely to end anytime soon.

How Deep will the next recession be?

It is natural for people to look back at recent history as an indicator of what will happen in the future. This makes investors uneasy as we continue the current economic expansion and look back at how deep the last recession was. However, the next recession may not be as bad. During the last 11 recessions dating back to the 1940s, the median stock market decline during a recession was 21 percent.

Sometimes the best offense is a good defense.

No one can predict when the business cycle will end and when the next recession will start. Our philosophy is to remain invested and diversified to provide some downside protection during times of market volatility. We look at our clients’ long-term goals to determine the allocation between stocks and bonds needed to help improve the odds of successfully achieving those goals.

Having a financial plan can help you establish long-term goals and keep you focused on what you want to achieve. Contact an advisor to set up or update your financial plan today.