Like The Grinch: History Doesn't Repeat Itself, But It Rhymes

December 16, 2024

By Michael List, CRA, CFP®

By Michael List, CRA, CFP®

Investment Management OfficerI will probably read How the Grinch Stole Christmas a couple dozen times between now and the end of the year. My children may even listen along two or three of those times. The more times you read a Dr. Seuss book, the quicker you read. It almost becomes a game of how fast you can finish. This is in part because the story becomes more familiar and we memorize the words, but it’s also because of the rhythm and rhymes he used. This caused me to reflect on another author’s quote, “History doesn’t repeat, but if often rhymes.” So, what market moments in history are we rhyming with today?

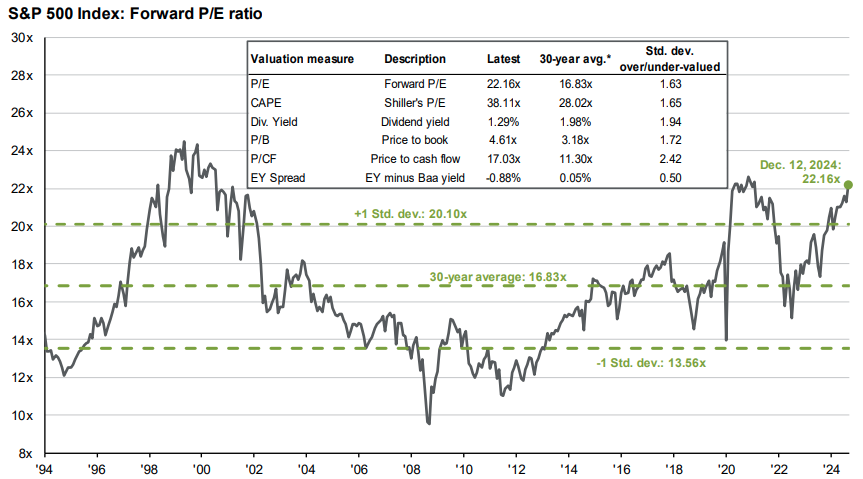

Valuations are high, expectations to the sky

The chart below shows the S&P 500 price-to-earnings (P/E) ratio over time. This ratio measures the current price of a stock or market for every dollar a company/market earns. It is not uncommon for companies and sectors to trade a higher P/E ratio, this often reflects investors’ expectations this stock/sector’s earnings will grow at a faster rate than the rest of the market. The current P/E of 22.16 for the S&P 500 is exceeded only by 2021 and the late 1990’s. These peaks reflect investors' expectations for the internet and Big Data, and Artificial Intelligence to propel earnings growth far into the future.

Source: JPMorgan Guide to the Markets 12/13/2024

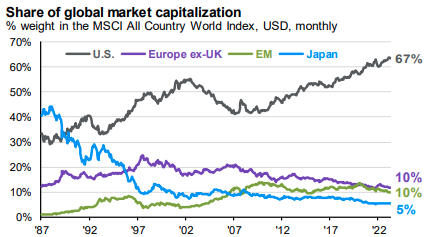

USA is the best, much better than the rest

Time and again the United States has been a strong economic engine for the world. Similar to P/E ratios for fast growing companies, the United States stock market demanded a higher valuation resulting from continued innovation, productivity, and relative stability. However, the gap between US and international markets in terms of valuation and total market cap are approaching those last seen in the late 1990’s.

Source: JPMorgan Guide to the Markets 12/13/2024

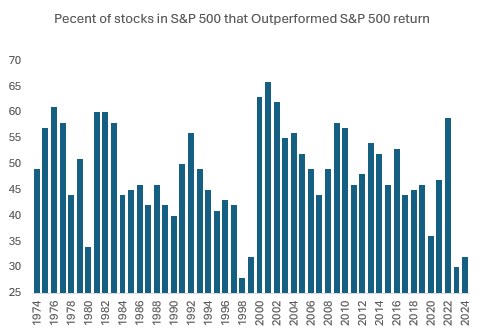

Concentrations of return, a lesson to relearn

Indices are a convenient tool for investors to quickly gauge how the overall market is performing. But, if we look a little deeper, we see a pattern that is again similar to the late 1990’s. The chart below shows the percent of stocks within the S&P 500 that outperformed the overall index return each year. In 2023 and 2024 (and 1998 and 1999), only around 30 percent of stocks in the index have outperformed the index return, compared to an average of 48 percent over the past 50 years. In the late 1990’s as today, this low outperformance ratio is the result of a small concentration of securities generating outsized gains compared to the rest of the index. However, between 2000 and 2002 this trend reversed with nearly 65 percent of stocks outperforming the index return each year.

Source: S&P; Morningstar

Are you ready? Or nice and steady.

In Cisco’s 2000 annual report the company encouraged investors to discover all that’s possible on the internet and asked, “Are you ready?” The implication was simple, the internet will change the world, if you are not ready you will be left behind. 2000 was a banner year for the company, revenue and earnings both jumped 55% and this was just the beginning. Investors were ready; the share price had risen 800% in under two years. Unfortunately, revenue growth came to a halt and was still unchanged four years later. While Cisco was right about the Internet, expectations for company growth were out of this world, as the stock was priced at 29 times revenue and 200 times earnings. In contrast, General Mills shares were 90% cheaper than Cisco, the stock’s dividend subsequently repaid investors 140% of their original investment and revenue and earnings have increased 300%. Today we all carry the internet in our pockets, but the possibilities of Artificial Intelligence are enticing, Nvidia is trading at 28 times revenue and 51 times earnings. Time will tell if the enthusiasm around Artificial Intelligence and Nvidia is warranted, but our focus will be to find less expensive investment opportunities.

That didn’t stop the new highs from coming, they came…somehow or other they came just the same

The market peak in 1999 was not the last. High expectations do push stock prices higher in the short term, but when combined with opportunity, they also drive innovation and growth. And, it is innovation and growth that will move the market higher in the long run. This was fun and we're here to help - reach out to your Financial Advisor today. Your financial success matters.

Merry Christmas and Happy Holidays!